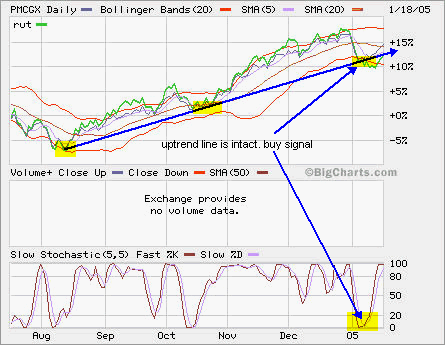

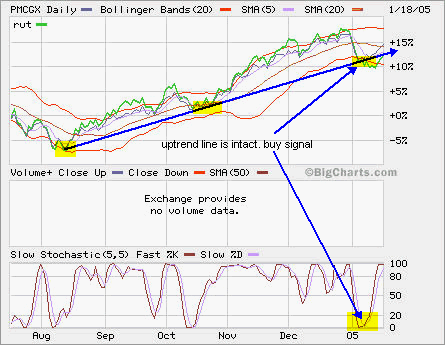

INDU has not changed much from yesterday. There is no increasing selloff, so it’s a good sign that the uptrend may stay. Based on overall market condition, I have reentered PMCGX after the blackout period is over. My current asset allocation for this 410(k) is 60% cash, 20% PMCGX and 20% TEFTX.

INDU has not changed much from yesterday. There is no increasing selloff, so it’s a good sign that the uptrend may stay. Based on overall market condition, I have reentered PMCGX after the blackout period is over. My current asset allocation for this 410(k) is 60% cash, 20% PMCGX and 20% TEFTX.

Tag Archives: Pmcgx

INDU

INDU has not changed much from yesterday. There is no increasing selloff, so it’s a good sign that the uptrend may stay. Based on overall market condition, I have reentered PMCGX after the blackout period is over. My current asset allocation for this 410(k) is 60% cash, 20% PMCGX and 20% TEFTX.

INDU has not changed much from yesterday. There is no increasing selloff, so it’s a good sign that the uptrend may stay. Based on overall market condition, I have reentered PMCGX after the blackout period is over. My current asset allocation for this 410(k) is 60% cash, 20% PMCGX and 20% TEFTX.

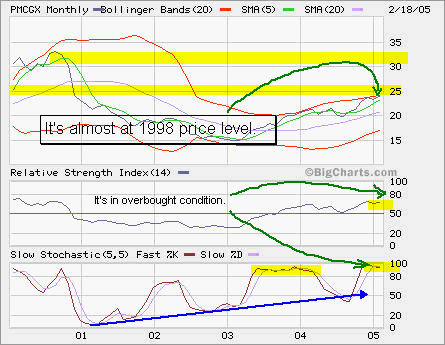

PMCGX back in 1998 level

PMCGX has followed the overall market and resumed its ascending. Currently, it’s in overbought condition indicated by both RSI and Stochastic. As we can see from prior history, the overbought or oversold condition could stay there for a while. I do plan to close or at least to square some money off the table next week as our 401(k) plan will have a week of black out period when the plan is to be adjusted with a few changes. As we all knew from history such as Enron debacle, black out period could be very risky although the mutual funds are much more diversified in this regard. One company imploding would not make a fund to plummet.

PMCGX has followed the overall market and resumed its ascending. Currently, it’s in overbought condition indicated by both RSI and Stochastic. As we can see from prior history, the overbought or oversold condition could stay there for a while. I do plan to close or at least to square some money off the table next week as our 401(k) plan will have a week of black out period when the plan is to be adjusted with a few changes. As we all knew from history such as Enron debacle, black out period could be very risky although the mutual funds are much more diversified in this regard. One company imploding would not make a fund to plummet.

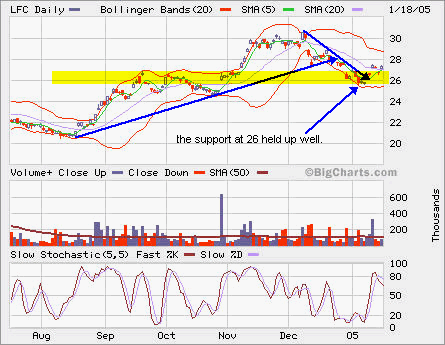

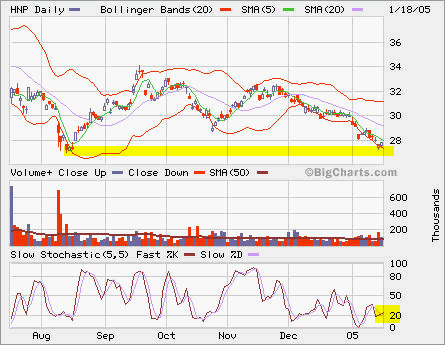

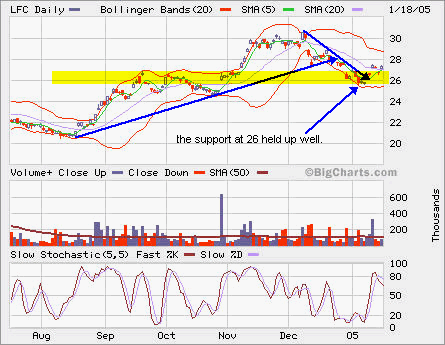

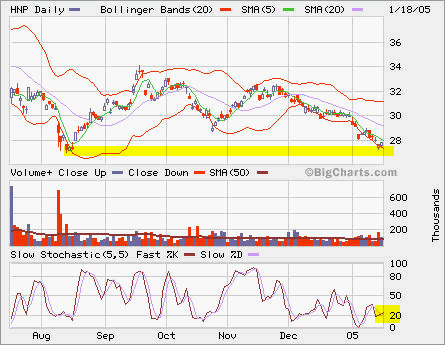

Update on LFC, HNP and PMCGX

Update on LFC, HNP and PMCGX