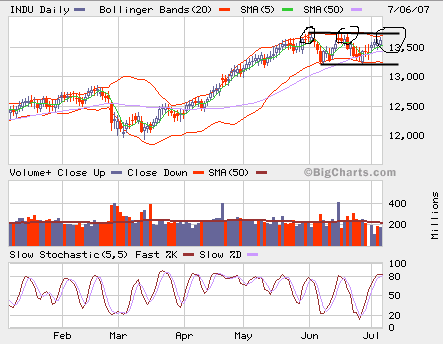

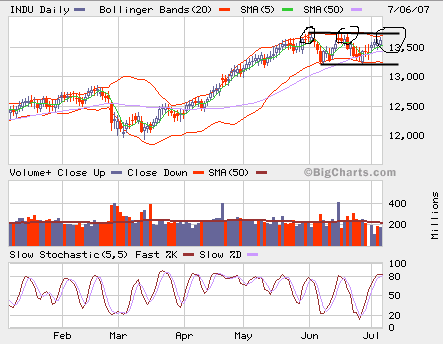

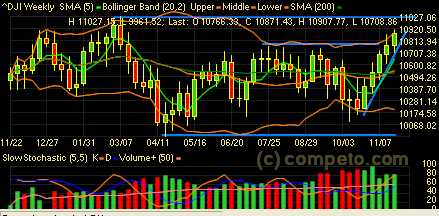

It’s forming a triple top, likely reversal?

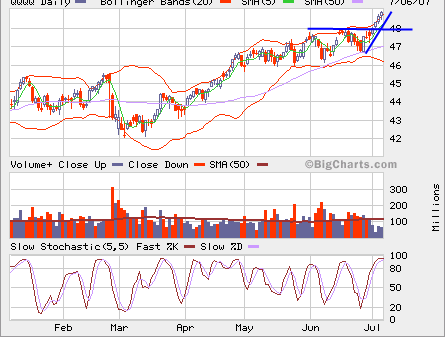

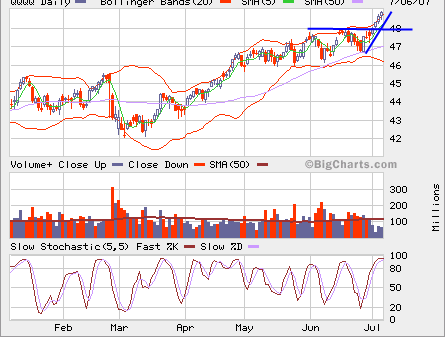

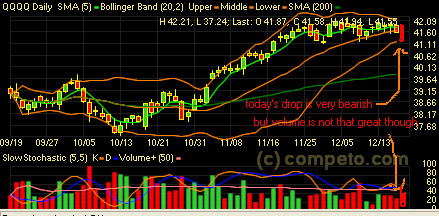

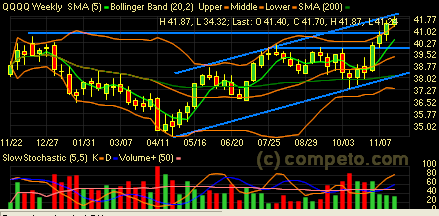

However, QQQQ broke out but the lighter than average volume makes the breakout less convincing.

It’s forming a triple top, likely reversal?

However, QQQQ broke out but the lighter than average volume makes the breakout less convincing.

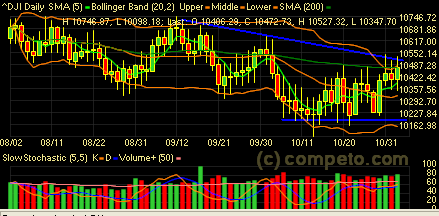

In 2006, RUT performed the best followed by INDU and S&P 500. QQQQ recovered the 10% loss from the mid-year and ended up more than 5%.

Both QQQQ and RUT are in the overhead resistence levels, only INDU and S&P 500 broke out. INDU is at all-time high and S&P 500 is about 100 points away from its all-time high.

QQQQ looks bearish. It seems that a lot of money is moving out (a lot of selling). I actually closed all equity positions in 401(k) two weeks ago, that is 100% cash. What’s ahead for the new year? Don’t know yet.

QQQQ looks bearish. It seems that a lot of money is moving out (a lot of selling). I actually closed all equity positions in 401(k) two weeks ago, that is 100% cash. What’s ahead for the new year? Don’t know yet.

How much will the market continue to rally? All major markets are quite extended after going straight up for almost two months.

How much will the market continue to rally? All major markets are quite extended after going straight up for almost two months.

It’s quite possible that it continues to move up, but I would sell into the strength to take some profits.

It’s quite possible that it continues to move up, but I would sell into the strength to take some profits.

All major indexes are back at the SMA 200 line. Judging from the overhead downtrend lines and SMA 200, we shall see some pullback unless the bulls take charge from here.

All major indexes are back at the SMA 200 line. Judging from the overhead downtrend lines and SMA 200, we shall see some pullback unless the bulls take charge from here.