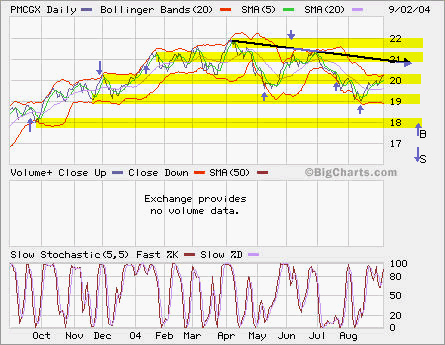

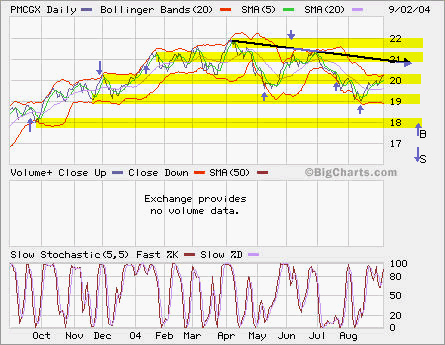

PMCGX retreats from the resistence of the intermediate downtrend line. If it goes lower, I will close my position. Currently I still have 1/3 position opened between 19.6 and 21.

PMCGX retreats from the resistence of the intermediate downtrend line. If it goes lower, I will close my position. Currently I still have 1/3 position opened between 19.6 and 21.

Category Archives: Mutual Funds

PMCGX

PMCGX retreats from the resistence of the intermediate downtrend line. If it goes lower, I will close my position. Currently I still have 1/3 position opened between 19.6 and 21.

PMCGX retreats from the resistence of the intermediate downtrend line. If it goes lower, I will close my position. Currently I still have 1/3 position opened between 19.6 and 21.

PMCGX

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX YTD performance is -0.05%, my PMCGX YTD is 1.92%.

PMCGX

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX YTD performance is -0.05%, my PMCGX YTD is 1.92%.

Some info on stable value funds …

Here’re some facts and links that may help anyone who is researching on stable value funds.

Personally, I put all the cash in my 401(k) into a GIC, which works just like a money market fund as sweep account to trade other mutual funds in the 401(k) account. Currently it yields a little over 4% annually.

Stable Value Funds

OBJECTIVE

Preserve principal and earn a stable rate of return. Their current average yield is around 4%.

PORTFOLIO

Funds own high-quality asset-backed securities, corporate bonds, U.S. Treasuries.

RETURN

Funds have returned 7.19% annually over the past 10 years, vs. 5.28% for money market funds and 8.45% for taxable bond funds.

The links in no particular order: