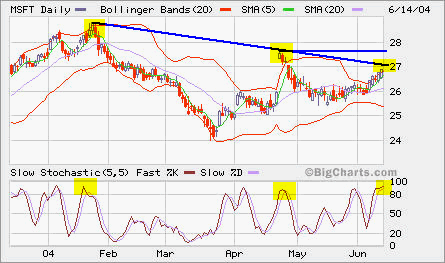

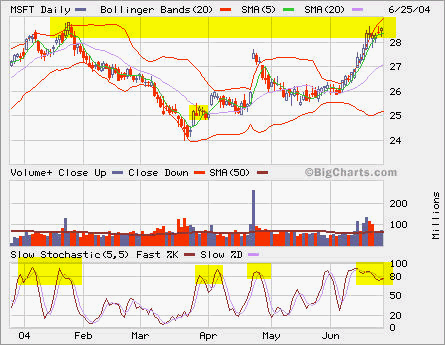

MSFT is right at the resistence level. In light of next week feds decision on interest hike, I closed a long position opened at 25.32 on March 26.

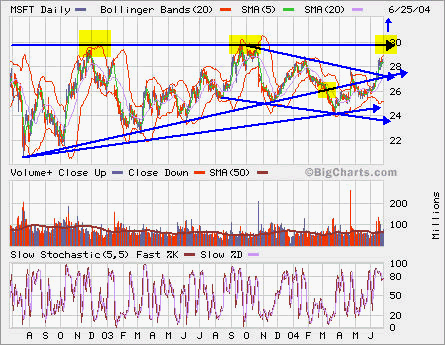

Looking longer term, MSFT has had this breakout from its intermediate-term downtrend and it is approaching the long-term resistence at 30. From the rising triangle, let’s watch if it breaks out to the up side.