All major markets rocket back over 10% today. A lot of short squeezes probably. I don’t believe that there’re so many longs that couldn’t wait and jump on the buying spree.

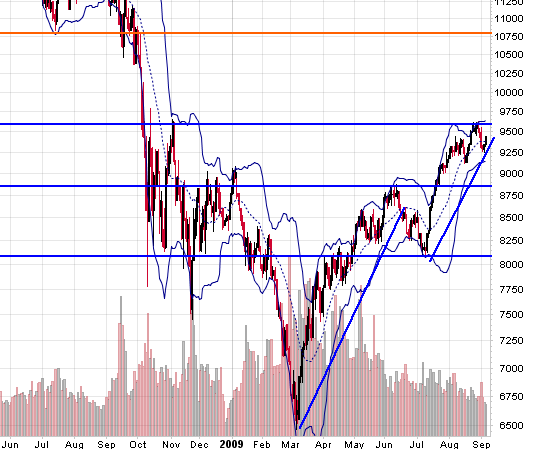

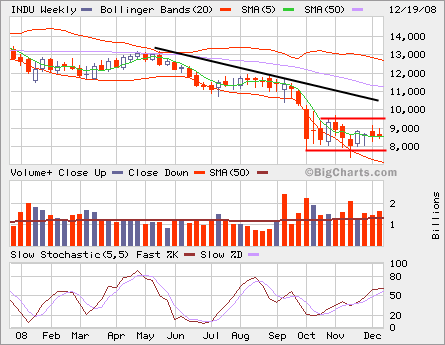

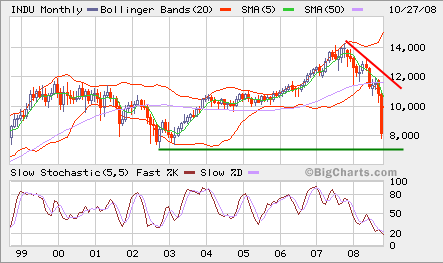

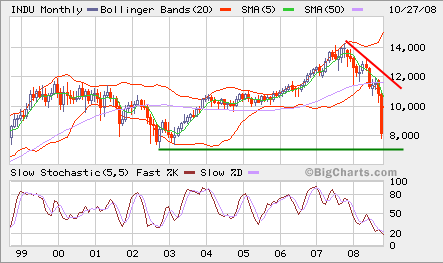

On the monthly chart of Dow Jones Industrial Average (INDU), you can see that we’re approaching previous low, which occured 5 years ago. Have we reached the bottom yet? Not sure, but we might be near the bottom judging by the previous low, which is the current support level.

The looming global recession is on everyone’s mind, so it’s possible that the support may not hold. There will be many ups and downs around that support. We can certainly play longs at the support level and shorts at any rally near 9,500/10,000 zone. The markets are currently in oversold condition and volatility will remain high as seen in the past a few weeks.

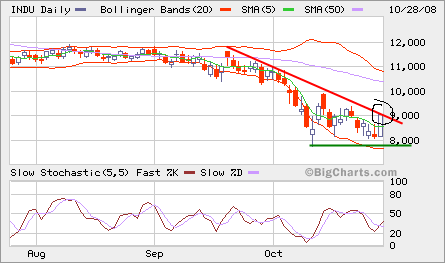

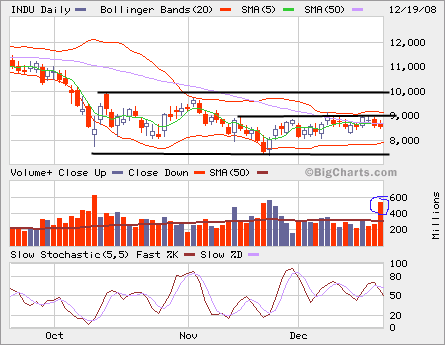

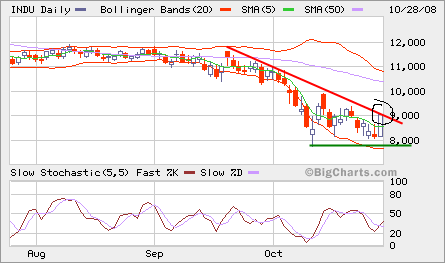

On the 3-month daily chart, INDU is moving away from the oversold condition. If we don’t see a follow through on this snap back, the downward trend will continue. 8,000 looks like a good support for now and the more fight between the bears and bulls around 8,000 the stronger it will become. If the downtrend continues, 7,500 is the next major support to watch.