Opened a vertical call spread position using QQQ Nov 35C and 37C with a debt of 0.85 on each spread.

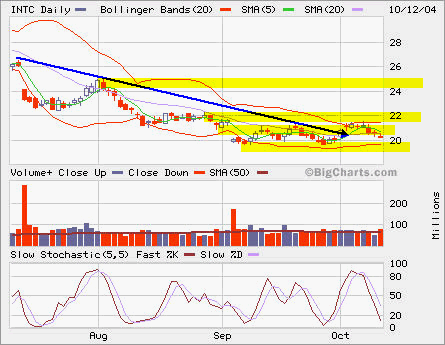

INTC

INTC closed lower today. However, AH, INTL announced earning, slight better than the lowered forcast by the street. It went up to 21.04. Let’s see how the market reacts. I still hold 15 Oct 25C calls. Maybe I can get 0.05 each tomorrow morning. I rolled all Oct 22.5C to Nov 22.5C and Nov 20C. Will sell Nov 25C.

YTD Performance

Market pullbacks

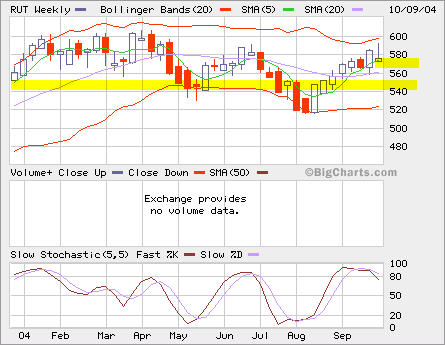

INDU backed off from the resistence just like last failed attempt to break the downtrend line. Similar actions were seen at RUT, SPX and NDX. However, if the cahnnels are held intact, they present some good entry points to go long.

INDU backed off from the resistence just like last failed attempt to break the downtrend line. Similar actions were seen at RUT, SPX and NDX. However, if the cahnnels are held intact, they present some good entry points to go long.

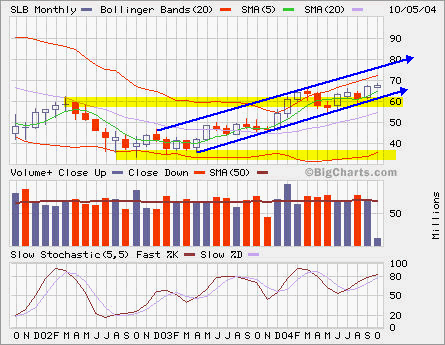

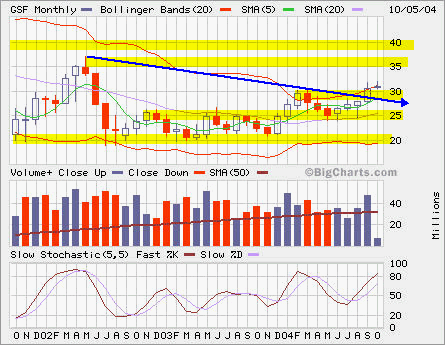

SLB, GSF and RIG

SLB has been in this uptrend for more than a year. At oil price above $51, it is breaking out from recent consolidation around the resistence at 60.

SLB has been in this uptrend for more than a year. At oil price above $51, it is breaking out from recent consolidation around the resistence at 60.

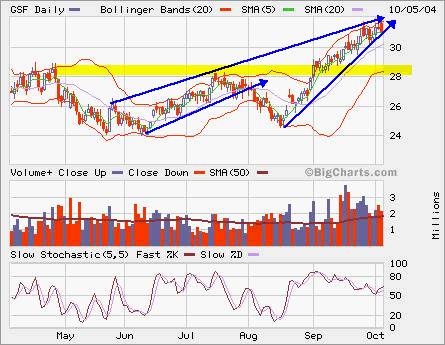

GSF is approaching its resistence at 35 if it can overcome the resistence at 32 first. Based on its charts, we may see another pullback before breaking out at 32.

GSF is approaching its resistence at 35 if it can overcome the resistence at 32 first. Based on its charts, we may see another pullback before breaking out at 32.

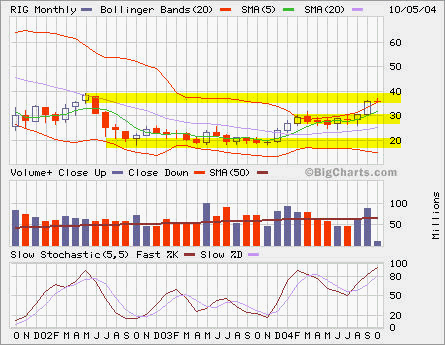

RIG is already half way to its resistence at 40.

RIG is already half way to its resistence at 40.