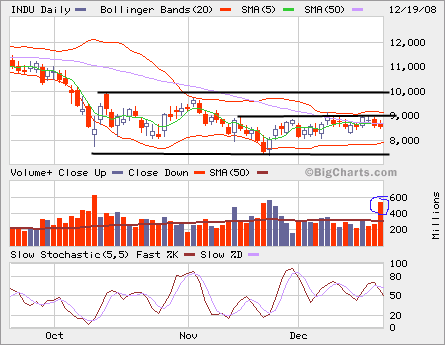

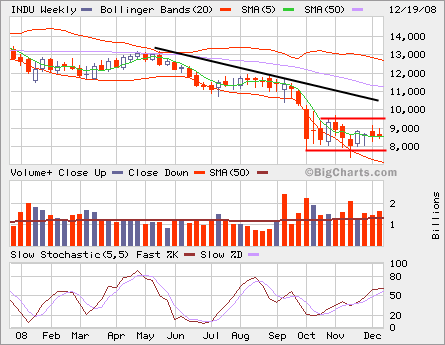

Dow Jones Industrial Average has been up and down for the past many weeks but it appears that it has moved towards sideways. As recession has been officially announced and confirmed, how much has the market priced in all the bad news?

Certainly investors are looking for values after significant drops, but it’s not clear that if it will range bound between somewhere below 8000 and somewhere above 9000.

If it builds a long base above 8000 and consolidates the base, we may see more upside but we need to see the confirmation.

Previous support at 10600 has become the resistence here. All longer term SMAs are pointing downwards, but SMA 5 is pointing sideway or flat. Obviously some good news would help to break the stalemate.

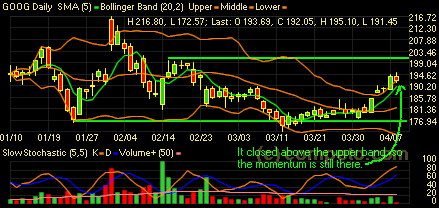

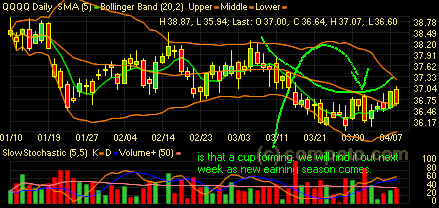

Previous support at 10600 has become the resistence here. All longer term SMAs are pointing downwards, but SMA 5 is pointing sideway or flat. Obviously some good news would help to break the stalemate. GOOG’s volume has been low. Friday was a down, but volume was very low compared to the up day on Thursday. Not too many sellers and it’s bullish sign.

GOOG’s volume has been low. Friday was a down, but volume was very low compared to the up day on Thursday. Not too many sellers and it’s bullish sign. Waiting for something to happen here.

Waiting for something to happen here.

A good entry to long LOW if the support holds. The extremly high selling volume might indicate that most sellers wanted out were out now.

A good entry to long LOW if the support holds. The extremly high selling volume might indicate that most sellers wanted out were out now. HNP is right at the previous high after breaking the uptrend line. It’s probably fueld by recent news on China’s rising retail price in electricity. Since it’s forming a double top, it’s more likely to see it come down again or at least a pull back.

HNP is right at the previous high after breaking the uptrend line. It’s probably fueld by recent news on China’s rising retail price in electricity. Since it’s forming a double top, it’s more likely to see it come down again or at least a pull back. GOOG is at previous low, which is the support. Will it stick, don’t know. The bounce needs some kind of news or rumors. Or MM may stage a shake out to break the support.

GOOG is at previous low, which is the support. Will it stick, don’t know. The bounce needs some kind of news or rumors. Or MM may stage a shake out to break the support.