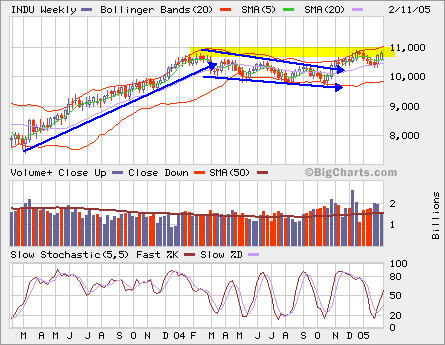

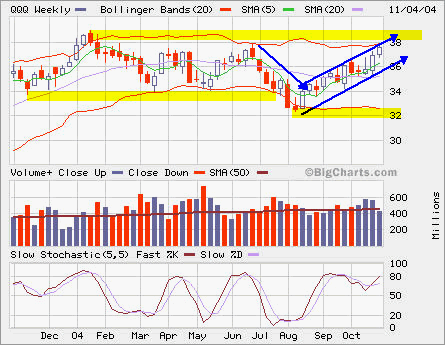

INDU, SPX and RUT all pose for breakout. INDU will probably test 11,000, while QQQQ is not out of woods yet.

INDU, SPX and RUT all pose for breakout. INDU will probably test 11,000, while QQQQ is not out of woods yet.

Tag Archives: Indu

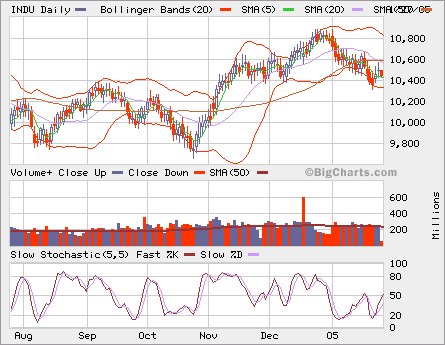

INDU

The short-term moving averages have become the overhead resistences. Both SMA 20 and 50 are pointing downwards currently, a bearish tune in spite of runup in the past two days. The longer-term SMA 200 is the support area and it’s pointing side way.

Market Overview

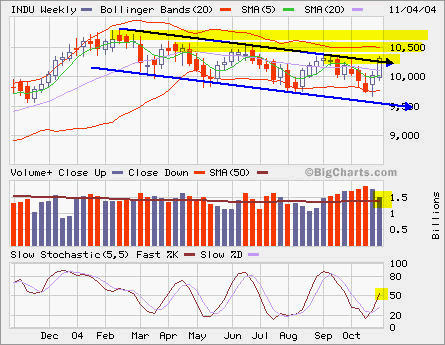

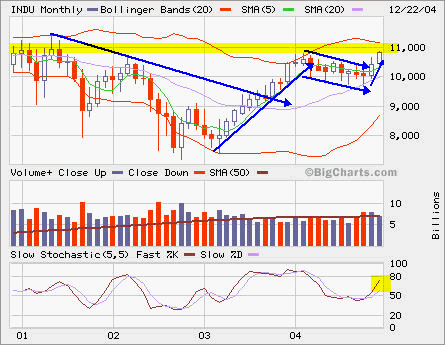

INDU is approaching its major resistence at 11,000. We may hit 11,000 before 2004 ends even we will only have one trading seesion left on the calendar!

INDU is approaching its major resistence at 11,000. We may hit 11,000 before 2004 ends even we will only have one trading seesion left on the calendar!

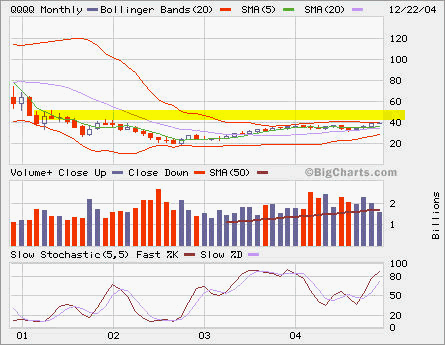

QQQQ has been around 40 a few times, it poses to break through the resistence and leaves this long base built over three years!

QQQQ has been around 40 a few times, it poses to break through the resistence and leaves this long base built over three years!

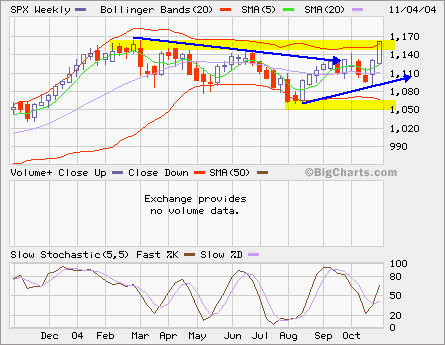

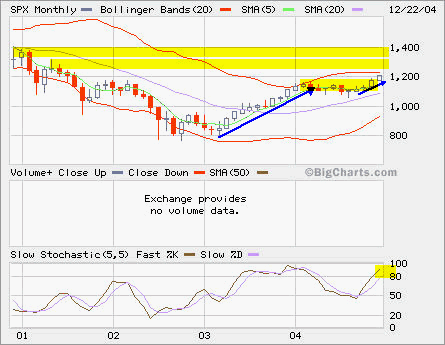

SPX looks more like INDU than QQQQ, but its major resistence is at 13,00 before next one at 1,400, still a long way to go. The trend is up.

SPX looks more like INDU than QQQQ, but its major resistence is at 13,00 before next one at 1,400, still a long way to go. The trend is up.

JANSX and PMCGX

JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24.

JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24.

PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25.

PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25.

As we approach the 2004 year end, my current 401(k) has 75% in a stable value fund (earning a little over 4%) and 25% in international funds with exposure to Europe and Asia Pacific. I have always maintained at least 25% cash in this account.

The overall return is YTD 9.6%, compared to JANSX 1.75%, PMCGX 14.13%, TEMFX 13.18%, AEPGX 14.43%, S&P 500 about 6%, QQQ about 8%, RUT about 14% and INDU about 1%.

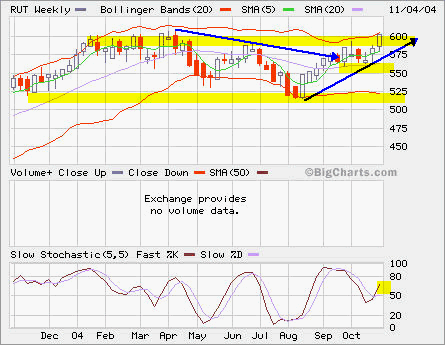

QQQ, RUT, SPX and INDU

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

The vertical spread on QQQ Nov calls opened a while ago has increased its value to 0.85 or 100%. If the QQQ stays above 37, it can reach maximum profit of 1.15 or 135%.