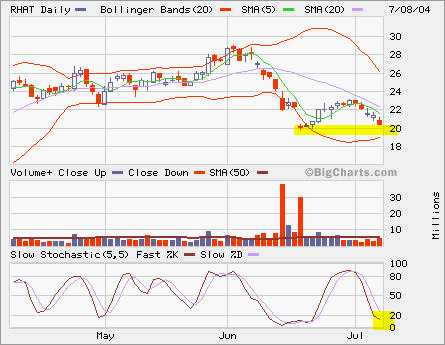

It pulled back again. Judging by the lower volume on the decline, the selling is not panic. Obviously a lot of buying has been done in the past month, but the buyers don’t want to buy higher. This pullback presents a buying opportunity in my view between 24 and 25.

It pulled back again. Judging by the lower volume on the decline, the selling is not panic. Obviously a lot of buying has been done in the past month, but the buyers don’t want to buy higher. This pullback presents a buying opportunity in my view between 24 and 25.

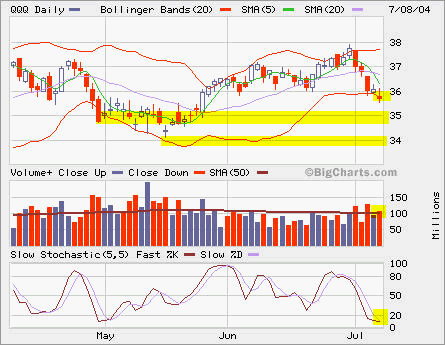

QQQ sits right at 20SMA and in over-sold condition, let’s see if it bounces back next week.

QQQ sits right at 20SMA and in over-sold condition, let’s see if it bounces back next week.

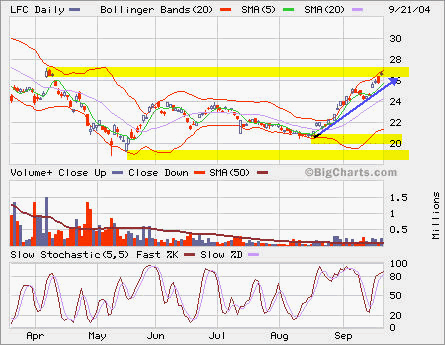

Another big move today with high volume. LFC now sits at the 27 resistence. Breaking out 27 leads directly to test 30.

Another big move today with high volume. LFC now sits at the 27 resistence. Breaking out 27 leads directly to test 30.