Here’s the quote from Reuters.

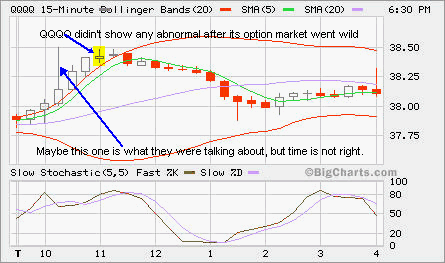

NEW YORK, Feb 15 (Reuters) – A number of erroneous options trades executed by Citigroup Inc. (C.N: Quote, Profile, Research) on derivatives market The Pacific Exchange may have caused a small late-morning jump in the Nasdaq Composite Index on Tuesday.

There were a number of erroneous trades of options on the exchange-traded fund Nasdaq 100 (QQQQ.O: Quote, Profile, Research) (“quad-Q”) during morning dealing, according to Dale Carlson, vice president of corporate affairs at the Pacific Exchange.

Danielle Romero-Apsilos, a spokeswoman for Citigroup’s corporate and investment bank, said the erroneous trades were executed by Citigroup and that they occurred at 10:57 a.m. on Tuesday.

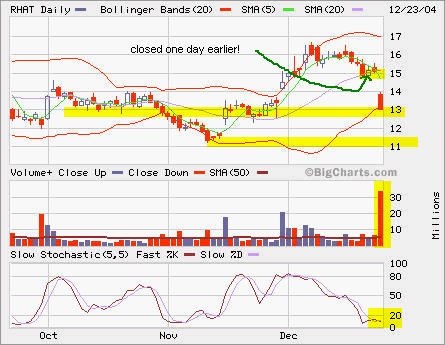

I closed a RHAT Jan 15 Put position on Monday, which was a basic scratch trade. Today, it dropped like a rock! It stopped at the lower Bollinger Band and stochastic also stayed in the over-sold territory.

I closed a RHAT Jan 15 Put position on Monday, which was a basic scratch trade. Today, it dropped like a rock! It stopped at the lower Bollinger Band and stochastic also stayed in the over-sold territory. LFC bounces back after touching the uptrend line. The bounce came with decent volume. It’s a buying opportunity right now. The Dec 30 covered calls expired worthless. I will sell some covered calls at 30 level again. This time, it may break 30 and move forward, but I’d rather buy it back later at higher price after it takes out 30.

LFC bounces back after touching the uptrend line. The bounce came with decent volume. It’s a buying opportunity right now. The Dec 30 covered calls expired worthless. I will sell some covered calls at 30 level again. This time, it may break 30 and move forward, but I’d rather buy it back later at higher price after it takes out 30. HNP is forming a triangle here. Which direction will it resolve to? The prevailing trend is down, but it’s been in oversold condition for a month, so I think it will move up from here. How far can it go? I’m not sure. The resistences are at 32 and 34. I may open a small call position on HNP Jan or Feb 30 Calls. Yesterday, the quote for Feb 30 Call was 1.3 x 1.5.

HNP is forming a triangle here. Which direction will it resolve to? The prevailing trend is down, but it’s been in oversold condition for a month, so I think it will move up from here. How far can it go? I’m not sure. The resistences are at 32 and 34. I may open a small call position on HNP Jan or Feb 30 Calls. Yesterday, the quote for Feb 30 Call was 1.3 x 1.5.

QQQQ had a little pullback. It did break SMA 20. After almost 5 month of steady move, it may just go sideway for a while as it did around 36 in October. The major support should be at 38. Take a look at the weekly and monthly charts for more perspectives.

QQQQ had a little pullback. It did break SMA 20. After almost 5 month of steady move, it may just go sideway for a while as it did around 36 in October. The major support should be at 38. Take a look at the weekly and monthly charts for more perspectives.