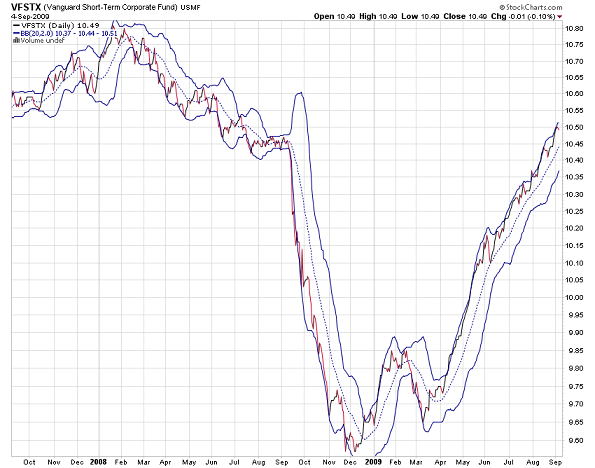

Here we took a look at one of Vanguard Bond Funds: VFSTX. Yield 4.41%; YTD return 10%; investment grade corporate bonds; average maturity 2.6 yr.

It suffered a 10% drop in price in 2008. The actual return was -5%, which was big in short term investment grade bond fund.

What was the cause of that big drop? Client redemption? Maybe considering credit crisis occurred last year. A few bond holdings went under? Maybe too. Had it owned Lehman Brother, for example.

It’s quite interesting that it has a unusual V-shape recovery after the drop. Obviously the relative higher yield has been attracting a lot of investors looking for better returns on their short term investment. Has it also attracted a lot of people who are basically using it as money market funds? Maybe.

Another reason for the recovery might be the valuation of its certain holdings has recovered since the credit crisis.

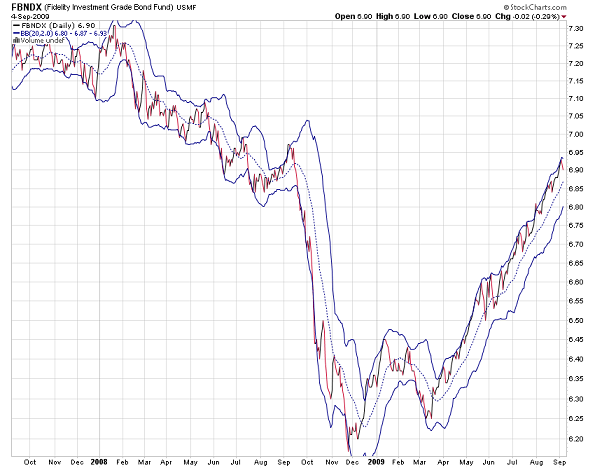

For comparison, here’s Fidelity FBNDX chart, which showed similar drop last year.

If you have owned similar fund, you probably want to pay closer attention to its price movement.

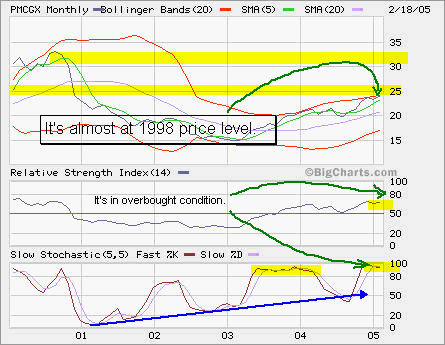

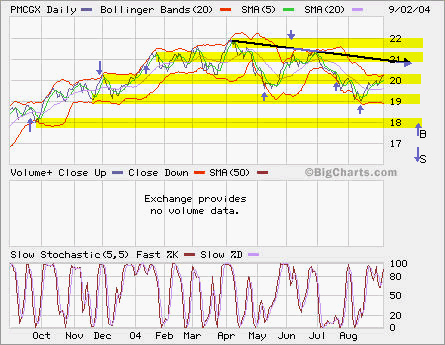

PMCGX has followed the overall market and resumed its ascending. Currently, it’s in overbought condition indicated by both RSI and Stochastic. As we can see from prior history, the overbought or oversold condition could stay there for a while. I do plan to close or at least to square some money off the table next week as our 401(k) plan will have a week of black out period when the plan is to be adjusted with a few changes. As we all knew from history such as Enron debacle, black out period could be very risky although the mutual funds are much more diversified in this regard. One company imploding would not make a fund to plummet.

PMCGX has followed the overall market and resumed its ascending. Currently, it’s in overbought condition indicated by both RSI and Stochastic. As we can see from prior history, the overbought or oversold condition could stay there for a while. I do plan to close or at least to square some money off the table next week as our 401(k) plan will have a week of black out period when the plan is to be adjusted with a few changes. As we all knew from history such as Enron debacle, black out period could be very risky although the mutual funds are much more diversified in this regard. One company imploding would not make a fund to plummet.

JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24.

JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24. PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25.

PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25. PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.