JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24.

JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24.

PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25.

PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25.

As we approach the 2004 year end, my current 401(k) has 75% in a stable value fund (earning a little over 4%) and 25% in international funds with exposure to Europe and Asia Pacific. I have always maintained at least 25% cash in this account.

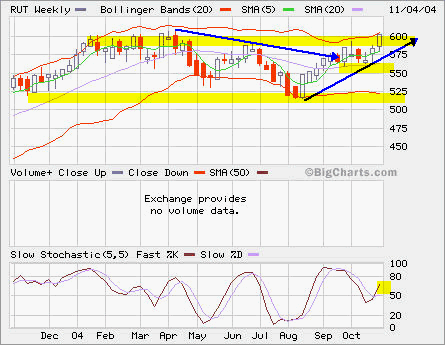

The overall return is YTD 9.6%, compared to JANSX 1.75%, PMCGX 14.13%, TEMFX 13.18%, AEPGX 14.43%, S&P 500 about 6%, QQQ about 8%, RUT about 14% and INDU about 1%.

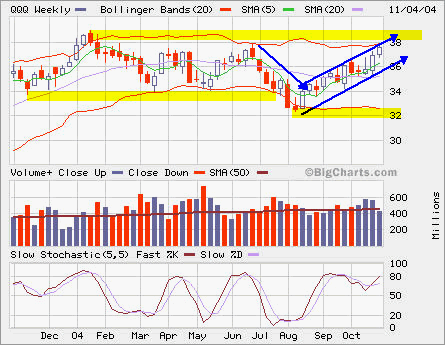

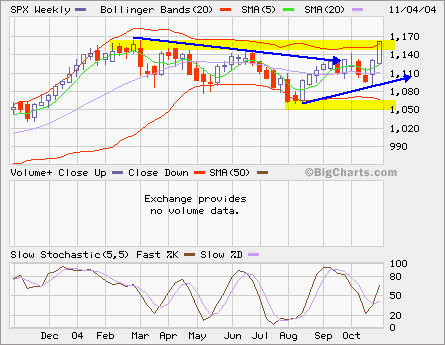

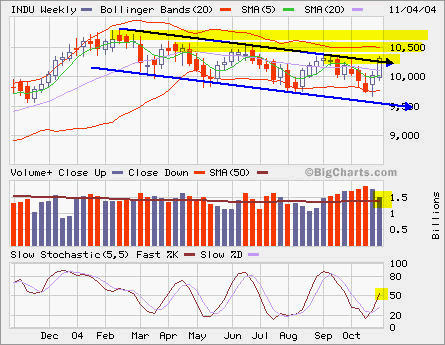

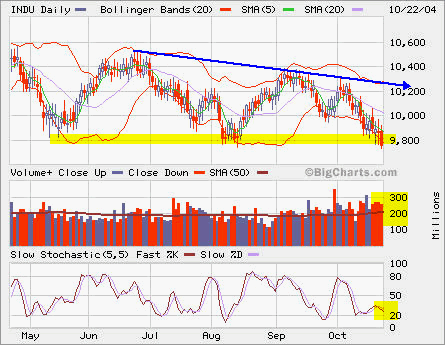

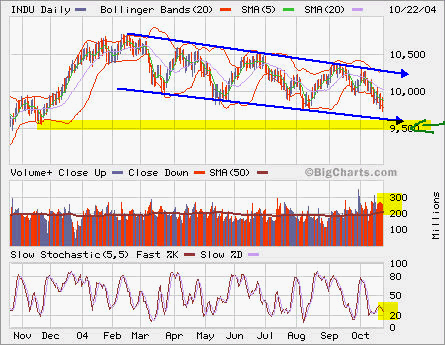

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

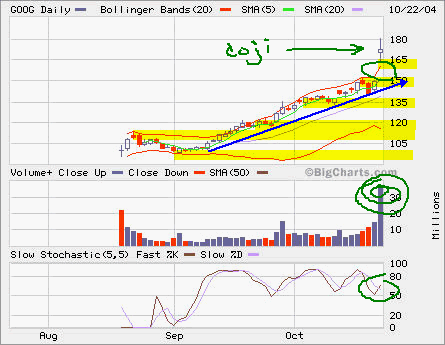

GOOG gapped up big time today after excellent earning report. It now looks like we are back in dot com boom era when stocks move 20 points or more in a single day.

