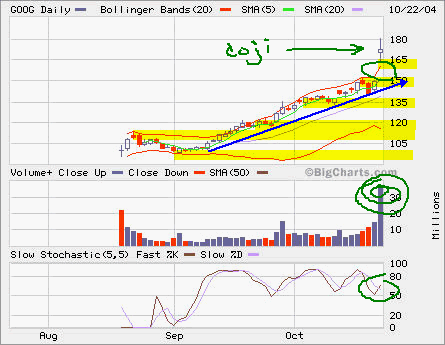

GOOG gapped up big time today after excellent earning report. It now looks like we are back in dot com boom era when stocks move 20 points or more in a single day.

GOOG gapped up big time today after excellent earning report. It now looks like we are back in dot com boom era when stocks move 20 points or more in a single day.

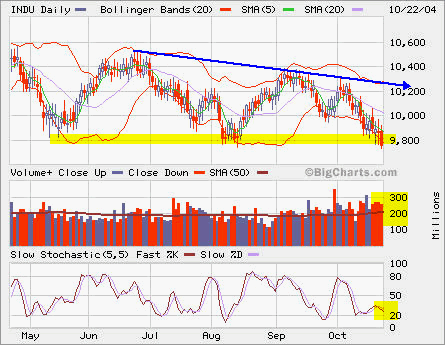

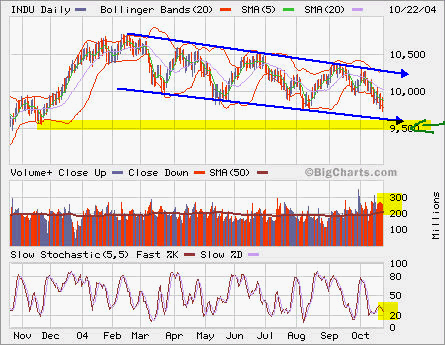

INDU is now at year’s low. The support at 9800 was borken slightly at higher than average volume. It’s very weak now. Let’s see if it can hold up above 9700. The next support is at 9500.

INDU is now at year’s low. The support at 9800 was borken slightly at higher than average volume. It’s very weak now. Let’s see if it can hold up above 9700. The next support is at 9500.

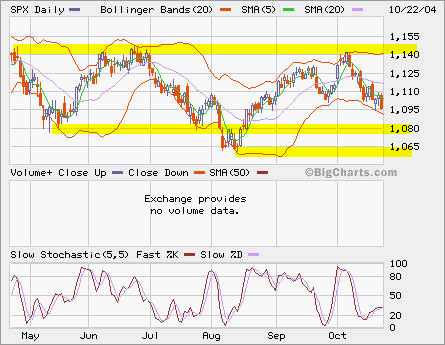

SPX is likely seeking support between 1095 and 1065.

SPX is likely seeking support between 1095 and 1065.

RUT is in better shape with support at 560.

RUT is in better shape with support at 560.

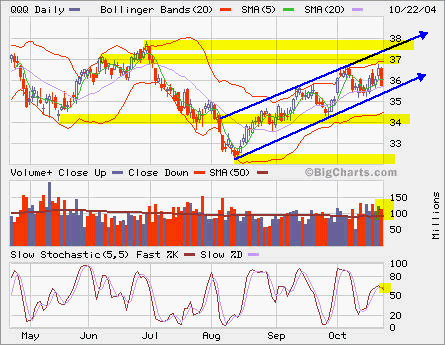

QQQ is so far the best among major indexes. The uptrend channel is still intact despite today’s big drop. The volume is slightly above average level.

QQQ is so far the best among major indexes. The uptrend channel is still intact despite today’s big drop. The volume is slightly above average level.

