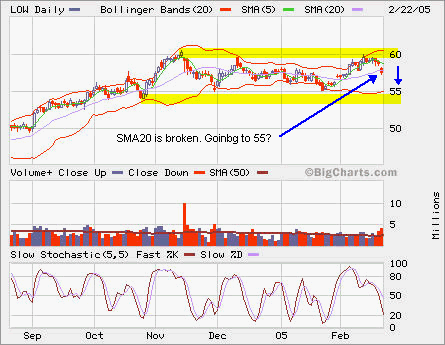

LOW broke its support at the SMA20. It’s going towards the lower bound of this range.

LOW broke its support at the SMA20. It’s going towards the lower bound of this range.

Is it time to get in SUNW again? Not now, let’s wait until we see the support above 4 is held and after it comes out some kind of stablization period.

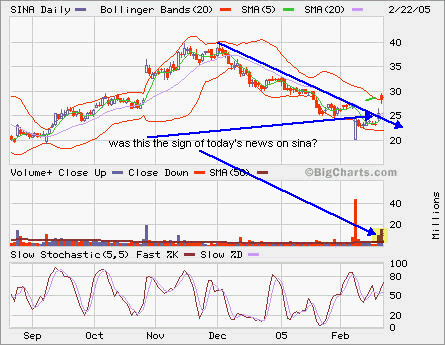

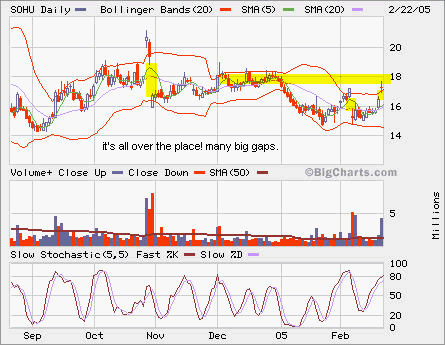

SINA and SOHU jumped

Chinese internet stocks jumped over 5% contrasting to the rest of market. It’s fueled by possible consolidation in China’s major internet players. SOHU closed higher too.

Chinese internet stocks jumped over 5% contrasting to the rest of market. It’s fueled by possible consolidation in China’s major internet players. SOHU closed higher too.

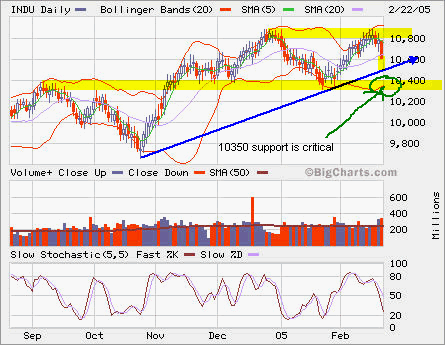

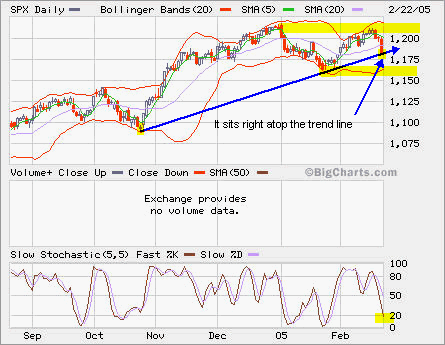

INDU, SPX, QQQQ

INDU suffered 173 point loss today. SPX lost more than 17 and NDX lost more than 21. All major markets moved downward.

INDU suffered 173 point loss today. SPX lost more than 17 and NDX lost more than 21. All major markets moved downward.

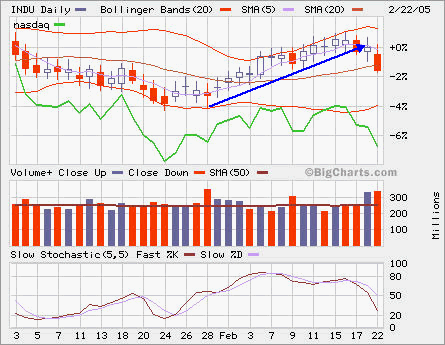

INDU has been performing better than NASDAQ this year.

INDU has been performing better than NASDAQ this year.

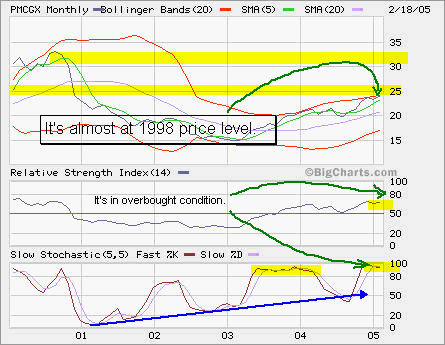

PMCGX back in 1998 level

PMCGX has followed the overall market and resumed its ascending. Currently, it’s in overbought condition indicated by both RSI and Stochastic. As we can see from prior history, the overbought or oversold condition could stay there for a while. I do plan to close or at least to square some money off the table next week as our 401(k) plan will have a week of black out period when the plan is to be adjusted with a few changes. As we all knew from history such as Enron debacle, black out period could be very risky although the mutual funds are much more diversified in this regard. One company imploding would not make a fund to plummet.

PMCGX has followed the overall market and resumed its ascending. Currently, it’s in overbought condition indicated by both RSI and Stochastic. As we can see from prior history, the overbought or oversold condition could stay there for a while. I do plan to close or at least to square some money off the table next week as our 401(k) plan will have a week of black out period when the plan is to be adjusted with a few changes. As we all knew from history such as Enron debacle, black out period could be very risky although the mutual funds are much more diversified in this regard. One company imploding would not make a fund to plummet.

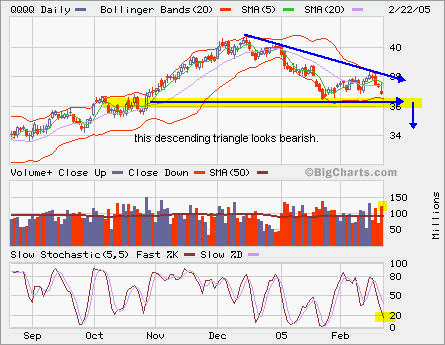

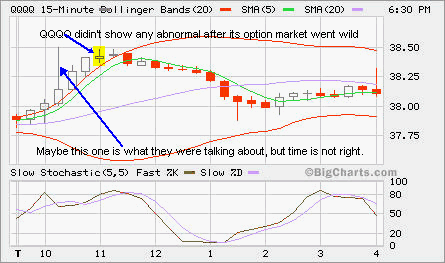

QQQQ went wild

Here’s the quote from Reuters.

NEW YORK, Feb 15 (Reuters) – A number of erroneous options trades executed by Citigroup Inc. (C.N: Quote, Profile, Research) on derivatives market The Pacific Exchange may have caused a small late-morning jump in the Nasdaq Composite Index on Tuesday.

There were a number of erroneous trades of options on the exchange-traded fund Nasdaq 100 (QQQQ.O: Quote, Profile, Research) (“quad-Q”) during morning dealing, according to Dale Carlson, vice president of corporate affairs at the Pacific Exchange.

Danielle Romero-Apsilos, a spokeswoman for Citigroup’s corporate and investment bank, said the erroneous trades were executed by Citigroup and that they occurred at 10:57 a.m. on Tuesday.