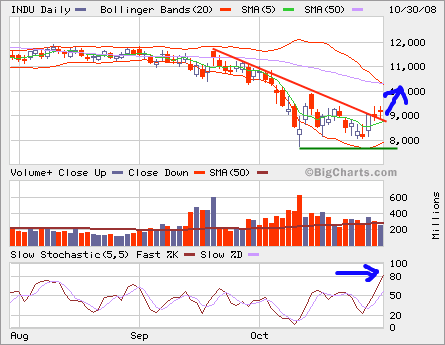

INDU is retesting the 8,000 level again. As we can see, it’s currently over sold and the volume is slightly above average. As we have said before, around 8,000 is the major support level. For a short-term trade, it’s time to buy some.

INDU is retesting the 8,000 level again. As we can see, it’s currently over sold and the volume is slightly above average. As we have said before, around 8,000 is the major support level. For a short-term trade, it’s time to buy some.

It closed up today and the week so it’s following through the big shoot up the other day. As we can see that on the daily chart, it’s in short-term over bought condition now. It’s slowly walking out the downtrend line, but we should be cautious as the volume was not confirming.

If you have significant equity positions in your portfolio, any rally into 9,500-10,000 zone can be your opportunity to lighten up and preserve your capital during this bear market.

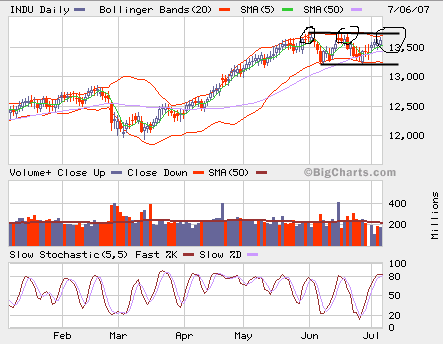

It’s forming a triple top, likely reversal?

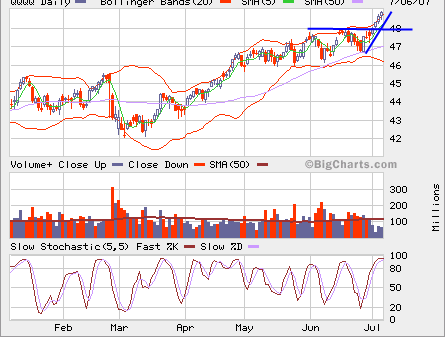

However, QQQQ broke out but the lighter than average volume makes the breakout less convincing.

Dow Jones Industrial broke out this resistence at higher than average volume. It’s in a 5-year high right now. Expecting some further up moves in the comming days.

Dow Jones Industrial broke out this resistence at higher than average volume. It’s in a 5-year high right now. Expecting some further up moves in the comming days.

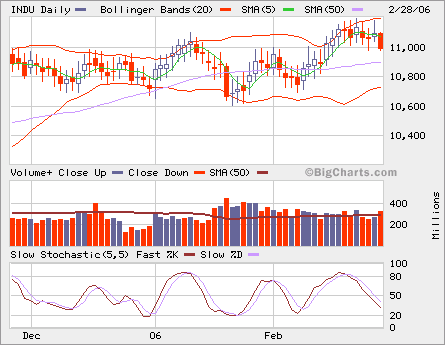

Dow Jones Industrial pulled back a little and closed just a hair line below 11,000. The volume was slightly higher than average. If it holds up at 11,000, it’s more likely we will see some movement on the upside in the comming days and weeks. However, if the 11,000 does not hold up, we expect to see it at the support level 10,700.

Dow Jones Industrial pulled back a little and closed just a hair line below 11,000. The volume was slightly higher than average. If it holds up at 11,000, it’s more likely we will see some movement on the upside in the comming days and weeks. However, if the 11,000 does not hold up, we expect to see it at the support level 10,700.