Both S&P and Dow Jones Industries reached the highs seen since 2007. It is time to sell some positions and have some cash as the market usually doesn’t go up like this in straight line.

Category Archives: Index

HFT is killing eMini?

Nanex had an article on this subject. You can google it.

Apparently it has not killed scalping. I have been doing some in the past weeks and it is working beautifully. It could be new guy’s charm or luck. Definitely it feels much better than years ago.

My current strategy is based on 1 min and 5 min charts plus watching other longer time frames for bigger trends or pending price reversals. I’m also watching other major indexes and futures to sense overall markets.

Dow Jones Industrial Down More than 200 points

As expected in the last post, it reached the resistance level and came down in a big way.

INDU Pullback?

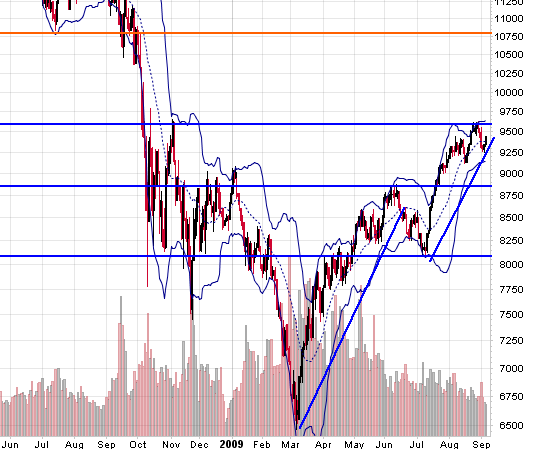

Dow Jones Industrials has completed another leg of up trend building since last pullback to 8100.

Current resistance at 9600 has not been broken. A pullback to 8800 is likely if it fails to break out 9600.

However, if 9600 is taken out, the next resistance is 10,750!

Dow Jones Industrials Retreated

It’s down more than 180 points. If the current uptrend line is broken, the first support is at 8000-8100 level, which could become a good base to build some long positions if the worst is over. Let’s watch closely as overall it’s oversold at this point. The V shape bounce needs some time to consolidate even we’re entering a new uptrend.

The next support is 7500, which is previous low before this last leg down.