LFC bounces back after touching the uptrend line. The bounce came with decent volume. It’s a buying opportunity right now. The Dec 30 covered calls expired worthless. I will sell some covered calls at 30 level again. This time, it may break 30 and move forward, but I’d rather buy it back later at higher price after it takes out 30.

LFC bounces back after touching the uptrend line. The bounce came with decent volume. It’s a buying opportunity right now. The Dec 30 covered calls expired worthless. I will sell some covered calls at 30 level again. This time, it may break 30 and move forward, but I’d rather buy it back later at higher price after it takes out 30.

Monthly Archives: December 2004

HNP

HNP is forming a triangle here. Which direction will it resolve to? The prevailing trend is down, but it’s been in oversold condition for a month, so I think it will move up from here. How far can it go? I’m not sure. The resistences are at 32 and 34. I may open a small call position on HNP Jan or Feb 30 Calls. Yesterday, the quote for Feb 30 Call was 1.3 x 1.5.

HNP is forming a triangle here. Which direction will it resolve to? The prevailing trend is down, but it’s been in oversold condition for a month, so I think it will move up from here. How far can it go? I’m not sure. The resistences are at 32 and 34. I may open a small call position on HNP Jan or Feb 30 Calls. Yesterday, the quote for Feb 30 Call was 1.3 x 1.5.

Updated:

CHN

CHN finally reached 35 and closed above 35 yesterday. It has reached my target at 35 and hit my exit limit order set long time ago. 35 is the major resistence level. It’s likely it will pull back. I’m still long-term bullish at CHN and will seek opportunity to get in again. The exit came right before the announced dividend and capital gain distribution date ($3.5701 per share), but I think the market should already factor it in price, so I didn’t cancel the exit. After the ex-div date, the price would adjust to around 32.

CHN finally reached 35 and closed above 35 yesterday. It has reached my target at 35 and hit my exit limit order set long time ago. 35 is the major resistence level. It’s likely it will pull back. I’m still long-term bullish at CHN and will seek opportunity to get in again. The exit came right before the announced dividend and capital gain distribution date ($3.5701 per share), but I think the market should already factor it in price, so I didn’t cancel the exit. After the ex-div date, the price would adjust to around 32.

QQQQ

QQQQ had a little pullback. It did break SMA 20. After almost 5 month of steady move, it may just go sideway for a while as it did around 36 in October. The major support should be at 38. Take a look at the weekly and monthly charts for more perspectives.

QQQQ had a little pullback. It did break SMA 20. After almost 5 month of steady move, it may just go sideway for a while as it did around 36 in October. The major support should be at 38. Take a look at the weekly and monthly charts for more perspectives.

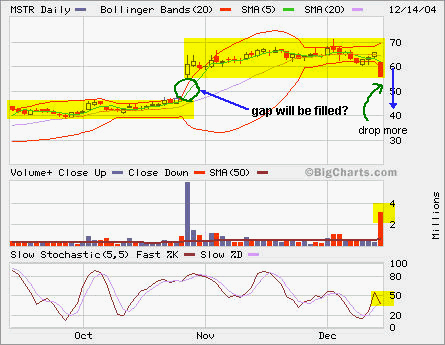

MSTR to fill the gap?

It looks like this gap will be filled soon. On the back of my mind, I was thinking about when to short it, but never acted upon. There is more room to go downward. It’s not in over sold condition yet and the selling pressure is huge based on the volume spike. A lot of catching a falling knife things are going on as every sell had to be matched with a buy!

It looks like this gap will be filled soon. On the back of my mind, I was thinking about when to short it, but never acted upon. There is more room to go downward. It’s not in over sold condition yet and the selling pressure is huge based on the volume spike. A lot of catching a falling knife things are going on as every sell had to be matched with a buy!