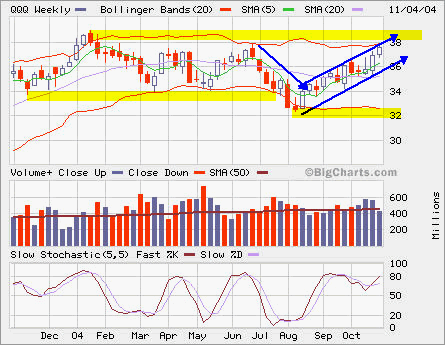

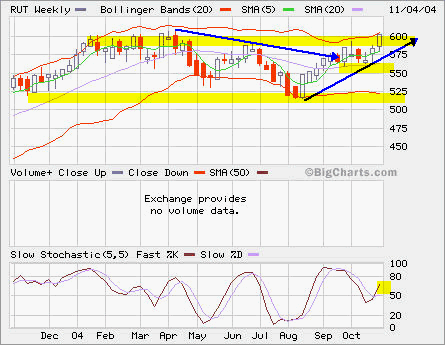

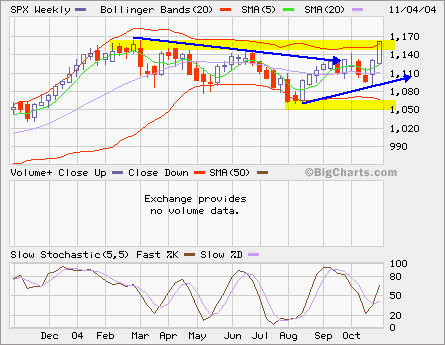

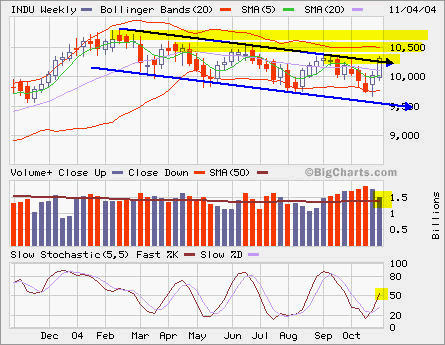

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

QQQ, RUT and SPX are all at or close to their 52 week high. The only exception is the INDU, which is breaking out from its downtrend line. Today’s rally were wide spread, but the volumes were at about average levels. Whether or not the overhead resistences can be taken out it remains to be seen in the comming days. As the election was over, traders and invetors alike move their focus back to routine aspects.

The vertical spread on QQQ Nov calls opened a while ago has increased its value to 0.85 or 100%. If the QQQ stays above 37, it can reach maximum profit of 1.15 or 135%.

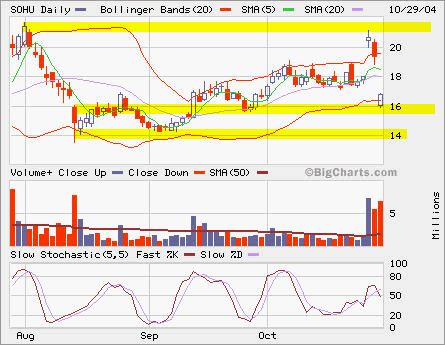

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16.

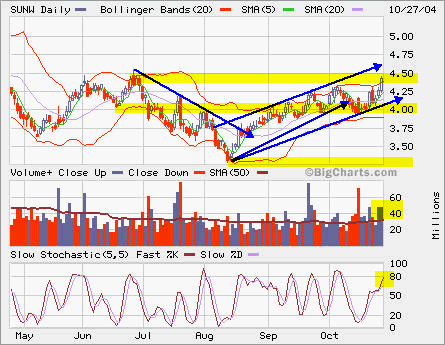

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16. SUNW is approaching its major resistence once again. The volume is decent, maybe this time it can break out from 4.5. However, I’m selling into this rally. Sold covered calls on my long term position.

SUNW is approaching its major resistence once again. The volume is decent, maybe this time it can break out from 4.5. However, I’m selling into this rally. Sold covered calls on my long term position.