I’m researching on ETFs for my Roth IRA investment options. The top 5 performers based on YTD data are XLE 19.89% (Energy Select Sector SPDR, not surprisingly, the crude reached at $57), IYE (iShares Dow Jones US Energy) 19.5%, VDE 19.44% (Vanguard Energy VIPERS), IXC 16.73% (iShares S&P Global Energy Sector) and IGE 14.17% (iShares Goldman Sachs Natural Resource).

Since I consider energy sectior quite extended for now, I won’t buy them at this point. The top 5 ETFs excluding energy related issues are EWY 11.52% (iShares MSCI South Korea Index), EWA 7.54% (iShares MSCI Australia Index), EPP 4.91% (iShares MSCI Pacific ex-Japan), EWS 4.88%(iShares MSCI Singapore Index) and ADRE 4.2% (BLDRS Emerging Markets 50 ADR Index).

We can see the underlying story, that is, Asia and Pacific are where the growth will be!

We can see the underlying story, that is, Asia and Pacific are where the growth will be!

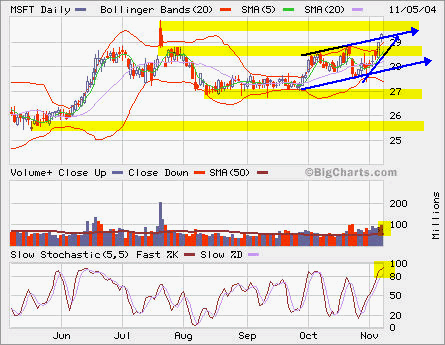

MSFT is moving towards major resistence at 30 once again. The volume is picking up and it’s in overbought condition. Later this month, it will pay a special dividend of $3. The stock price, its SSF and options will be adjusted with the $3 change accordingly.

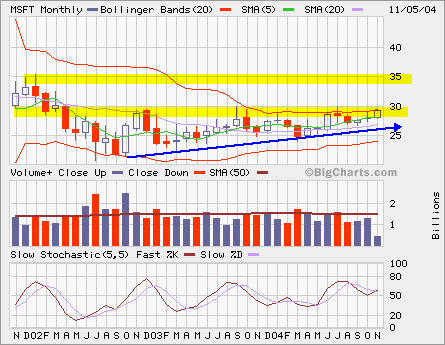

MSFT is moving towards major resistence at 30 once again. The volume is picking up and it’s in overbought condition. Later this month, it will pay a special dividend of $3. The stock price, its SSF and options will be adjusted with the $3 change accordingly. The monthly chart shows an ascending triangle indicating a possible breakout from 30. You may buy straddle (buy a call and a put at the same strike and expiration date) to capture this breakout, but with recent sharp move, you may have to pay more since its volativity is higher.

The monthly chart shows an ascending triangle indicating a possible breakout from 30. You may buy straddle (buy a call and a put at the same strike and expiration date) to capture this breakout, but with recent sharp move, you may have to pay more since its volativity is higher.

INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET.

INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET. MSFT will form a triple-top around 28.6.

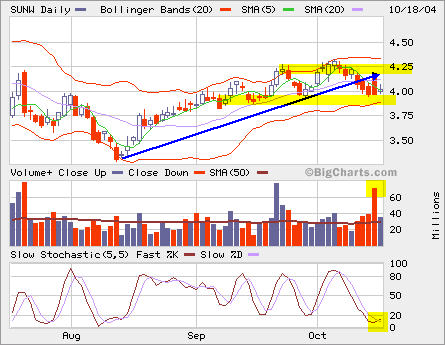

MSFT will form a triple-top around 28.6. SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver.

SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver. RHAT is building a base above support at 12.

RHAT is building a base above support at 12. QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today.

QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today. RUT broke the uptrend line slightly. I have opened a new position on PMCGX, which closely follows RUT. I will close half when RUT is at 593 or stop out at 555.

RUT broke the uptrend line slightly. I have opened a new position on PMCGX, which closely follows RUT. I will close half when RUT is at 593 or stop out at 555.

NDX held up at the support level. There is possibility that it will reverse itself this week.

NDX held up at the support level. There is possibility that it will reverse itself this week.