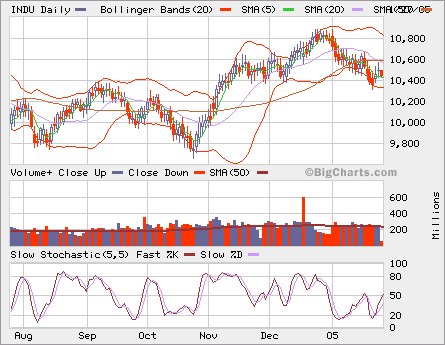

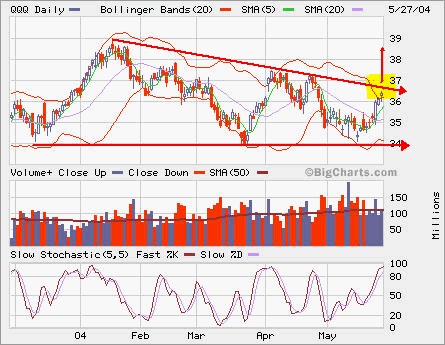

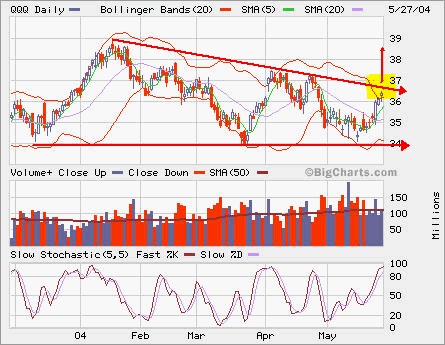

The short-term moving averages have become the overhead resistences. Both SMA 20 and 50 are pointing downwards currently, a bearish tune in spite of runup in the past two days. The longer-term SMA 200 is the support area and it’s pointing side way.

Tag Archives: Overhead

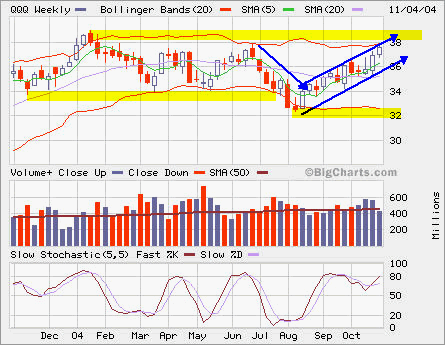

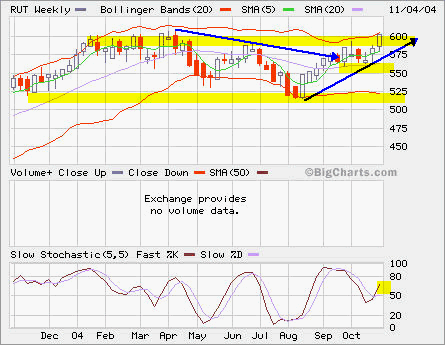

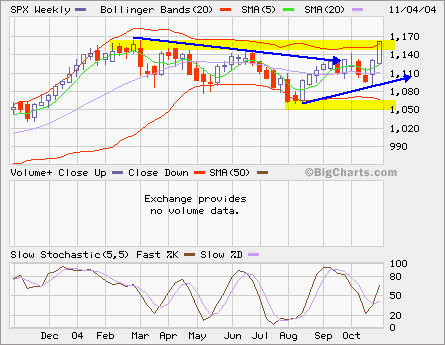

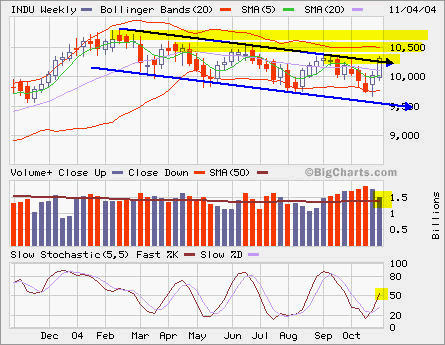

QQQ, RUT, SPX and INDU

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

The vertical spread on QQQ Nov calls opened a while ago has increased its value to 0.85 or 100%. If the QQQ stays above 37, it can reach maximum profit of 1.15 or 135%.

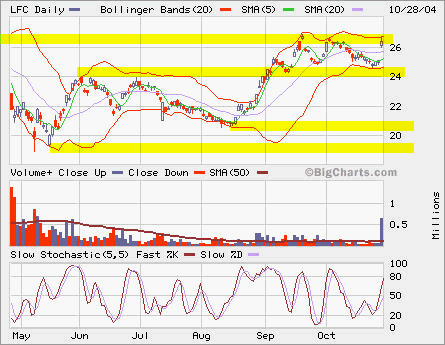

LFC, SUNW and LU

LFC rose 1.33 today in every high volume. It’s testing the overhead resistence again. The next major resistence is at 30.

LFC rose 1.33 today in every high volume. It’s testing the overhead resistence again. The next major resistence is at 30.

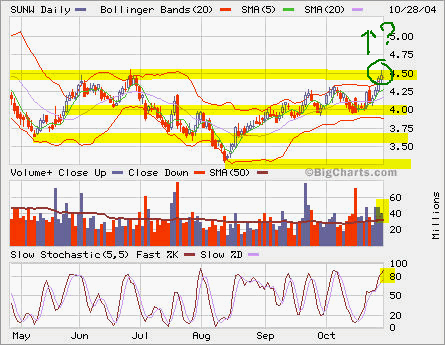

SUNW continued its ascending, but it backed off from 4.54 intraday high and ended at 4.47.

SUNW continued its ascending, but it backed off from 4.54 intraday high and ended at 4.47.

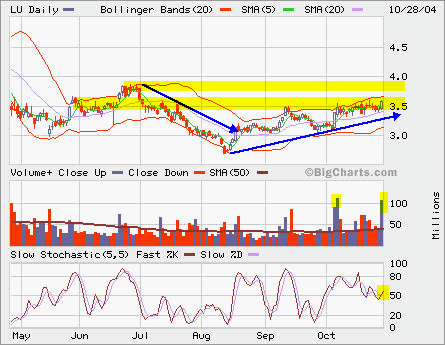

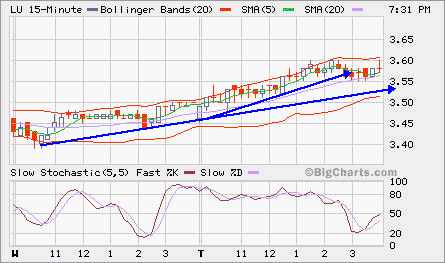

LU was very active traded today, over 100 million shares! It looks like that it’s posing for a breakout. From the two-day 15 minute char, we can see that buying was persistent.

LU was very active traded today, over 100 million shares! It looks like that it’s posing for a breakout. From the two-day 15 minute char, we can see that buying was persistent.

QQQ

It’s approaching the overhead resistence. The volume is about average. We will monitor SMA 5 closely.

QQQ

It’s approaching the overhead resistence. The volume is about average. We will monitor SMA 5 closely.