INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET.

INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET.

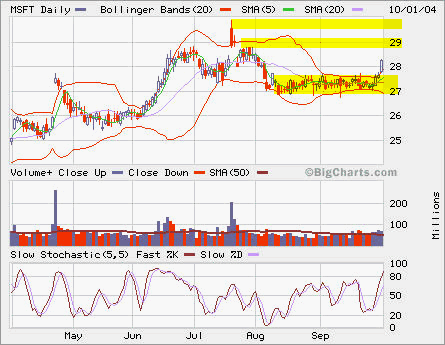

MSFT will form a triple-top around 28.6.

MSFT will form a triple-top around 28.6.

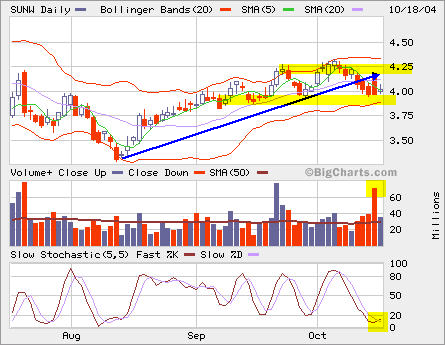

SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver.

SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver.

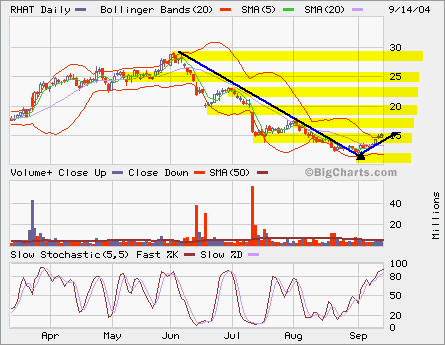

RHAT is building a base above support at 12.

RHAT is building a base above support at 12.

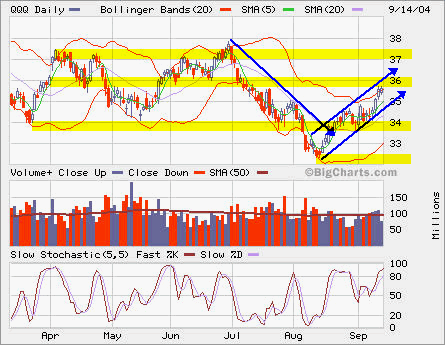

QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today.

QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today.

RUT broke the uptrend line slightly. I have opened a new position on PMCGX, which closely follows RUT. I will close half when RUT is at 593 or stop out at 555.

RUT broke the uptrend line slightly. I have opened a new position on PMCGX, which closely follows RUT. I will close half when RUT is at 593 or stop out at 555.

Tag Archives: Short

QQQ, MSFT and LFC

QQQ popped up more than 1 point intraday. Sold 1/2 Nov36 calls; also sold short Oct36 calls for 0.55, will cover it at dip. This QQQ position is now changed into an at-the-money calendar spread from previous near-the-money long call only.

QQQ popped up more than 1 point intraday. Sold 1/2 Nov36 calls; also sold short Oct36 calls for 0.55, will cover it at dip. This QQQ position is now changed into an at-the-money calendar spread from previous near-the-money long call only.

MSFT broke out from recent basing mode.

MSFT broke out from recent basing mode.

QQQ, RHAT and LFC

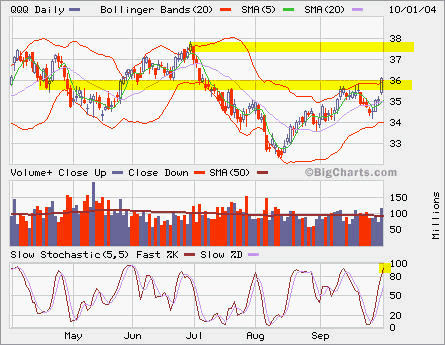

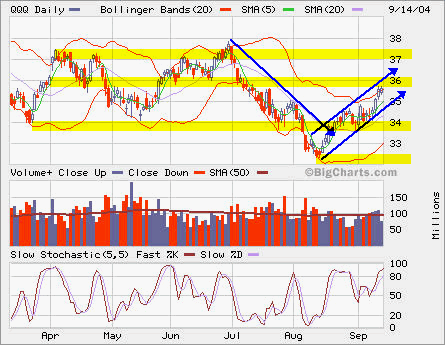

QQQ is in short-term uptrend. The resistence is ar 36 then 37.

QQQ is in short-term uptrend. The resistence is ar 36 then 37.

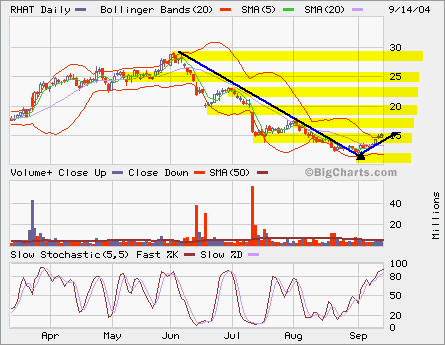

RHAT has a long way to go back its recent high.

RHAT has a long way to go back its recent high.

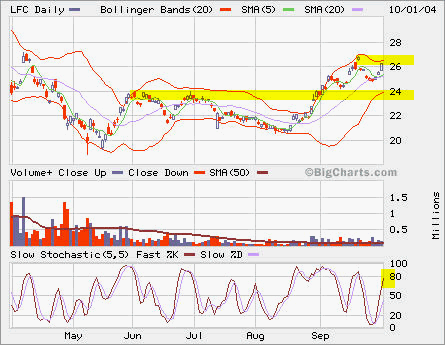

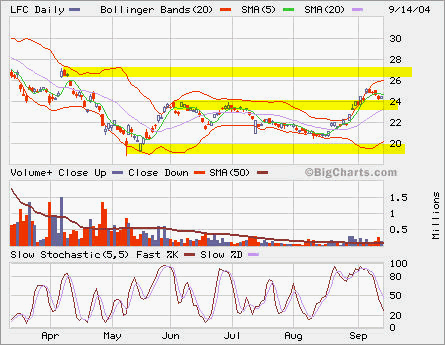

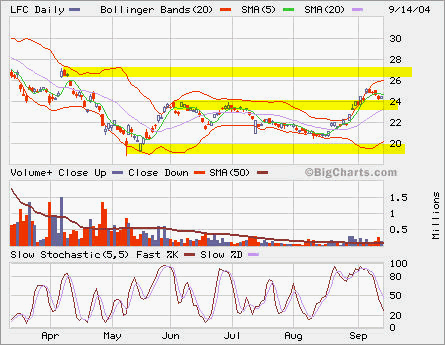

LFC is at pullback after strong move. However, it has to hold up above 24.

LFC is at pullback after strong move. However, it has to hold up above 24.

QQQ, RHAT and LFC

QQQ is in short-term uptrend. The resistence is ar 36 then 37.

QQQ is in short-term uptrend. The resistence is ar 36 then 37.

RHAT has a long way to go back its recent high.

RHAT has a long way to go back its recent high.

LFC is at pullback after strong move. However, it has to hold up above 24.

LFC is at pullback after strong move. However, it has to hold up above 24.

GSF and NE

Since GSF hit the 52 week high of 30.69, it has been steadily declining. The current bounce is still within the channel lines. Will it break out? Not sure. It’s a short candidate when reaching the top channel line if overall market is not in a big swing up.

Looking at NE, it’s right at the top channel line, it’s over bought, but it has an increasing volume while going up. Let’s wait for a while to see if it breaks out or down.