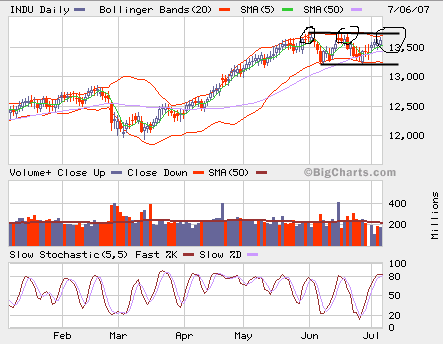

It’s forming a triple top, likely reversal?

However, QQQQ broke out but the lighter than average volume makes the breakout less convincing.

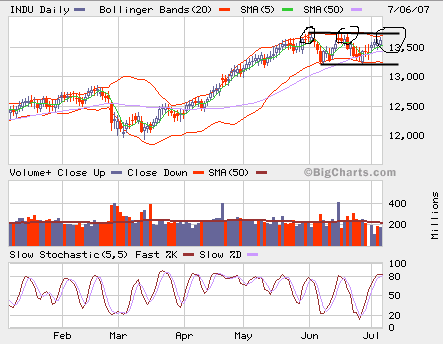

It’s forming a triple top, likely reversal?

However, QQQQ broke out but the lighter than average volume makes the breakout less convincing.

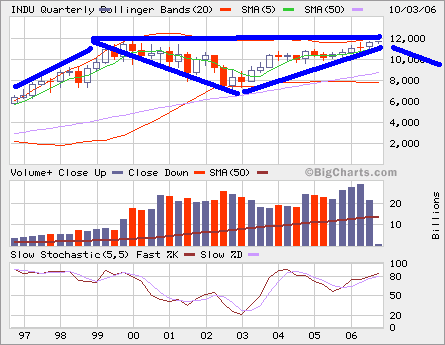

It looks rather symetric on this quarterly chart. What’s ahead of us after 12,000? It looks like a double top so it may pull back for a while before moving ahead.

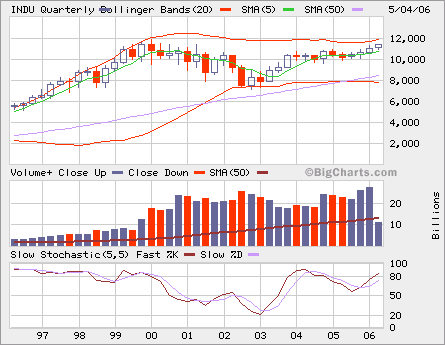

Marching to 12,000. It will form a double top on this long term chart, which means we may see some pullback around 12,000.

Marching to 12,000. It will form a double top on this long term chart, which means we may see some pullback around 12,000.

HNP is right at the previous high after breaking the uptrend line. It’s probably fueld by recent news on China’s rising retail price in electricity. Since it’s forming a double top, it’s more likely to see it come down again or at least a pull back.

HNP is right at the previous high after breaking the uptrend line. It’s probably fueld by recent news on China’s rising retail price in electricity. Since it’s forming a double top, it’s more likely to see it come down again or at least a pull back.

I’m researching on ETFs for my Roth IRA investment options. The top 5 performers based on YTD data are XLE 19.89% (Energy Select Sector SPDR, not surprisingly, the crude reached at $57), IYE (iShares Dow Jones US Energy) 19.5%, VDE 19.44% (Vanguard Energy VIPERS), IXC 16.73% (iShares S&P Global Energy Sector) and IGE 14.17% (iShares Goldman Sachs Natural Resource).

Since I consider energy sectior quite extended for now, I won’t buy them at this point. The top 5 ETFs excluding energy related issues are EWY 11.52% (iShares MSCI South Korea Index), EWA 7.54% (iShares MSCI Australia Index), EPP 4.91% (iShares MSCI Pacific ex-Japan), EWS 4.88%(iShares MSCI Singapore Index) and ADRE 4.2% (BLDRS Emerging Markets 50 ADR Index).

We can see the underlying story, that is, Asia and Pacific are where the growth will be!

We can see the underlying story, that is, Asia and Pacific are where the growth will be!