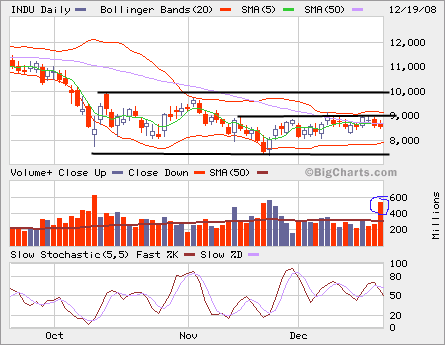

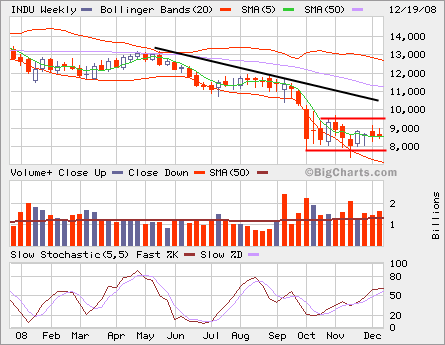

It’s down more than 180 points. If the current uptrend line is broken, the first support is at 8000-8100 level, which could become a good base to build some long positions if the worst is over. Let’s watch closely as overall it’s oversold at this point. The V shape bounce needs some time to consolidate even we’re entering a new uptrend.

The next support is 7500, which is previous low before this last leg down.

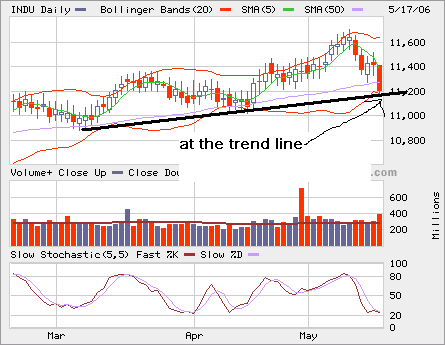

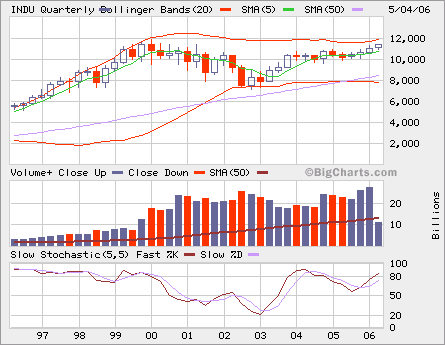

Dow Jones Industrial Average closed at the current uptrend line. Breaking down from here indicates a trend reversal. If you want t0 trade, here’s an opportunity to go long and set a stop loss somewhere below the trend line, say, 11,000.

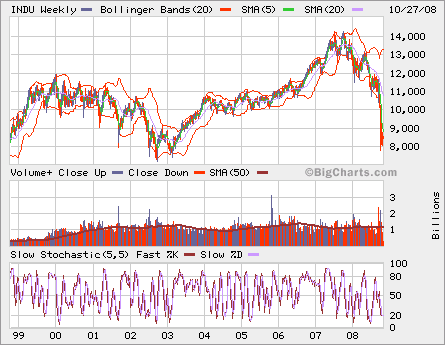

Dow Jones Industrial Average closed at the current uptrend line. Breaking down from here indicates a trend reversal. If you want t0 trade, here’s an opportunity to go long and set a stop loss somewhere below the trend line, say, 11,000. Marching to 12,000. It will form a double top on this long term chart, which means we may see some pullback around 12,000.

Marching to 12,000. It will form a double top on this long term chart, which means we may see some pullback around 12,000.