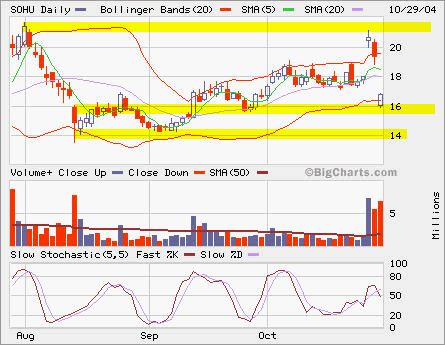

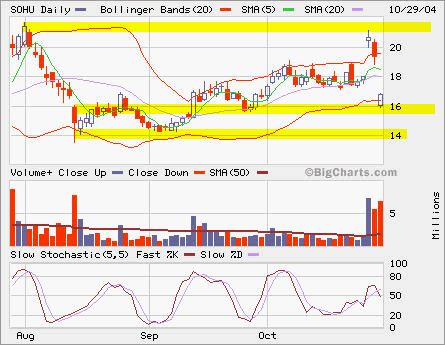

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16.

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16.

Tag Archives: Call

SOHU

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16.

SOHU was downgraded, big gap down. Obviously someone already knew it yesterday:-). Will open a small Dec Call position. Expecting the support around 16.

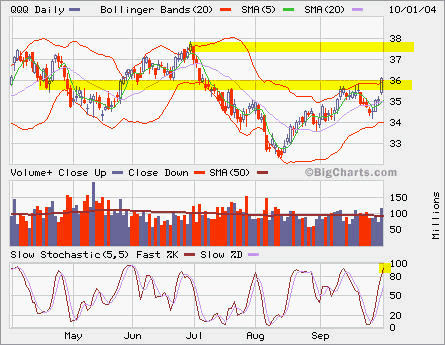

QQQ Vertical Call Spread

Opened a vertical call spread position using QQQ Nov 35C and 37C with a debt of 0.85 on each spread.

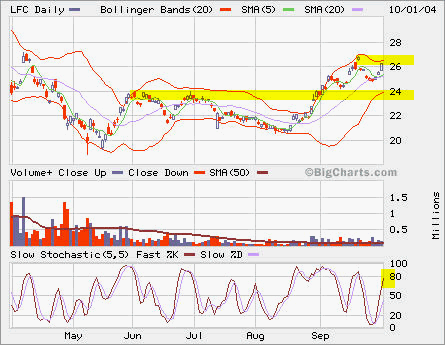

QQQ, MSFT and LFC

QQQ popped up more than 1 point intraday. Sold 1/2 Nov36 calls; also sold short Oct36 calls for 0.55, will cover it at dip. This QQQ position is now changed into an at-the-money calendar spread from previous near-the-money long call only.

QQQ popped up more than 1 point intraday. Sold 1/2 Nov36 calls; also sold short Oct36 calls for 0.55, will cover it at dip. This QQQ position is now changed into an at-the-money calendar spread from previous near-the-money long call only.

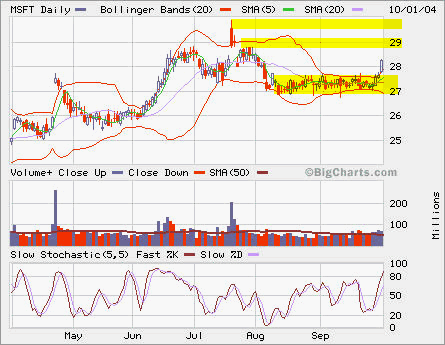

MSFT broke out from recent basing mode.

MSFT broke out from recent basing mode.

Option Pinning …

Option strike price sometimes has interesting effect on the market during option expiration week. Looking at MSFT chart, we can see it slides towards 25. Based on the option trading volume data at Yahoo, there were 10,791 contracts (Apr04 25 Call) changing hands with 79,265 still outstanding, the heavest traded strike today. For premium sellers, it’s to their advantages to let the contract expire worthless, which means in this case that MSFT has to go below or at 25 to let Apr04 25 call contracts expire worthless. I have a small long position where I had sold some at 0.95-1.05 earlier and hold some until today I sold them at 0.7.