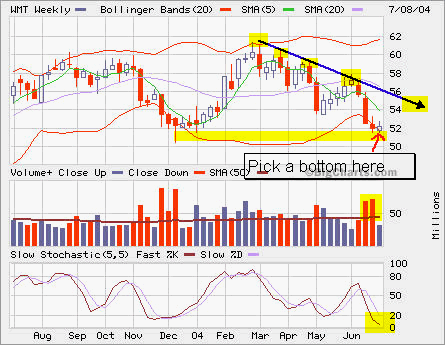

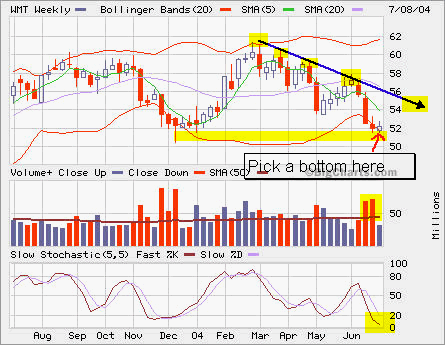

Bought WMT Aug 50 Calls at 2.5 today.

Bought WMT Aug 50 Calls at 2.5 today.

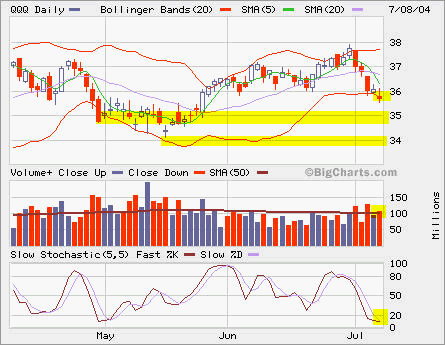

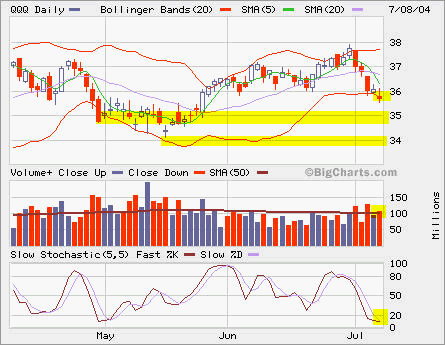

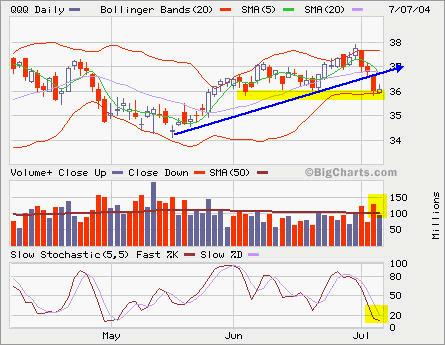

I closed QQQ Jul 36 Puts at 0.65 for a small profit as it gapped down today. The volume was about average. No panic selling. Holding ATM/OTM front-month puts won’t make too much sense when approaching expiration.