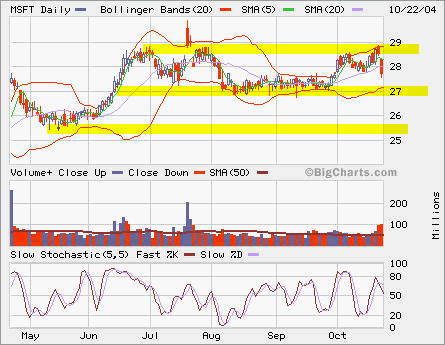

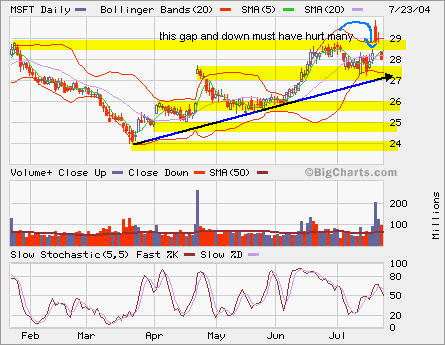

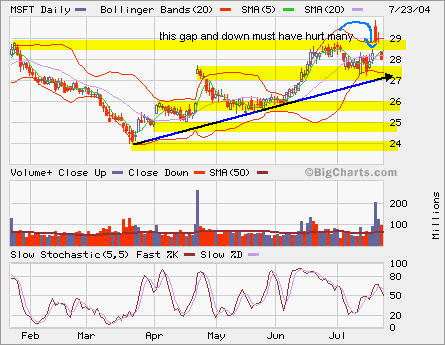

MSFT is hurt by disappointing earning data. The support is at 27. The high volume yesterday indicated heavy selling into the resistence of previous big gap down.

MSFT is hurt by disappointing earning data. The support is at 27. The high volume yesterday indicated heavy selling into the resistence of previous big gap down.

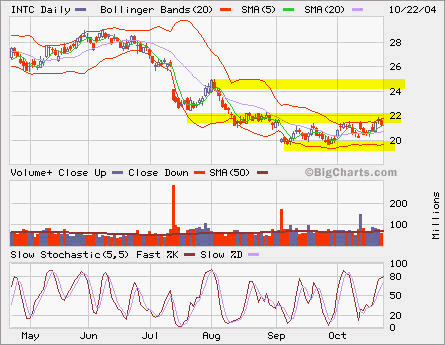

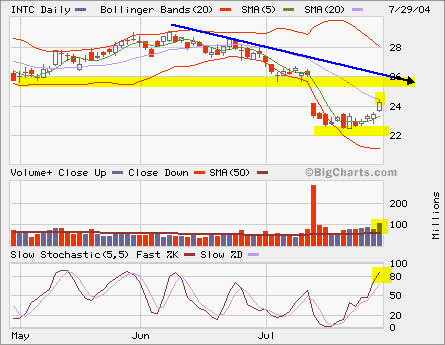

INTC did not fall too much among today’s big selling in tech related stocks, which means the market has much consensus at this level. Today’s volume is light.

INTC did not fall too much among today’s big selling in tech related stocks, which means the market has much consensus at this level. Today’s volume is light.

Tag Archives: Gap

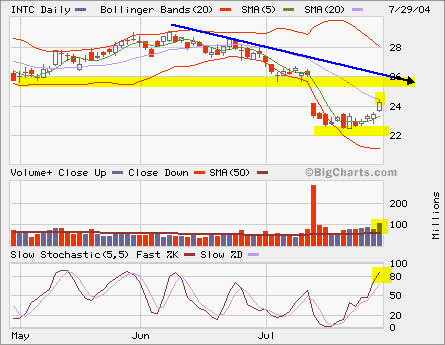

INTC

INTC is working its way to fill its gap. Sold the calls bought at 1.05 for 1.10. Still hold some Oct 25 calls bought around 0.5.

INTC is working its way to fill its gap. Sold the calls bought at 1.05 for 1.10. Still hold some Oct 25 calls bought around 0.5.

INTC

INTC is working its way to fill its gap. Sold the calls bought at 1.05 for 1.10. Still hold some Oct 25 calls bought around 0.5.

INTC is working its way to fill its gap. Sold the calls bought at 1.05 for 1.10. Still hold some Oct 25 calls bought around 0.5.

It’s ugly …

It must be the wrong time. The big gap up and gap down are really ugly. I got out way before the big announcement and earning report, therefore, missed the gap up and down.

It must be the wrong time. The big gap up and gap down are really ugly. I got out way before the big announcement and earning report, therefore, missed the gap up and down.

It’s ugly …

It must be the wrong time. The big gap up and gap down are really ugly. I got out way before the big announcement and earning report, therefore, missed the gap up and down.

It must be the wrong time. The big gap up and gap down are really ugly. I got out way before the big announcement and earning report, therefore, missed the gap up and down.