now, it supports property, collection, import and option not to generate codes for imported types. download.

for more info, check here.

Statement.xsd

<br />

<?xml version="1.0" encoding="utf-8" ?><br />

<xs:schema xmlns:tns="http://microsoft.com/practices/ConsolidatedAccountStatementResponse"

elementFormDefault="qualified" targetNamespace=http://microsoft.com/practices/ConsolidatedAccountStatementResponse

xmlns:xs="http://www.w3.org/2001/XMLSchema"><br />

<xs:annotation><br />

<xs:appinfo><br />

<code xmlns="http://weblogs.asp.net/cazzu" skipImportedType="true"><br />

<extension Type="XsdGenerator.Extensions.ArraysToCollectionsExtension, XsdGenerator.Library" /><br />

<extension Type="XsdGenerator.Extensions.FieldsToPropertiesExtension, XsdGenerator.Library" /><br />

</code><br />

</xs:appinfo><br />

</xs:annotation><br />

<xs:import namespace="http://microsoft.com/practices/CashAccount" schemaLocation="CashAccount.xsd" /><br />

<xs:element name="ConsolidatedAccountStatementResponse" type="tns:ConsolidatedAccountStatementResponse" /><br />

<xs:complexType name="ConsolidatedAccountStatementResponse"><br />

<xs:sequence><br />

<xs:element name="CashAccounts" xmlns="http://microsoft.com/practices/CashAccount" type="ArrayOfCashAccount" /><br />

</xs:sequence><br />

</xs:complexType><br />

</xs:schema><br />

CashAccount.xsd

<br />

<?xml version="1.0" encoding="utf-8" ?><br />

<xs:schema xmlns:tns="http://microsoft.com/practices/CashAccount" elementFormDefault="qualified"

targetNamespace="http://microsoft.com/practices/CashAccount" xmlns:xs="http://www.w3.org/2001/XMLSchema"><br />

<xs:annotation><br />

<xs:appinfo><br />

<code xmlns="http://weblogs.asp.net/cazzu" skipImportedType="true"><br />

<extension Type="XsdGenerator.Extensions.ArraysToCollectionsExtension, XsdGenerator.Library" /><br />

<extension Type="XsdGenerator.Extensions.FieldsToPropertiesExtension, XsdGenerator.Library" /><br />

</code><br />

</xs:appinfo><br />

</xs:annotation><br />

<xs:complexType name="CashAccount"><br />

<xs:sequence><br />

<xs:element minOccurs="0" maxOccurs="1" name="AccountNumber" type="xs:string" /><br />

<xs:element minOccurs="1" maxOccurs="1" name="Contract" type="xs:int" /><br />

<xs:element minOccurs="1" maxOccurs="1" name="Balance" type="xs:decimal" /><br />

<xs:element minOccurs="0" maxOccurs="1" name="AccountType" type="xs:string" /><br />

</xs:sequence><br />

</xs:complexType><br />

<xs:complexType name="ArrayOfCashAccount"><br />

<xs:sequence><br />

<xs:element minOccurs="0" maxOccurs="unbounded" ref="tns:CashAccount" /><br />

</xs:sequence><br />

</xs:complexType><br />

<xs:element name="CashAccount" type="tns:CashAccount" /><br />

</xs:schema><br />

‘ Statement.vb

‘

_

Public Class ConsolidatedAccountStatementResponse

Private _cashAccounts As CashAccountCollection

‘

_

Public Property CashAccounts As CashAccountCollection

Get

Return Me._cashAccounts

End Get

Set

Me._cashAccounts = value

End Set

End Property

End Class

Public Class CashAccountCollection

Inherits System.Collections.CollectionBase

Public Default Property Item(ByVal idx As Integer) As CashAccount

Get

Return CType(MyBase.InnerList(idx),CashAccount)

End Get

Set

MyBase.InnerList(idx) = value

End Set

End Property

Public Function Add(ByVal value As CashAccount) As Integer

Return MyBase.InnerList.Add(value)

End Function

End Class

JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24.

JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24. PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25.

PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25.

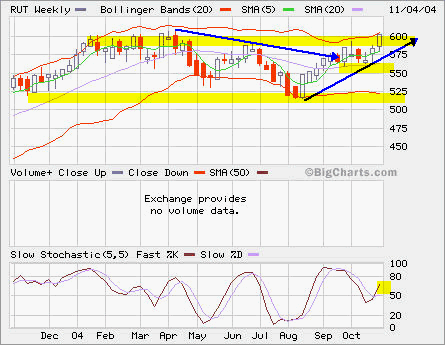

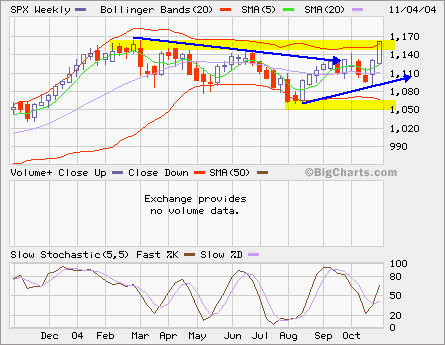

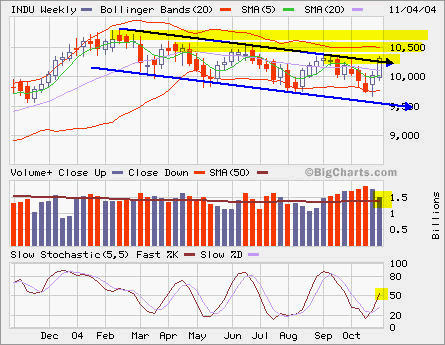

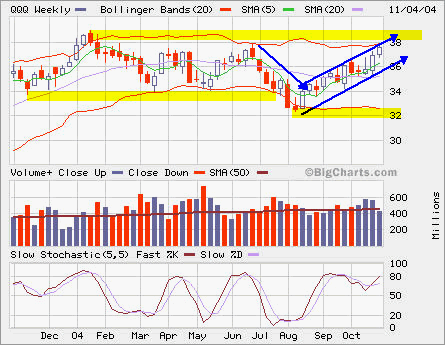

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.