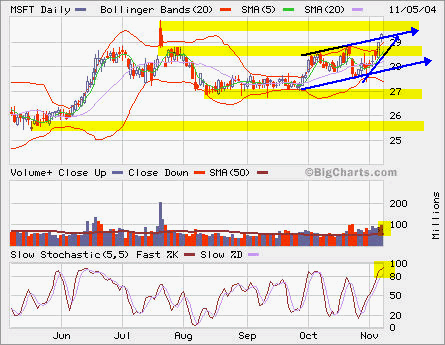

MSFT is moving towards major resistence at 30 once again. The volume is picking up and it’s in overbought condition. Later this month, it will pay a special dividend of $3. The stock price, its SSF and options will be adjusted with the $3 change accordingly.

MSFT is moving towards major resistence at 30 once again. The volume is picking up and it’s in overbought condition. Later this month, it will pay a special dividend of $3. The stock price, its SSF and options will be adjusted with the $3 change accordingly.

If you like to play breakout, you may watch it closly if it breaks out from 30 with higher than average volume, which is about 50 million shares.

If you like to short, it’s pretty close to the top now. The next resistence above 30 is 32, but you may not want to have that big stop loss. So it’s somewhere between 30 and 32.

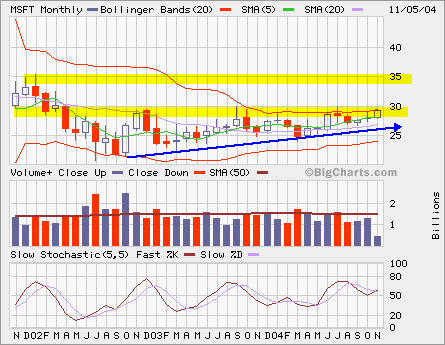

The monthly chart shows an ascending triangle indicating a possible breakout from 30. You may buy straddle (buy a call and a put at the same strike and expiration date) to capture this breakout, but with recent sharp move, you may have to pay more since its volativity is higher.

The monthly chart shows an ascending triangle indicating a possible breakout from 30. You may buy straddle (buy a call and a put at the same strike and expiration date) to capture this breakout, but with recent sharp move, you may have to pay more since its volativity is higher.

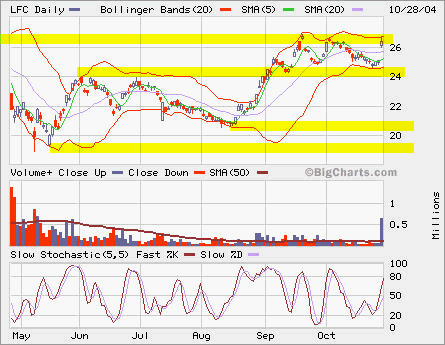

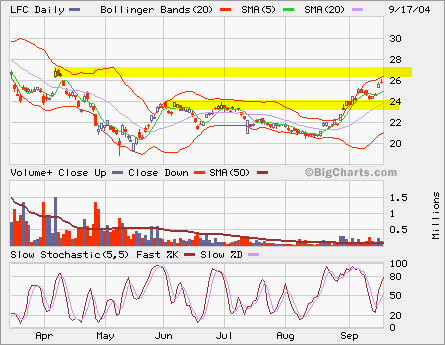

LFC rose 1.33 today in every high volume. It’s testing the overhead resistence again. The next major resistence is at 30.

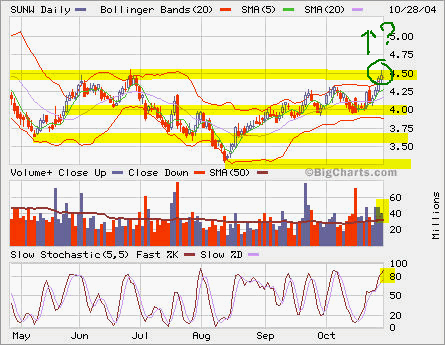

LFC rose 1.33 today in every high volume. It’s testing the overhead resistence again. The next major resistence is at 30. SUNW continued its ascending, but it backed off from 4.54 intraday high and ended at 4.47.

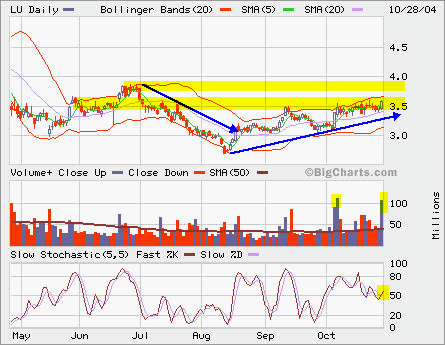

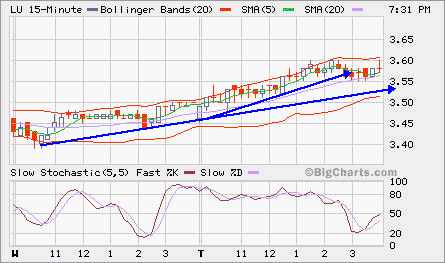

SUNW continued its ascending, but it backed off from 4.54 intraday high and ended at 4.47. LU was very active traded today, over 100 million shares! It looks like that it’s posing for a breakout. From the two-day 15 minute char, we can see that buying was persistent.

LU was very active traded today, over 100 million shares! It looks like that it’s posing for a breakout. From the two-day 15 minute char, we can see that buying was persistent.

IFC’s recent breakout is held after a pullback. breaking out 27 resistence will start a new bullish phase.

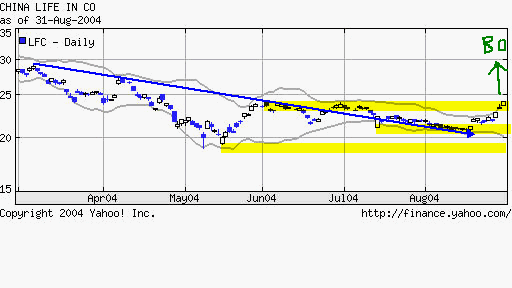

IFC’s recent breakout is held after a pullback. breaking out 27 resistence will start a new bullish phase. LFC is in breakout mode. It’s been down a lot this year.

LFC is in breakout mode. It’s been down a lot this year.