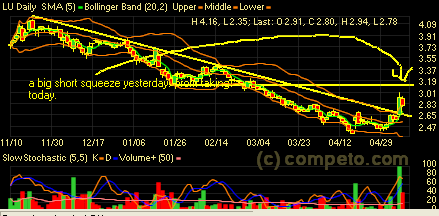

150 millions shares changed hands yesterday. After a big day like that, profit taking is normal.

150 millions shares changed hands yesterday. After a big day like that, profit taking is normal.

Tag Archives: Profit

QQQ, RUT, SPX and INDU

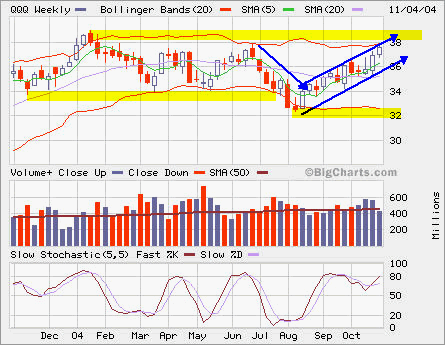

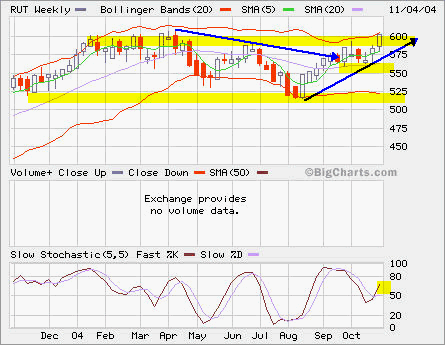

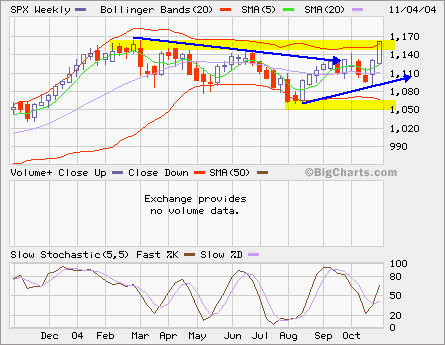

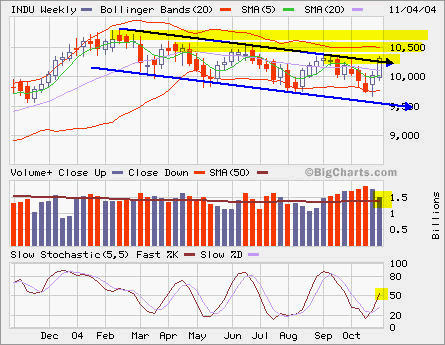

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

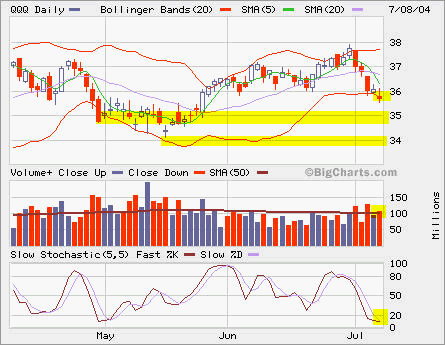

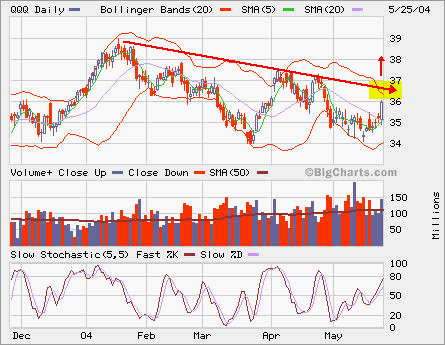

The vertical spread on QQQ Nov calls opened a while ago has increased its value to 0.85 or 100%. If the QQQ stays above 37, it can reach maximum profit of 1.15 or 135%.

QQQ and RHAT

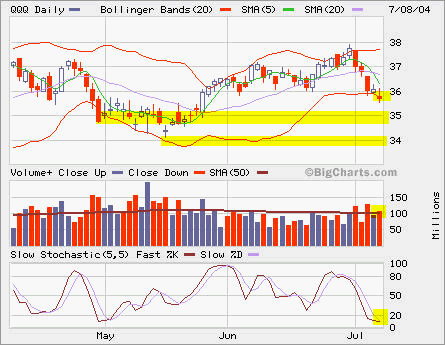

I closed QQQ Jul 36 Puts at 0.65 for a small profit as it gapped down today. The volume was about average. No panic selling. Holding ATM/OTM front-month puts won’t make too much sense when approaching expiration.

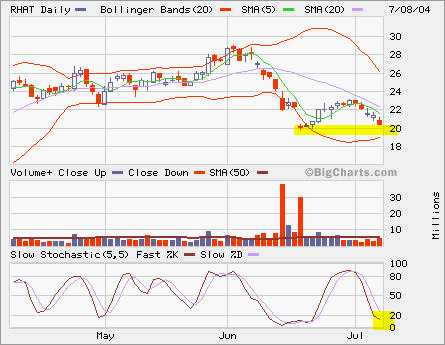

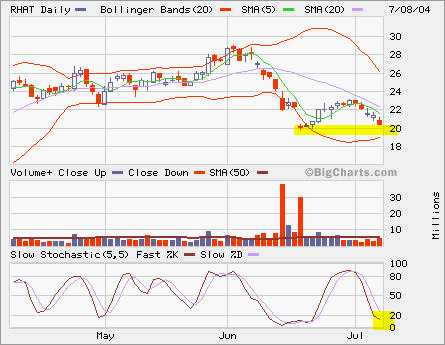

I also closed Jul 20 Puts at 0.50 at breakeven point. I still keep Aug 22.5 Puts as RHAT may retest critical support at 20. As it’s in oversold condition, buying interests are plenty as seen when it was bouncing back from the gap down.

QQQ and RHAT

I closed QQQ Jul 36 Puts at 0.65 for a small profit as it gapped down today. The volume was about average. No panic selling. Holding ATM/OTM front-month puts won’t make too much sense when approaching expiration.

I also closed Jul 20 Puts at 0.50 at breakeven point. I still keep Aug 22.5 Puts as RHAT may retest critical support at 20. As it’s in oversold condition, buying interests are plenty as seen when it was bouncing back from the gap down.

QQQ

QQQ closed at 35.96 today. The resistence will be the intermediate downtrend line below 37. If 37 is taken out, it will signal a breakout from the downtrend started in Jan. 2004. We will take some profit at 37 and use 36 as the stop for remaining position.