Tag Archives: Spx

Market pullbacks

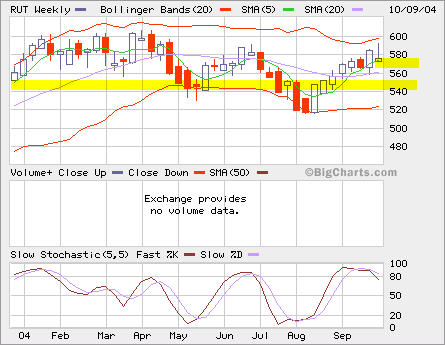

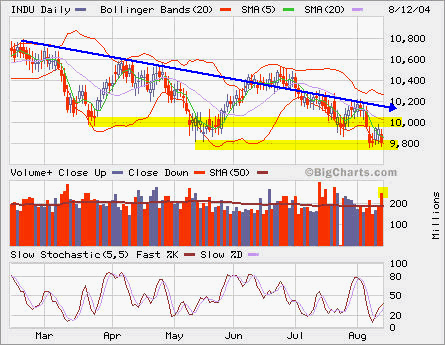

INDU backed off from the resistence just like last failed attempt to break the downtrend line. Similar actions were seen at RUT, SPX and NDX. However, if the cahnnels are held intact, they present some good entry points to go long.

INDU backed off from the resistence just like last failed attempt to break the downtrend line. Similar actions were seen at RUT, SPX and NDX. However, if the cahnnels are held intact, they present some good entry points to go long.

SPX and CHN

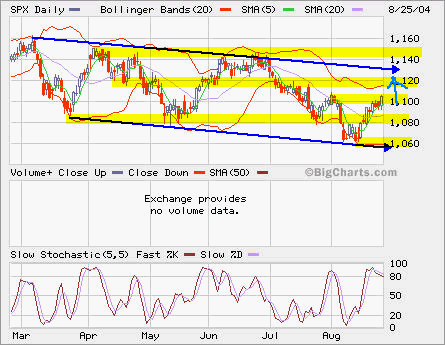

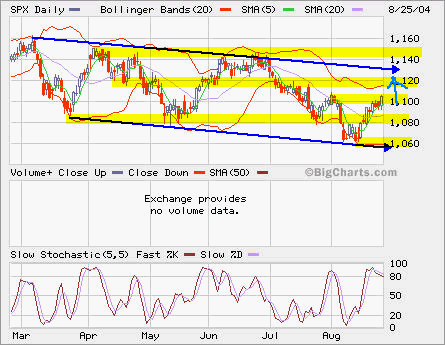

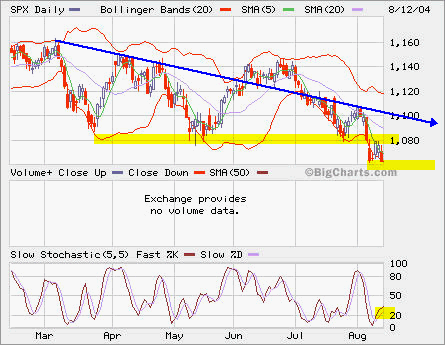

SPX looks like to move up at least to 1120.

SPX looks like to move up at least to 1120.

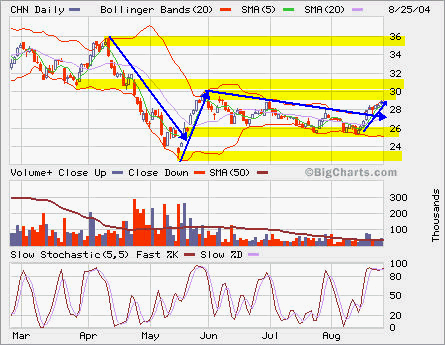

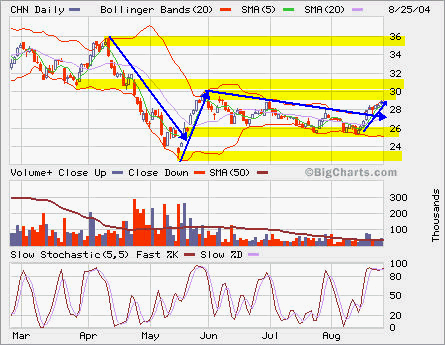

CHN breaks out from its long streak of declines since early April. It will be bullish if it continues to break next resistence at 30.

CHN breaks out from its long streak of declines since early April. It will be bullish if it continues to break next resistence at 30.

SPX and CHN

SPX looks like to move up at least to 1120.

SPX looks like to move up at least to 1120.

CHN breaks out from its long streak of declines since early April. It will be bullish if it continues to break next resistence at 30.

CHN breaks out from its long streak of declines since early April. It will be bullish if it continues to break next resistence at 30.

Do we see the bottom yet?

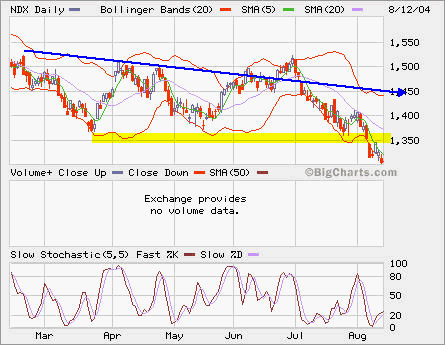

All major indexes broke their support levels and they are all at year low right now. As earning report season is almost over and oil price has hit new high, what would be the triggering point to move market lower?

NDX is at 1300, a major support level. 1050 is the major support for SPX while 9500 is the major support for INDU.

I would be a potential buyer at these support levels for my 401(k) account.