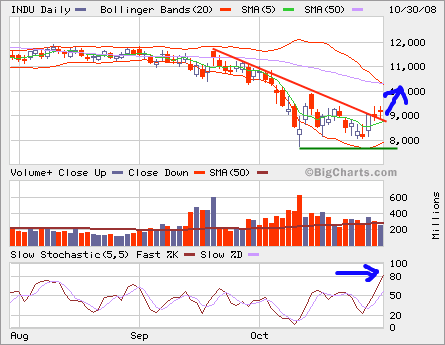

It closed up today and the week so it’s following through the big shoot up the other day. As we can see that on the daily chart, it’s in short-term over bought condition now. It’s slowly walking out the downtrend line, but we should be cautious as the volume was not confirming.

If you have significant equity positions in your portfolio, any rally into 9,500-10,000 zone can be your opportunity to lighten up and preserve your capital during this bear market.