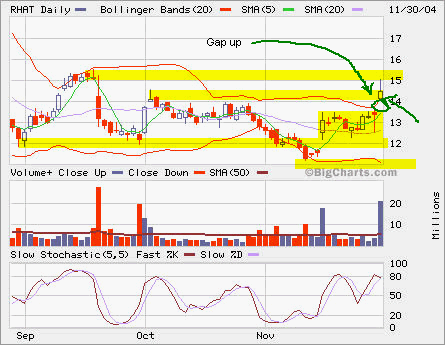

It’s breaking out from the tight range fueled by recent analysts’ upgrades. I’m scaling out my Dev 12.5 calls and will keep Dev 15 calls.

JANSX and PMCGX

JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24.

JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24.

PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25.

PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25.

As we approach the 2004 year end, my current 401(k) has 75% in a stable value fund (earning a little over 4%) and 25% in international funds with exposure to Europe and Asia Pacific. I have always maintained at least 25% cash in this account.

The overall return is YTD 9.6%, compared to JANSX 1.75%, PMCGX 14.13%, TEMFX 13.18%, AEPGX 14.43%, S&P 500 about 6%, QQQ about 8%, RUT about 14% and INDU about 1%.

MSFT

MSFT is showing some weakness. The support is at 26.

MSFT is showing some weakness. The support is at 26.

MSFT

MSFT is showing some weakness. The support is at 26.

MSFT is showing some weakness. The support is at 26.

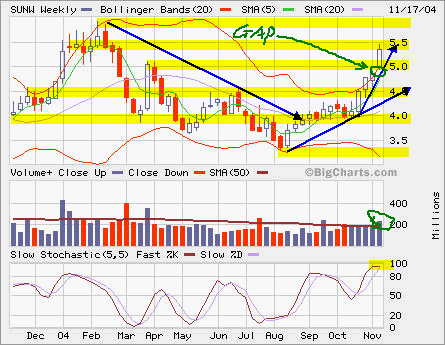

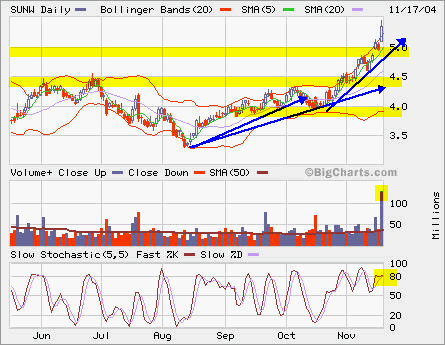

SUNW and LFC

SUNW is moving up quite bit in extremely high volume. It passed through the resistence at 5 and headed to the next one around 5.85, the year’s high.

SUNW is moving up quite bit in extremely high volume. It passed through the resistence at 5 and headed to the next one around 5.85, the year’s high.

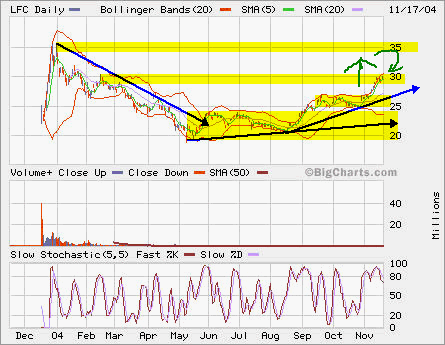

LFC is trying to break out from 30. If it fails to do so, we will see some pullback near the base it built in the past two months. From the chart, getting back to the all time high of 35 is reacheable. It may go sideway before moving to 35 just like it did around the base at 25.

LFC is trying to break out from 30. If it fails to do so, we will see some pullback near the base it built in the past two months. From the chart, getting back to the all time high of 35 is reacheable. It may go sideway before moving to 35 just like it did around the base at 25.