There was a big sell off this morning on LOWS. My put position finally turned positive. Out of fear that it might bounce back, half position was closed at small gain. Yet, looking at the daily chart, it’s likely that it may test 50 SMA. It’s still closed lower than the open. The greedy side of me decided to keep the rest of the position. In hindsight, keeping 1/3 position might be better idea or taking the profit by closing the position entirely. Let’s see how it goes tomorrow.

Long GSF May 20C; added SLB May 40P.

OAKMX: it’s still in the short-term uptrend since its breakout of long-term downtrend. Resistence at 31.55.

LSCRX: it’s right at resistence and overbought condition.

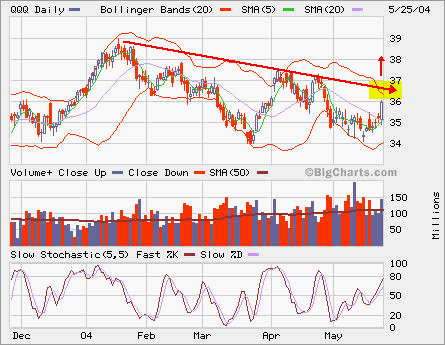

Since it broke its long term downtrend in last November, QQQ rose rapidly from low of 20 to near 28, then it was in a trading range for 4-5 months. In June, it broke out the range. The next resistence level is around 34. With recent run up, it may go sideway for a while before charging ahead to the resistence level near 40 provided the overall market condition is improving. The current support level is at 29 and 25 is the major support level.

Since it broke its long term downtrend in last November, QQQ rose rapidly from low of 20 to near 28, then it was in a trading range for 4-5 months. In June, it broke out the range. The next resistence level is around 34. With recent run up, it may go sideway for a while before charging ahead to the resistence level near 40 provided the overall market condition is improving. The current support level is at 29 and 25 is the major support level.