I’m researching on ETFs for my Roth IRA investment options. The top 5 performers based on YTD data are XLE 19.89% (Energy Select Sector SPDR, not surprisingly, the crude reached at $57), IYE (iShares Dow Jones US Energy) 19.5%, VDE 19.44% (Vanguard Energy VIPERS), IXC 16.73% (iShares S&P Global Energy Sector) and IGE 14.17% (iShares Goldman Sachs Natural Resource).

Since I consider energy sectior quite extended for now, I won’t buy them at this point. The top 5 ETFs excluding energy related issues are EWY 11.52% (iShares MSCI South Korea Index), EWA 7.54% (iShares MSCI Australia Index), EPP 4.91% (iShares MSCI Pacific ex-Japan), EWS 4.88%(iShares MSCI Singapore Index) and ADRE 4.2% (BLDRS Emerging Markets 50 ADR Index).

We can see the underlying story, that is, Asia and Pacific are where the growth will be!

We can see the underlying story, that is, Asia and Pacific are where the growth will be!

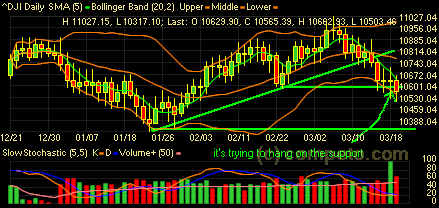

Many are hanging on the support area.

Many are hanging on the support area.

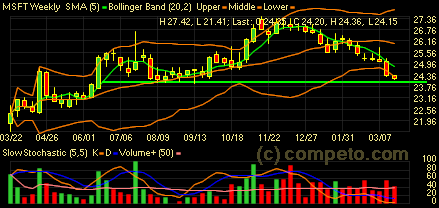

HNP is at crtical point.

HNP is at crtical point.