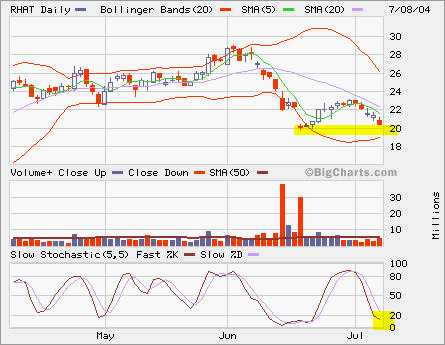

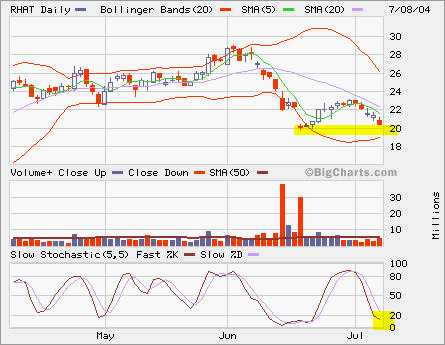

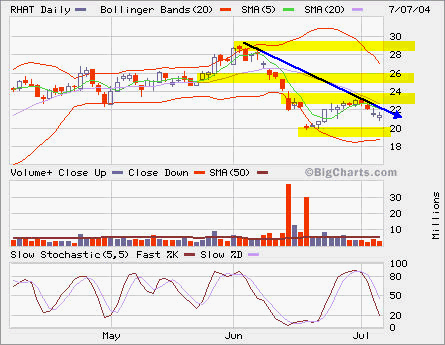

I also closed Jul 20 Puts at 0.50 at breakeven point. I still keep Aug 22.5 Puts as RHAT may retest critical support at 20. As it’s in oversold condition, buying interests are plenty as seen when it was bouncing back from the gap down.

I closed QQQ Jul 36 Puts at 0.65 for a small profit as it gapped down today. The volume was about average. No panic selling. Holding ATM/OTM front-month puts won’t make too much sense when approaching expiration.

I also closed Jul 20 Puts at 0.50 at breakeven point. I still keep Aug 22.5 Puts as RHAT may retest critical support at 20. As it’s in oversold condition, buying interests are plenty as seen when it was bouncing back from the gap down.

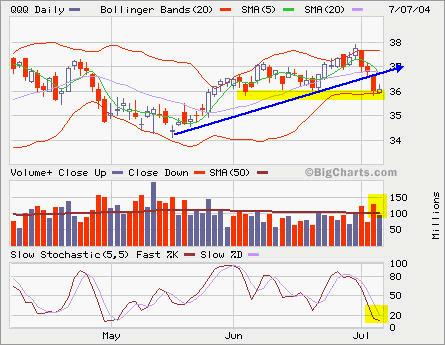

QQQ has broken its uptrend line. Today’s move would look like a dead cat bounce after YHOO lost almost 12% in after-hour trading. Tomorrow will be a big gap down. I have reduced my puts on QQQ.

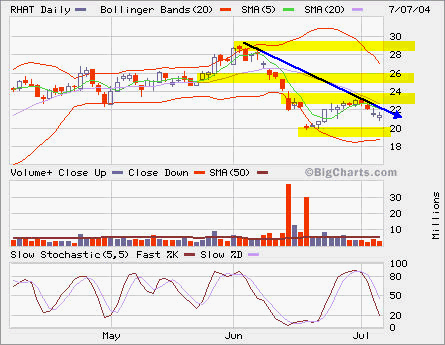

My Jul 20 Puts are under water, but Aug 22.5 Puts are doing OK. I will monitor closely tomorrow to see if I should seize the opportunity to close the Jul 20 Puts.

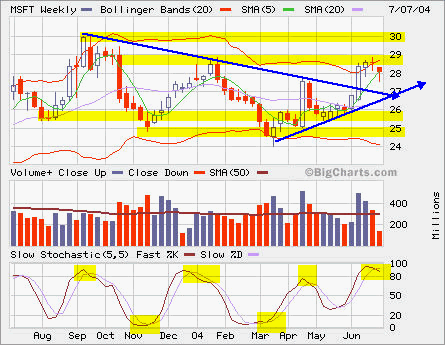

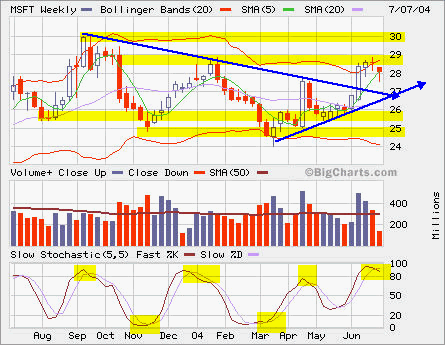

I’m also looking for opportunities to buy back some shares of MSFT for my long-term accounts.

QQQ has broken its uptrend line. Today’s move would look like a dead cat bounce after YHOO lost almost 12% in after-hour trading. Tomorrow will be a big gap down. I have reduced my puts on QQQ.

My Jul 20 Puts are under water, but Aug 22.5 Puts are doing OK. I will monitor closely tomorrow to see if I should seize the opportunity to close the Jul 20 Puts.

I’m also looking for opportunities to buy back some shares of MSFT for my long-term accounts.