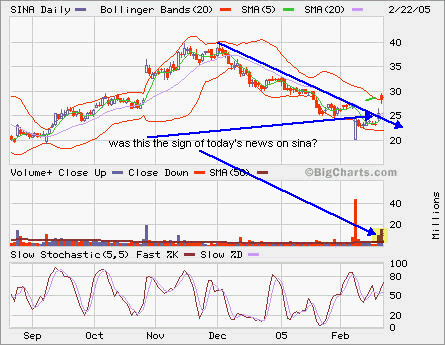

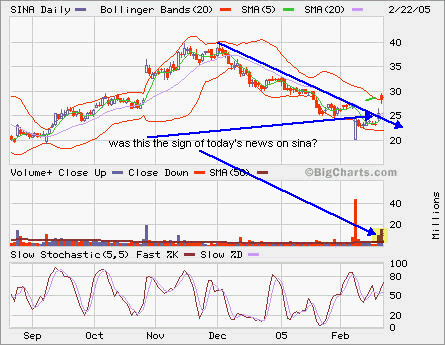

Chinese internet stocks jumped over 5% contrasting to the rest of market. It’s fueled by possible consolidation in China’s major internet players. SOHU closed higher too.

Chinese internet stocks jumped over 5% contrasting to the rest of market. It’s fueled by possible consolidation in China’s major internet players. SOHU closed higher too.

Chinese internet stocks jumped over 5% contrasting to the rest of market. It’s fueled by possible consolidation in China’s major internet players. SOHU closed higher too.

Chinese internet stocks jumped over 5% contrasting to the rest of market. It’s fueled by possible consolidation in China’s major internet players. SOHU closed higher too.

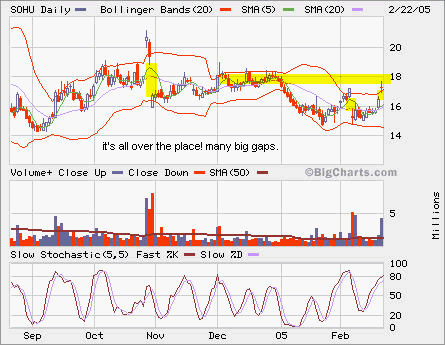

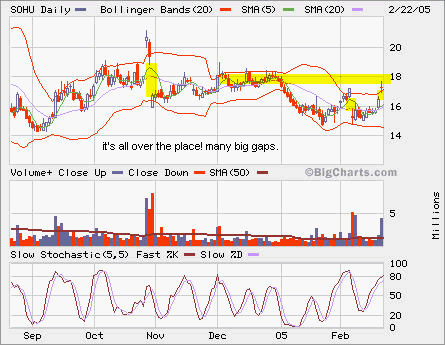

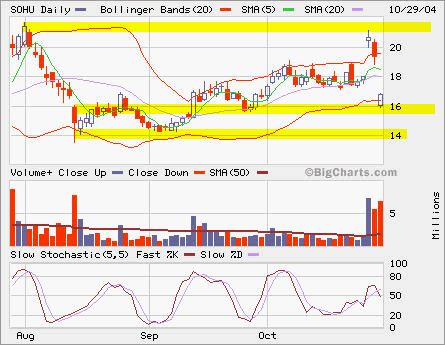

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16.

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16.

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16.

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16.

Things have turned worse. SUNW broke down from early attempt to break out at 6. The downgrade to junk status from S&P on credit rating didn’t help either. SUNW is seeking support again around 4.5. I’m adding more. I also opened a position in LU.

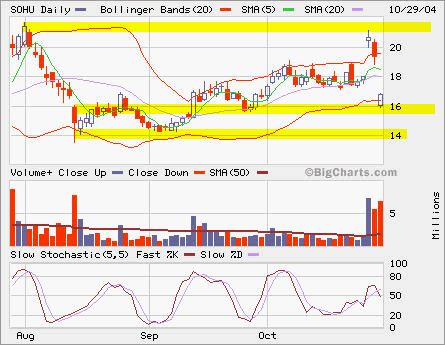

SOHU failed to test 30 and it’s been moving downward ever since. Next week will be option expiration week, we shall see more volatility. I failed to close some positions on SOHU due to lack of time following it closely. Since there’s no much time value left anyway, I’m holding it until expiration.

SOHU closed above the 20SMA in average volume. It looks good to break the resistence at 30.

SOHU closed above the 20SMA in average volume. It looks good to break the resistence at 30.

I will watch it closely this week and plan to close half of the position if it crosses 30 intraday to book some profits in case it pulls back below 30.

The current open interest in Mar 30C is 7,839, which is not very big. I’m not sure how market markers will play near expiration days (roughly two weeks away). For premium sellers, they would love to let Mar 30C expire worthless and they can sell Apr 30 C and 35 C again.