After a few days of trading CL, it turns out that a big factor moving the oil market is the FX rate change, specifically, EUR/USD pair. A calendar spread on CL will remove this FX factor so the focus can be on the oil price actions.

Tag Archives: Spread

SUNW is on the move …

SUNW is once again reaching the resistence level. I’m unloading some March SSF as I have accumulated some June SSF. The spread on SUNW’s SSF is still large, currently about 0.03 – 0.04.

SUNW is once again reaching the resistence level. I’m unloading some March SSF as I have accumulated some June SSF. The spread on SUNW’s SSF is still large, currently about 0.03 – 0.04.

SUNW is on the move …

SUNW is once again reaching the resistence level. I’m unloading some March SSF as I have accumulated some June SSF. The spread on SUNW’s SSF is still large, currently about 0.03 – 0.04.

SUNW is once again reaching the resistence level. I’m unloading some March SSF as I have accumulated some June SSF. The spread on SUNW’s SSF is still large, currently about 0.03 – 0.04.

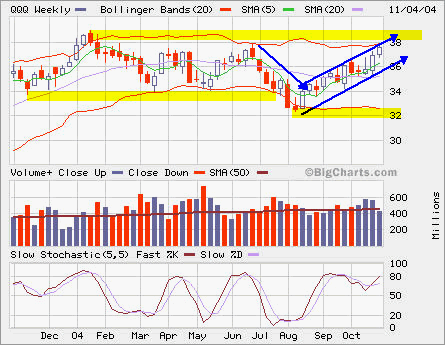

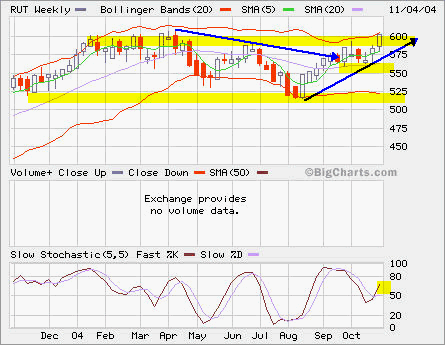

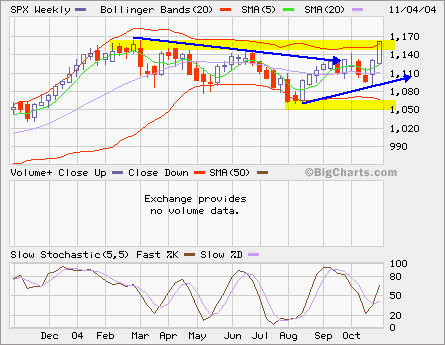

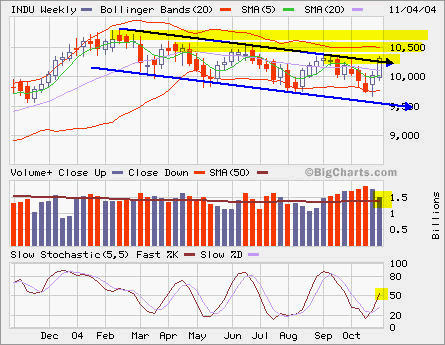

QQQ, RUT, SPX and INDU

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

The vertical spread on QQQ Nov calls opened a while ago has increased its value to 0.85 or 100%. If the QQQ stays above 37, it can reach maximum profit of 1.15 or 135%.

QQQ Vertical Call Spread

Opened a vertical call spread position using QQQ Nov 35C and 37C with a debt of 0.85 on each spread.