INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET.

INTC has stablized from declining. We may see some kind of bounce to 22. AH quote is at 20.96 x 21.00 on INET.

MSFT will form a triple-top around 28.6.

MSFT will form a triple-top around 28.6.

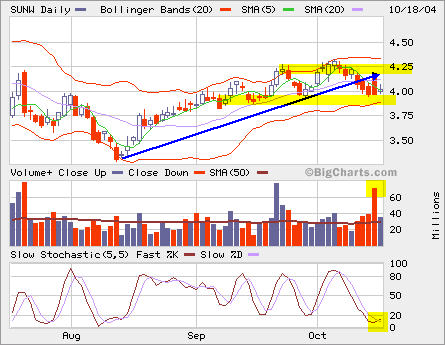

SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver.

SUNW broke its short-term uptrend, but held up at 4. It has to break out from 4.3 to resume the uptrend. The large volume and volatility on Friday might be related to option expiration maneuver.

RHAT is building a base above support at 12.

RHAT is building a base above support at 12.

QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today.

QQQ has maintained its uptrend line. It bounced back right from the uptrend line on Friday and today.

RUT broke the uptrend line slightly. I have opened a new position on PMCGX, which closely follows RUT. I will close half when RUT is at 593 or stop out at 555.

RUT broke the uptrend line slightly. I have opened a new position on PMCGX, which closely follows RUT. I will close half when RUT is at 593 or stop out at 555.

Tag Archives: Support

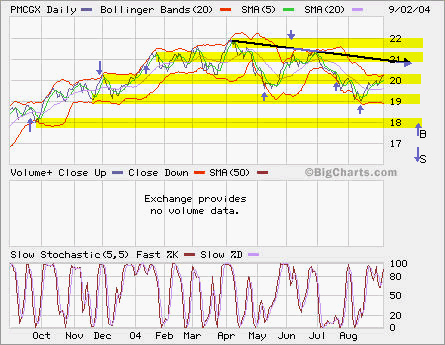

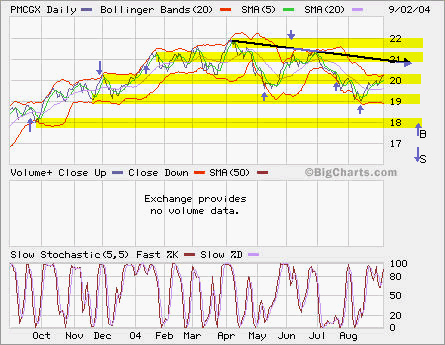

PMCGX

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX YTD performance is -0.05%, my PMCGX YTD is 1.92%.

PMCGX

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX YTD performance is -0.05%, my PMCGX YTD is 1.92%.

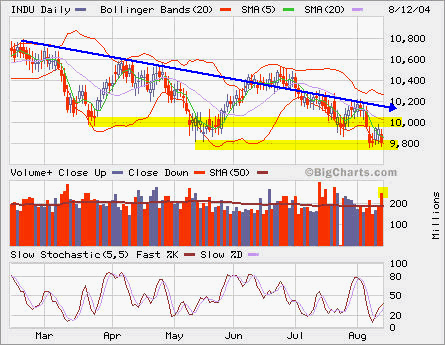

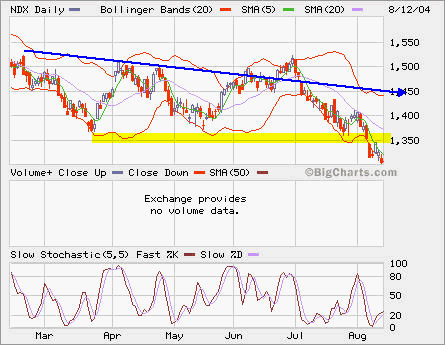

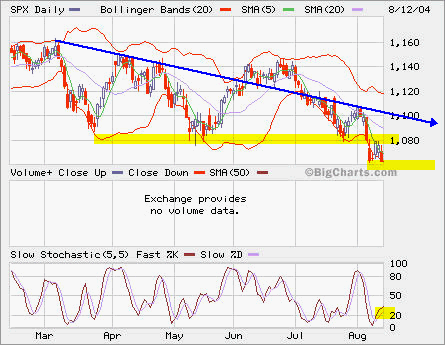

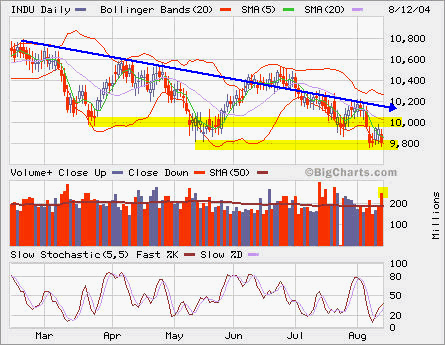

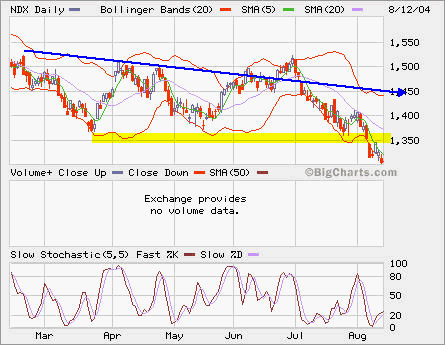

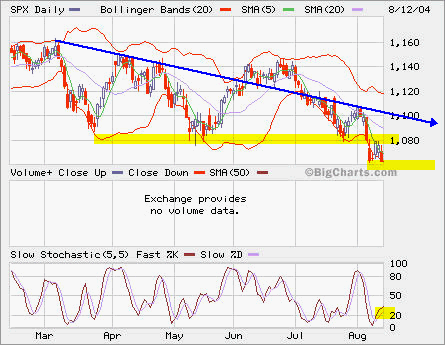

Do we see the bottom yet?

All major indexes broke their support levels and they are all at year low right now. As earning report season is almost over and oil price has hit new high, what would be the triggering point to move market lower?

NDX is at 1300, a major support level. 1050 is the major support for SPX while 9500 is the major support for INDU.

I would be a potential buyer at these support levels for my 401(k) account.

Do we see the bottom yet?

All major indexes broke their support levels and they are all at year low right now. As earning report season is almost over and oil price has hit new high, what would be the triggering point to move market lower?

NDX is at 1300, a major support level. 1050 is the major support for SPX while 9500 is the major support for INDU.

I would be a potential buyer at these support levels for my 401(k) account.