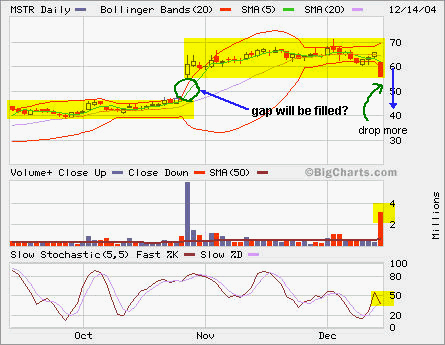

It looks like this gap will be filled soon. On the back of my mind, I was thinking about when to short it, but never acted upon. There is more room to go downward. It’s not in over sold condition yet and the selling pressure is huge based on the volume spike. A lot of catching a falling knife things are going on as every sell had to be matched with a buy!

It looks like this gap will be filled soon. On the back of my mind, I was thinking about when to short it, but never acted upon. There is more room to go downward. It’s not in over sold condition yet and the selling pressure is huge based on the volume spike. A lot of catching a falling knife things are going on as every sell had to be matched with a buy!

Tag Archives: Buy

MSFT

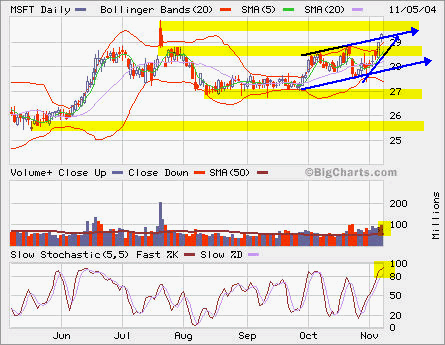

MSFT is moving towards major resistence at 30 once again. The volume is picking up and it’s in overbought condition. Later this month, it will pay a special dividend of $3. The stock price, its SSF and options will be adjusted with the $3 change accordingly.

MSFT is moving towards major resistence at 30 once again. The volume is picking up and it’s in overbought condition. Later this month, it will pay a special dividend of $3. The stock price, its SSF and options will be adjusted with the $3 change accordingly.

If you like to play breakout, you may watch it closly if it breaks out from 30 with higher than average volume, which is about 50 million shares.

If you like to short, it’s pretty close to the top now. The next resistence above 30 is 32, but you may not want to have that big stop loss. So it’s somewhere between 30 and 32.

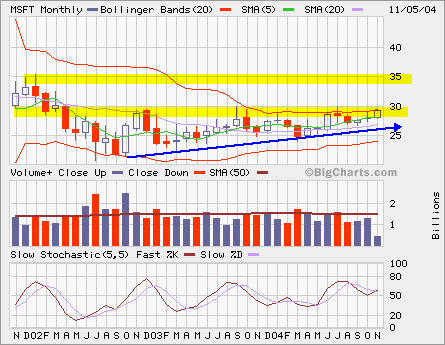

The monthly chart shows an ascending triangle indicating a possible breakout from 30. You may buy straddle (buy a call and a put at the same strike and expiration date) to capture this breakout, but with recent sharp move, you may have to pay more since its volativity is higher.

The monthly chart shows an ascending triangle indicating a possible breakout from 30. You may buy straddle (buy a call and a put at the same strike and expiration date) to capture this breakout, but with recent sharp move, you may have to pay more since its volativity is higher.

LFC and QQQ

It pulled back again. Judging by the lower volume on the decline, the selling is not panic. Obviously a lot of buying has been done in the past month, but the buyers don’t want to buy higher. This pullback presents a buying opportunity in my view between 24 and 25.

It pulled back again. Judging by the lower volume on the decline, the selling is not panic. Obviously a lot of buying has been done in the past month, but the buyers don’t want to buy higher. This pullback presents a buying opportunity in my view between 24 and 25.

QQQ sits right at 20SMA and in over-sold condition, let’s see if it bounces back next week.

QQQ sits right at 20SMA and in over-sold condition, let’s see if it bounces back next week.

LFC and QQQ

It pulled back again. Judging by the lower volume on the decline, the selling is not panic. Obviously a lot of buying has been done in the past month, but the buyers don’t want to buy higher. This pullback presents a buying opportunity in my view between 24 and 25.

It pulled back again. Judging by the lower volume on the decline, the selling is not panic. Obviously a lot of buying has been done in the past month, but the buyers don’t want to buy higher. This pullback presents a buying opportunity in my view between 24 and 25.

QQQ sits right at 20SMA and in over-sold condition, let’s see if it bounces back next week.

QQQ sits right at 20SMA and in over-sold condition, let’s see if it bounces back next week.

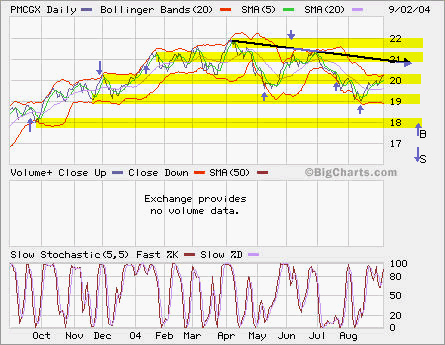

PMCGX

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX YTD performance is -0.05%, my PMCGX YTD is 1.92%.