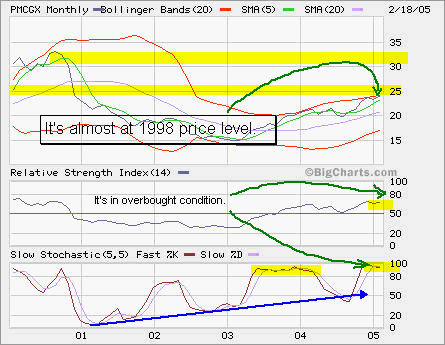

PMCGX has followed the overall market and resumed its ascending. Currently, it’s in overbought condition indicated by both RSI and Stochastic. As we can see from prior history, the overbought or oversold condition could stay there for a while. I do plan to close or at least to square some money off the table next week as our 401(k) plan will have a week of black out period when the plan is to be adjusted with a few changes. As we all knew from history such as Enron debacle, black out period could be very risky although the mutual funds are much more diversified in this regard. One company imploding would not make a fund to plummet.

PMCGX has followed the overall market and resumed its ascending. Currently, it’s in overbought condition indicated by both RSI and Stochastic. As we can see from prior history, the overbought or oversold condition could stay there for a while. I do plan to close or at least to square some money off the table next week as our 401(k) plan will have a week of black out period when the plan is to be adjusted with a few changes. As we all knew from history such as Enron debacle, black out period could be very risky although the mutual funds are much more diversified in this regard. One company imploding would not make a fund to plummet.

Category Archives: Mutual Funds

Open a position in PMCGX

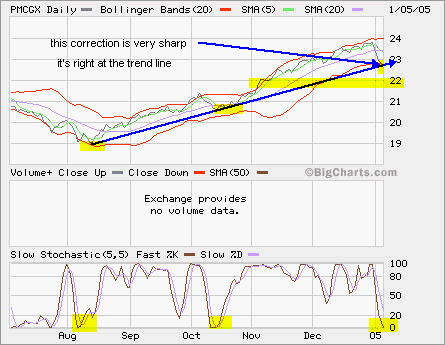

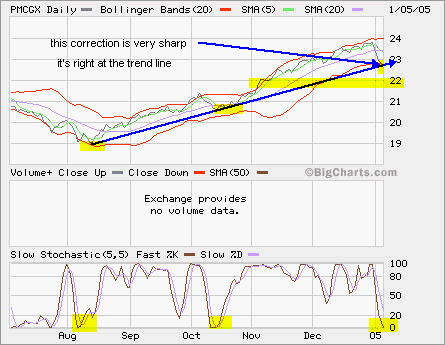

Well, New Year has not brought much upside. Instead, it has wiped out last month’s gain! I opened a position in PMCGX in 401k account as it’s in over sold condition. I expect that the current uptrend will continue, I may add more until it goes below 22 where my stop loss is set.

Open a position in PMCGX

Well, New Year has not brought much upside. Instead, it has wiped out last month’s gain! I opened a position in PMCGX in 401k account as it’s in over sold condition. I expect that the current uptrend will continue, I may add more until it goes below 22 where my stop loss is set.

JANSX and PMCGX

JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24.

JANSX continued to move up after a little dip. I actually closed my JANSX position (+6.13%) at that dip as I thought that it had reversed and didn’t want to wait for another confirmation. It has a major resistence at 24.

PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25.

PMCGX is at 52-week high right now. I closed it at the same time when I closed JANSX. Bad move! The next resistence is at 25.

As we approach the 2004 year end, my current 401(k) has 75% in a stable value fund (earning a little over 4%) and 25% in international funds with exposure to Europe and Asia Pacific. I have always maintained at least 25% cash in this account.

The overall return is YTD 9.6%, compared to JANSX 1.75%, PMCGX 14.13%, TEMFX 13.18%, AEPGX 14.43%, S&P 500 about 6%, QQQ about 8%, RUT about 14% and INDU about 1%.

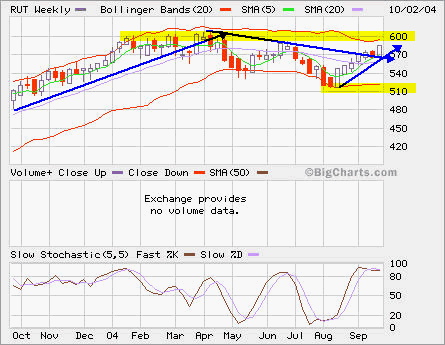

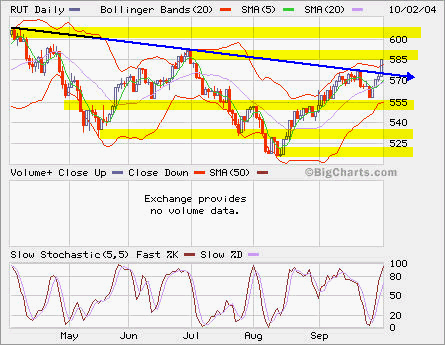

RUT

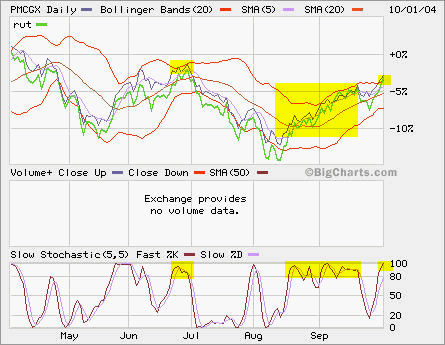

RUT has broken its downtrend line. I have a remaining position on PMCGX which tracks RUT closely and was planning to close it around 21. Let’s wait and see if this move can last into next week.

RUT has broken its downtrend line. I have a remaining position on PMCGX which tracks RUT closely and was planning to close it around 21. Let’s wait and see if this move can last into next week.