INDU backed off from the resistence just like last failed attempt to break the downtrend line. Similar actions were seen at RUT, SPX and NDX. However, if the cahnnels are held intact, they present some good entry points to go long.

INDU backed off from the resistence just like last failed attempt to break the downtrend line. Similar actions were seen at RUT, SPX and NDX. However, if the cahnnels are held intact, they present some good entry points to go long.

Tag Archives: Long

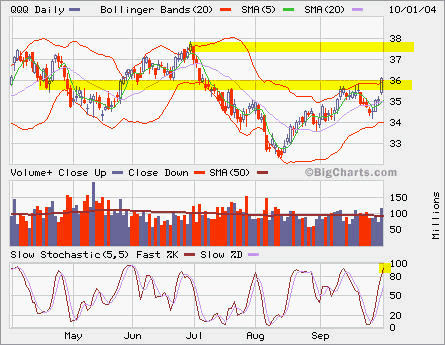

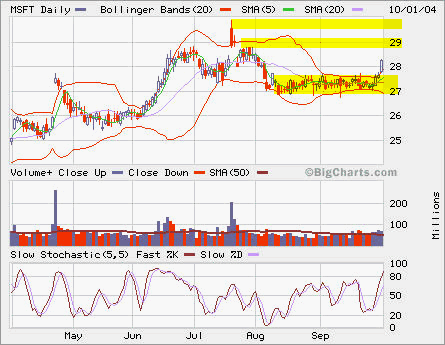

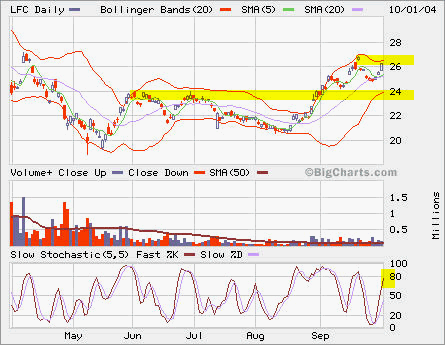

QQQ, MSFT and LFC

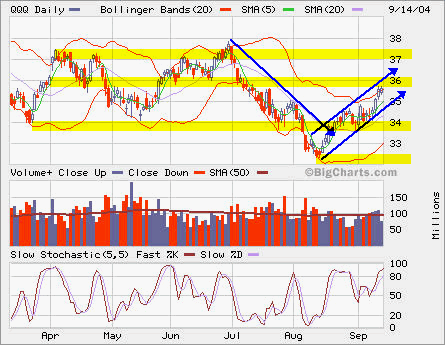

QQQ popped up more than 1 point intraday. Sold 1/2 Nov36 calls; also sold short Oct36 calls for 0.55, will cover it at dip. This QQQ position is now changed into an at-the-money calendar spread from previous near-the-money long call only.

QQQ popped up more than 1 point intraday. Sold 1/2 Nov36 calls; also sold short Oct36 calls for 0.55, will cover it at dip. This QQQ position is now changed into an at-the-money calendar spread from previous near-the-money long call only.

MSFT broke out from recent basing mode.

MSFT broke out from recent basing mode.

QQQ, RHAT and LFC

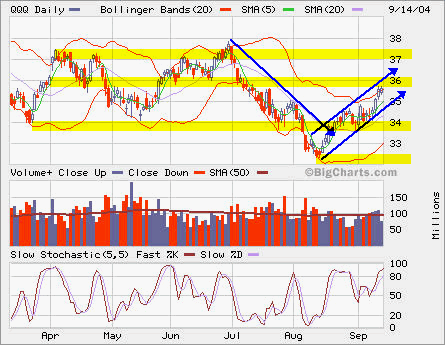

QQQ is in short-term uptrend. The resistence is ar 36 then 37.

QQQ is in short-term uptrend. The resistence is ar 36 then 37.

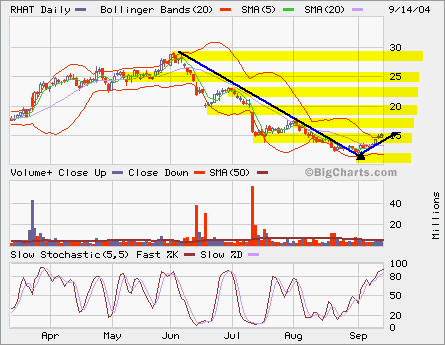

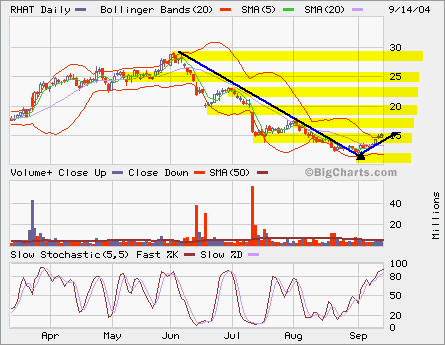

RHAT has a long way to go back its recent high.

RHAT has a long way to go back its recent high.

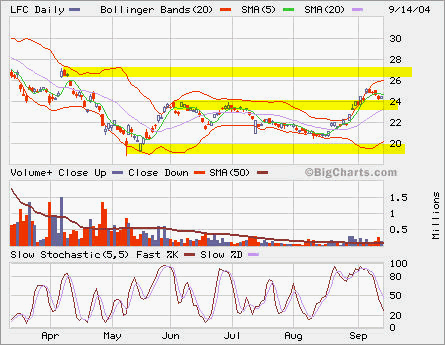

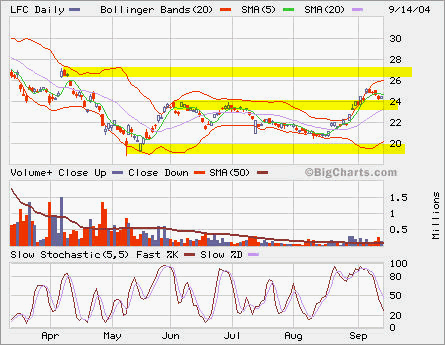

LFC is at pullback after strong move. However, it has to hold up above 24.

LFC is at pullback after strong move. However, it has to hold up above 24.

QQQ, RHAT and LFC

QQQ is in short-term uptrend. The resistence is ar 36 then 37.

QQQ is in short-term uptrend. The resistence is ar 36 then 37.

RHAT has a long way to go back its recent high.

RHAT has a long way to go back its recent high.

LFC is at pullback after strong move. However, it has to hold up above 24.

LFC is at pullback after strong move. However, it has to hold up above 24.

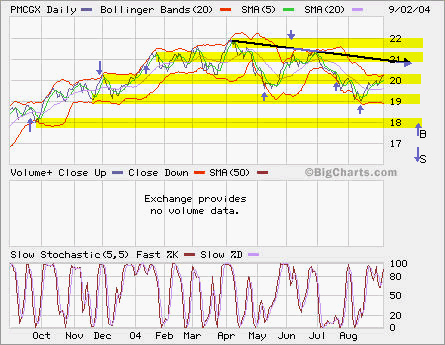

PMCGX

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX YTD performance is -0.05%, my PMCGX YTD is 1.92%.