I’m spending the weekends researching options on WAP security with my Sony Ericsson T610. I signed up a plan with T-Mobile with its T-Zones, which supports GPRS for web browsing, email, SMS and MMS. T610 also supports Bluetooth and IR connectivity. Using Bluetooth is really easy, there’s nothing to configure other than turn on the Bluetooth. Setting up IR with a PC is more challenging since it involves with PC and modem driver issue. I’m gonna get a Bluetooth USB adapter instead.

While playing with the phone, I found that the four trusted CA certificates were gone for reason unknown. I did do a master reset after changing many settings. Trying to figure out how to install trusted CA certificates looks impossible. I found no useful information on Google, Sony Ericsson and T-Mobile sites. Calls to the T-Mobile tech support were not helpful either.

I can not connect to T-Zones with security turned on. With security turned off, browsing web works, but I can not login into passort site, nor any other msn mobile sites such as hotmail and msn messenger.

I start to think that maybe T-Mobile does not support secured T-Zones on its unlimited T-Zones plan. It does have another unlimited T-Zones Pro plan, which supports additional WAP gateway other than T-Mobile’s.

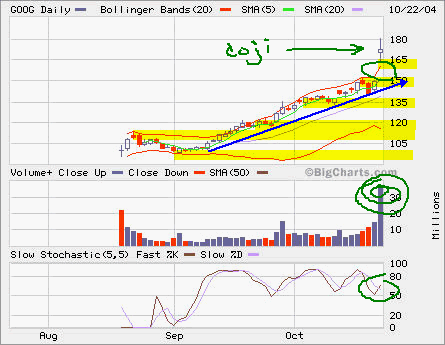

GOOG gapped up big time today after excellent earning report. It now looks like we are back in dot com boom era when stocks move 20 points or more in a single day.

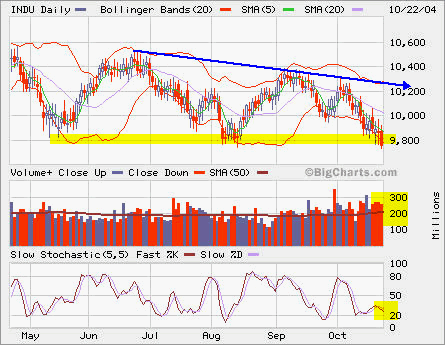

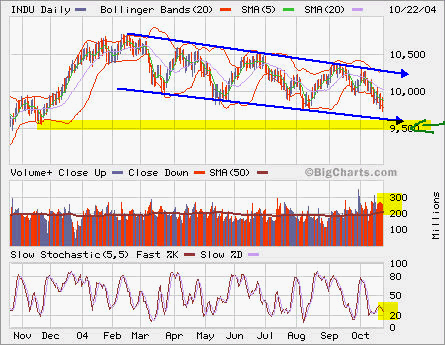

GOOG gapped up big time today after excellent earning report. It now looks like we are back in dot com boom era when stocks move 20 points or more in a single day. INDU is now at year’s low. The support at 9800 was borken slightly at higher than average volume. It’s very weak now. Let’s see if it can hold up above 9700. The next support is at 9500.

INDU is now at year’s low. The support at 9800 was borken slightly at higher than average volume. It’s very weak now. Let’s see if it can hold up above 9700. The next support is at 9500.

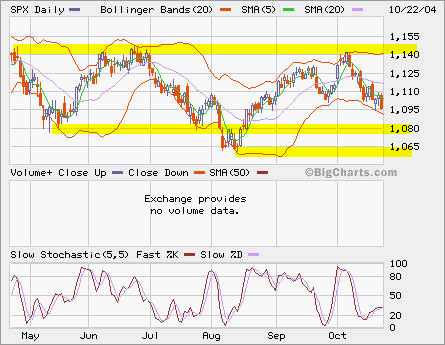

SPX is likely seeking support between 1095 and 1065.

SPX is likely seeking support between 1095 and 1065. RUT is in better shape with support at 560.

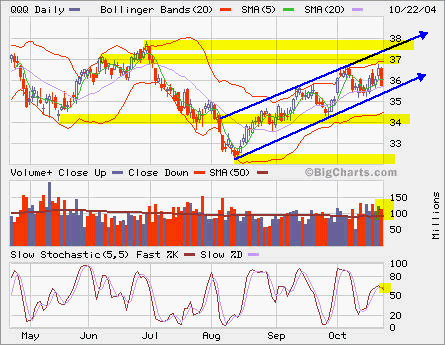

RUT is in better shape with support at 560. QQQ is so far the best among major indexes. The uptrend channel is still intact despite today’s big drop. The volume is slightly above average level.

QQQ is so far the best among major indexes. The uptrend channel is still intact despite today’s big drop. The volume is slightly above average level. MSFT is hurt by disappointing earning data. The support is at 27. The high volume yesterday indicated heavy selling into the resistence of previous big gap down.

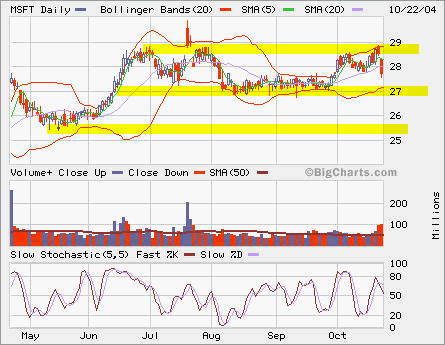

MSFT is hurt by disappointing earning data. The support is at 27. The high volume yesterday indicated heavy selling into the resistence of previous big gap down. INTC did not fall too much among today’s big selling in tech related stocks, which means the market has much consensus at this level. Today’s volume is light.

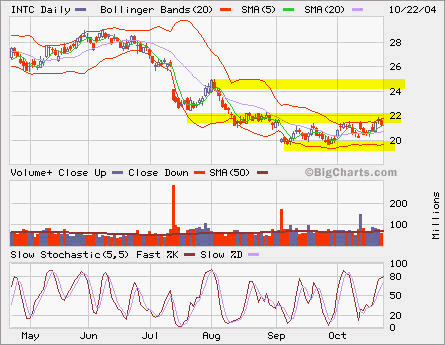

INTC did not fall too much among today’s big selling in tech related stocks, which means the market has much consensus at this level. Today’s volume is light. INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET.

INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET. MSFT will form a triple-top around 28.6.

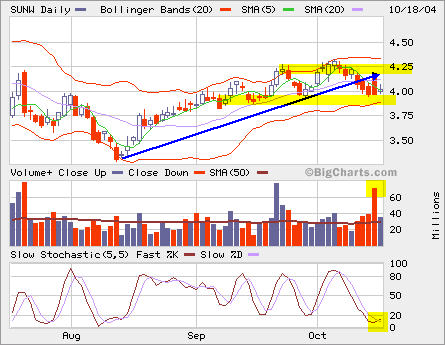

MSFT will form a triple-top around 28.6. SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver.

SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver. RHAT is building a base above support at 12.

RHAT is building a base above support at 12. QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today.

QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today.