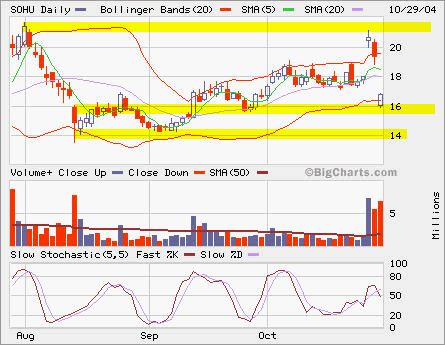

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16.

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16.

Tag Archives: Position

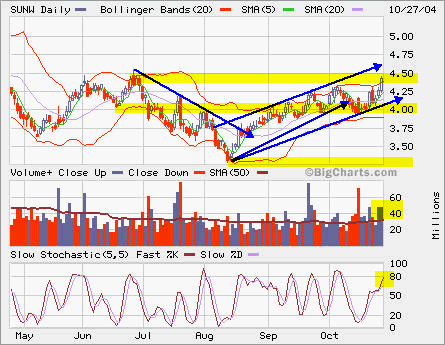

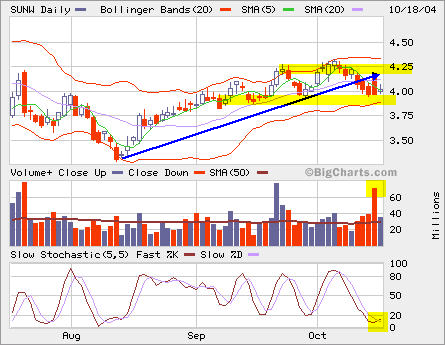

SUNW

SUNW is approaching its major resistence once again. The volume is decent, maybe this time it can break out from 4.5. However, I’m selling into this rally. Sold covered calls on my long term position.

SUNW is approaching its major resistence once again. The volume is decent, maybe this time it can break out from 4.5. However, I’m selling into this rally. Sold covered calls on my long term position.

INTC, MSFT, SUNW, RHAT, LU, QQQ and RUT

INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET.

INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET.

MSFT will form a triple-top around 28.6.

MSFT will form a triple-top around 28.6.

SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver.

SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver.

RHAT is building a base above support at 12.

RHAT is building a base above support at 12.

QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today.

QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today.

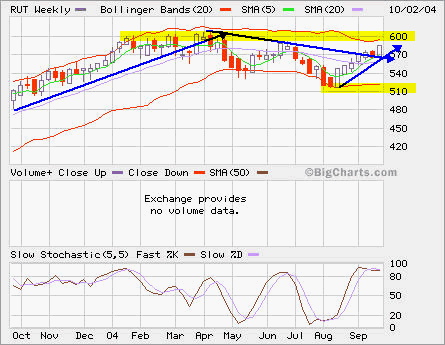

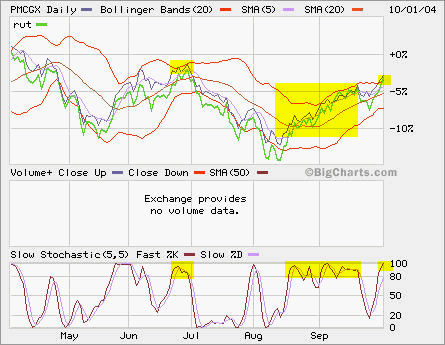

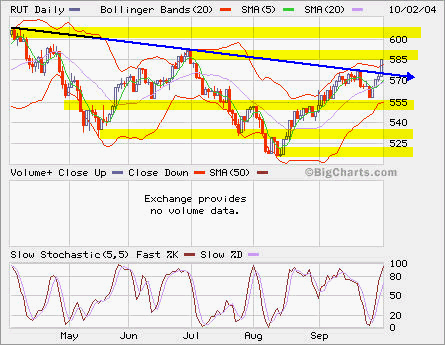

RUT broke the uptrend line slightly. I have opened a new position on PMCGX, which closely follows RUT. I will close half when RUT is at 593 or stop out at 555.

RUT broke the uptrend line slightly. I have opened a new position on PMCGX, which closely follows RUT. I will close half when RUT is at 593 or stop out at 555.

QQQ Vertical Call Spread

Opened a vertical call spread position using QQQ Nov 35C and 37C with a debt of 0.85 on each spread.

RUT

RUT has broken its downtrend line. I have a remaining position on PMCGX which tracks RUT closely and was planning to close it around 21. Let’s wait and see if this move can last into next week.

RUT has broken its downtrend line. I have a remaining position on PMCGX which tracks RUT closely and was planning to close it around 21. Let’s wait and see if this move can last into next week.