GOOG gapped up big time today after excellent earning report. It now looks like we are back in dot com boom era when stocks move 20 points or more in a single day. INDU is now at year’s low. The support at 9800 was borken slightly at higher than average volume. It’s very weak now. Let’s see if it can hold up above 9700. The next support is at 9500.

INDU is now at year’s low. The support at 9800 was borken slightly at higher than average volume. It’s very weak now. Let’s see if it can hold up above 9700. The next support is at 9500.

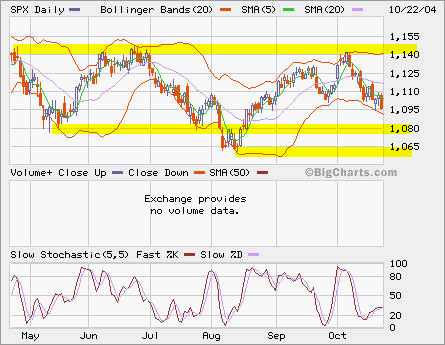

SPX is likely seeking support between 1095 and 1065.

SPX is likely seeking support between 1095 and 1065. RUT is in better shape with support at 560.

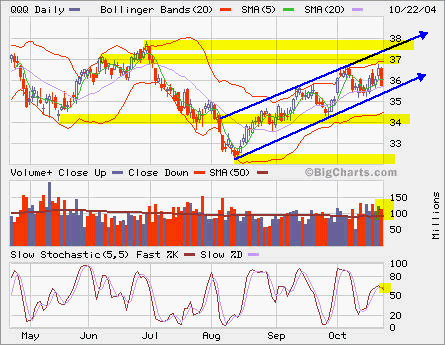

RUT is in better shape with support at 560. QQQ is so far the best among major indexes. The uptrend channel is still intact despite today’s big drop. The volume is slightly above average level.

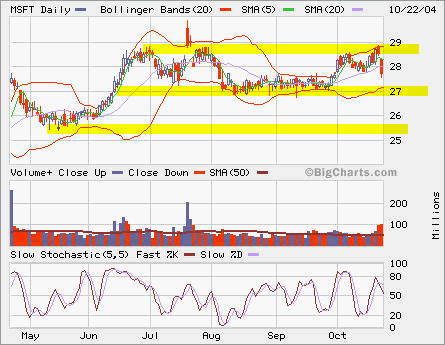

QQQ is so far the best among major indexes. The uptrend channel is still intact despite today’s big drop. The volume is slightly above average level. MSFT is hurt by disappointing earning data. The support is at 27. The high volume yesterday indicated heavy selling into the resistence of previous big gap down.

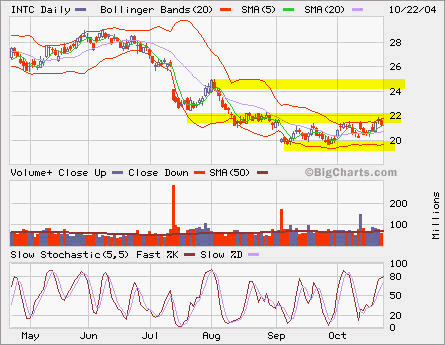

MSFT is hurt by disappointing earning data. The support is at 27. The high volume yesterday indicated heavy selling into the resistence of previous big gap down. INTC did not fall too much among today’s big selling in tech related stocks, which means the market has much consensus at this level. Today’s volume is light.

INTC did not fall too much among today’s big selling in tech related stocks, which means the market has much consensus at this level. Today’s volume is light. INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET.

INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET. MSFT will form a triple-top around 28.6.

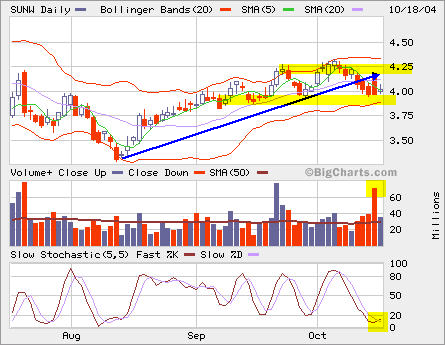

MSFT will form a triple-top around 28.6. SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver.

SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver. RHAT is building a base above support at 12.

RHAT is building a base above support at 12. QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today.

QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today.