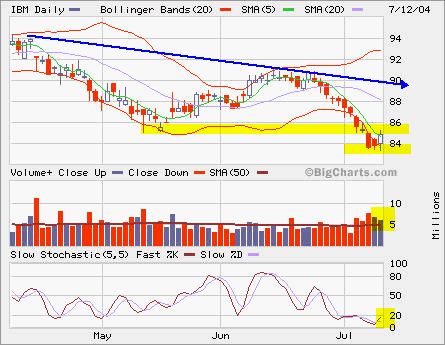

IBM has been declining for a while. It is showing a bounce around 84, which may become the support. We shall watch it closely. The big support is at 80.

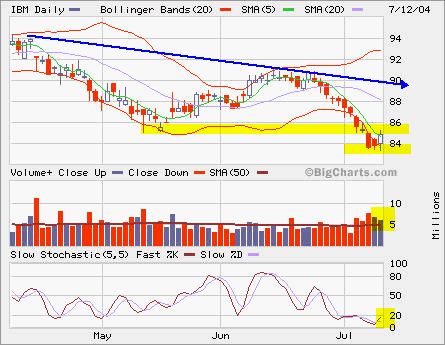

IBM has been declining for a while. It is showing a bounce around 84, which may become the support. We shall watch it closely. The big support is at 80.

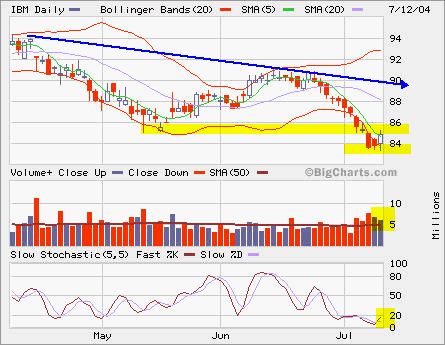

IBM has been declining for a while. It is showing a bounce around 84, which may become the support. We shall watch it closely. The big support is at 80.

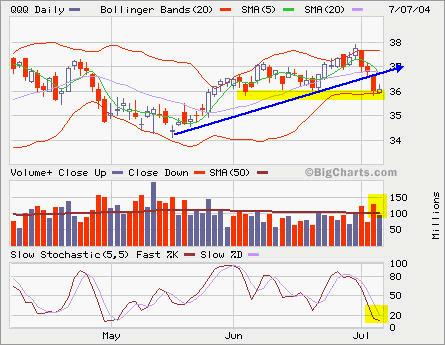

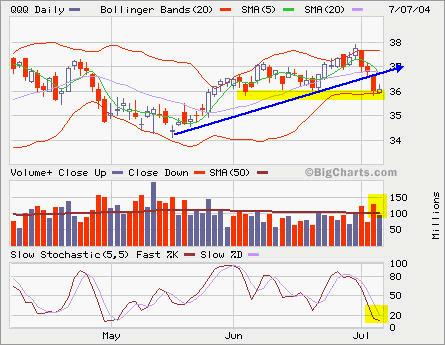

QQQ has broken its uptrend line. Today’s move would look like a dead cat bounce after YHOO lost almost 12% in after-hour trading. Tomorrow will be a big gap down. I have reduced my puts on QQQ.

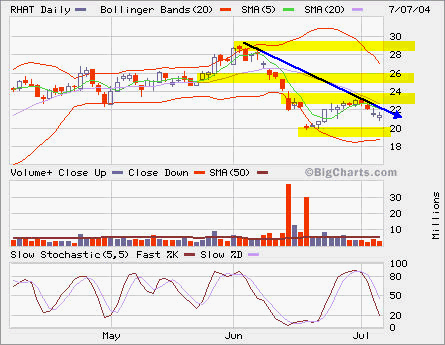

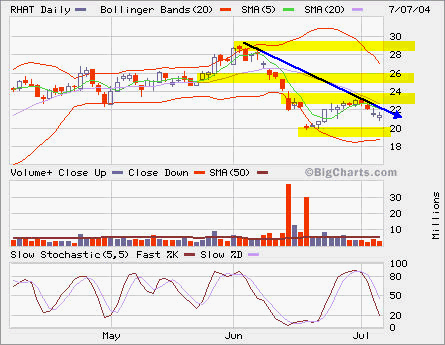

My Jul 20 Puts are under water, but Aug 22.5 Puts are doing OK. I will monitor closely tomorrow to see if I should seize the opportunity to close the Jul 20 Puts.

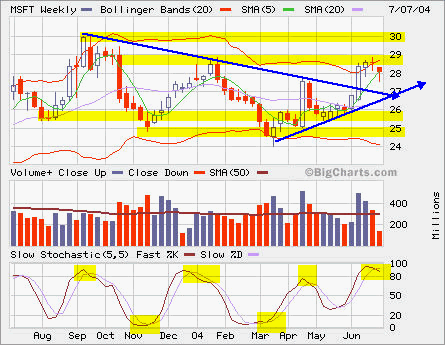

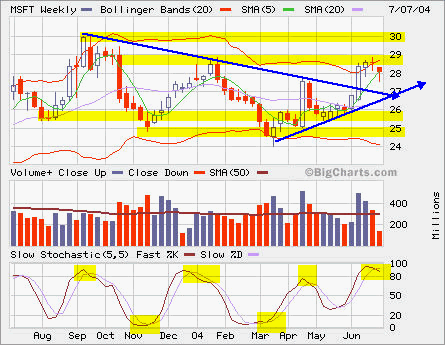

I’m also looking for opportunities to buy back some shares of MSFT for my long-term accounts.

QQQ has broken its uptrend line. Today’s move would look like a dead cat bounce after YHOO lost almost 12% in after-hour trading. Tomorrow will be a big gap down. I have reduced my puts on QQQ.

My Jul 20 Puts are under water, but Aug 22.5 Puts are doing OK. I will monitor closely tomorrow to see if I should seize the opportunity to close the Jul 20 Puts.

I’m also looking for opportunities to buy back some shares of MSFT for my long-term accounts.

Since GSF hit the 52 week high of 30.69, it has been steadily declining. The current bounce is still within the channel lines. Will it break out? Not sure. It’s a short candidate when reaching the top channel line if overall market is not in a big swing up.

Looking at NE, it’s right at the top channel line, it’s over bought, but it has an increasing volume while going up. Let’s wait for a while to see if it breaks out or down.