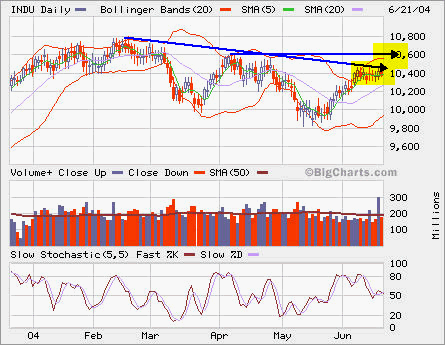

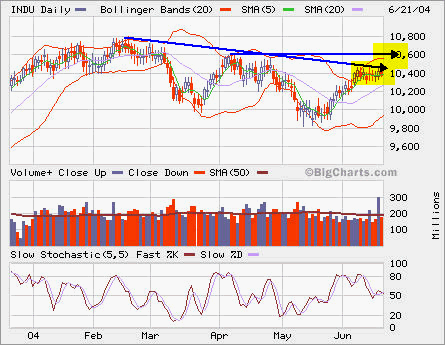

INDU is hanging around the 10400 line for a while. It needs to break out and try 10600 again or 10000 can be retested, which would be really bad.

INDU is hanging around the 10400 line for a while. It needs to break out and try 10600 again or 10000 can be retested, which would be really bad.

NDX is in oversold condition. The major support is at 1350. For QQQ, the support is 34. SPX support is 1075 and INDU is 10000.

INDU closed at 10042.16. S&P 500 closed at 1074.14 and NASDAQ closed at 1949. It looks like more money is moving into the big caps.

Started experimenting YM, the e-mini Dow Jones index future. It trades in much lower volume compared to ES. The result has been good so far using the same setup for ES. Actually, the same setup (trend following plus price action, resistence and support, plus Bollinger Band with Slow Stochastic is being used in stocks, stock options, and futures.

It turned out that last night’s low 1057.75 was the bottom. S&P 500 rallied back to the resistence level 1070, a few points away from the high 1075. INDU is fewer than 50 points away from 10K. Barring from any surprises, we shall see 10K pretty soon since everyone is talking about it.

Covered the short, reversed, and rode through half way, but missed the last leg from 1064 to 1070. Went short again at 1068 and 1069. We shall see some pullback tomorrow morning after this big run up, but so far hours into the new session, the market stays right at 1069.75×1070. The bears and bulls won’t blink. The stalemate should resolve in the morning.

Slowly moving August is over. After this comming Labor Day week, trading volume should be picking up as traders return from their summer vacations. NASDAQ has reached new high and INDU and SPX are approaching its recent high respectively. All markets have done some base building, we will find out wheither or not they will break out or go down. Short term wise, it looks the market will move up a little. Short: QQQ Oct 32 Put (it’s not working obviously after QQQ’s big run up). Long: HNP (I have been waiting for opportunity to own some HNP shares), SUNW, SOHU and MSFT (SSF).