LFC bounces back after touching the uptrend line. The bounce came with decent volume. It’s a buying opportunity right now. The Dec 30 covered calls expired worthless. I will sell some covered calls at 30 level again. This time, it may break 30 and move forward, but I’d rather buy it back later at higher price after it takes out 30.

LFC bounces back after touching the uptrend line. The bounce came with decent volume. It’s a buying opportunity right now. The Dec 30 covered calls expired worthless. I will sell some covered calls at 30 level again. This time, it may break 30 and move forward, but I’d rather buy it back later at higher price after it takes out 30.

Tag Archives: Sell

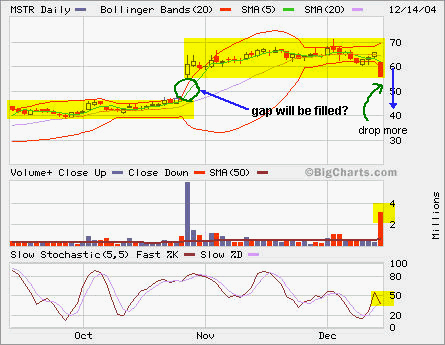

MSTR to fill the gap?

It looks like this gap will be filled soon. On the back of my mind, I was thinking about when to short it, but never acted upon. There is more room to go downward. It’s not in over sold condition yet and the selling pressure is huge based on the volume spike. A lot of catching a falling knife things are going on as every sell had to be matched with a buy!

It looks like this gap will be filled soon. On the back of my mind, I was thinking about when to short it, but never acted upon. There is more room to go downward. It’s not in over sold condition yet and the selling pressure is huge based on the volume spike. A lot of catching a falling knife things are going on as every sell had to be matched with a buy!

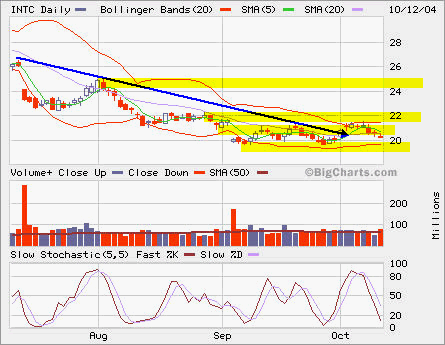

INTC

INTC closed lower today. However, AH, INTL announced earning, slight better than the lowered forcast by the street. It went up to 21.04. Let’s see how the market reacts. I still hold 15 Oct 25C calls. Maybe I can get 0.05 each tomorrow morning. I rolled all Oct 22.5C to Nov 22.5C and Nov 20C. Will sell Nov 25C.

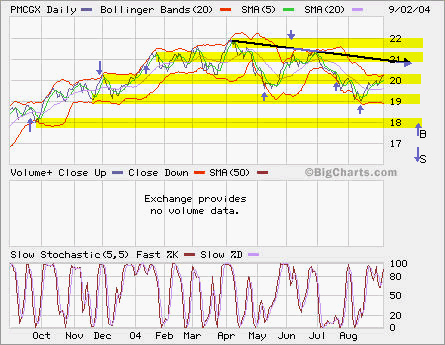

PMCGX

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX YTD performance is -0.05%, my PMCGX YTD is 1.92%.

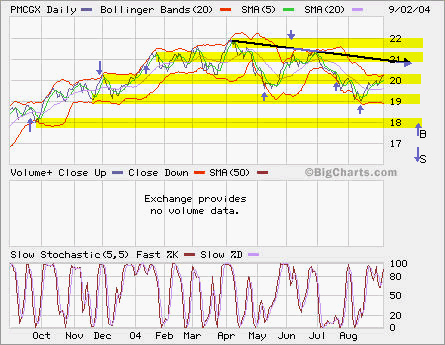

PMCGX

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX is PIMCO’s mid cap growth fund available in my long-term account. Here’re the trades in the past 12 months. I simply buy at support levels and sell at the resistence levels. Currently I’m long and look for opportunity to close it around 21 or I will sell early if it goes below 19.65.

PMCGX YTD performance is -0.05%, my PMCGX YTD is 1.92%.