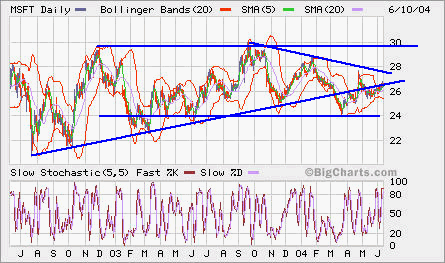

MSFT broke down a little bit from the two year uptrend line in March as seen in this weekly chart. It’s slowly forming a cup. Whether or not it can break out from the intermediate term downtrend remains to be seen in the comming weeks. MSFT has been lagging from its peers. However, with its over $50B in cash and gradually settled legal cases, plus M&A rumors such as SAP, we may see some big movement sson.