GOOG has broken its downtrend line finally. Let’s see if it could have a follow through next week.

GOOG has broken its downtrend line finally. Let’s see if it could have a follow through next week.

Monthly Archives: March 2005

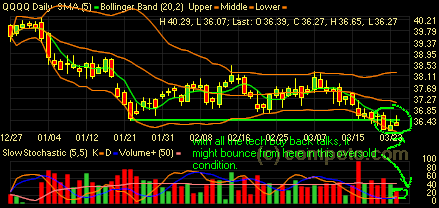

QQQQ

With all the tech stock buy back talks, QQQQ is ready for a rebound as well if this last candle shows more positive sign. It needs to break this SMA 5 first to speak of any possibility.

With all the tech stock buy back talks, QQQQ is ready for a rebound as well if this last candle shows more positive sign. It needs to break this SMA 5 first to speak of any possibility.

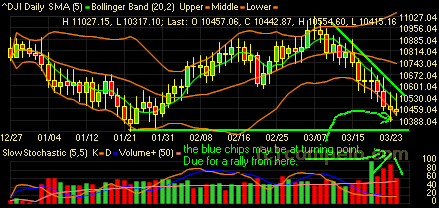

INDU

The blue chips have slowed its decline. It closed slightly lower although it was in the positive most of day. As in the support area, it may bounce back anytime.

The blue chips have slowed its decline. It closed slightly lower although it was in the positive most of day. As in the support area, it may bounce back anytime.

Top 5 ETFs (YTD)

I’m researching on ETFs for my Roth IRA investment options. The top 5 performers based on YTD data are XLE 19.89% (Energy Select Sector SPDR, not surprisingly, the crude reached at $57), IYE (iShares Dow Jones US Energy) 19.5%, VDE 19.44% (Vanguard Energy VIPERS), IXC 16.73% (iShares S&P Global Energy Sector) and IGE 14.17% (iShares Goldman Sachs Natural Resource).

Since I consider energy sectior quite extended for now, I won’t buy them at this point. The top 5 ETFs excluding energy related issues are EWY 11.52% (iShares MSCI South Korea Index), EWA 7.54% (iShares MSCI Australia Index), EPP 4.91% (iShares MSCI Pacific ex-Japan), EWS 4.88%(iShares MSCI Singapore Index) and ADRE 4.2% (BLDRS Emerging Markets 50 ADR Index).

We can see the underlying story, that is, Asia and Pacific are where the growth will be!

We can see the underlying story, that is, Asia and Pacific are where the growth will be!

Top 5 ETFs (YTD)

I’m researching on ETFs for my Roth IRA investment options. The top 5 performers based on YTD data are XLE 19.89% (Energy Select Sector SPDR, not surprisingly, the crude reached at $57), IYE (iShares Dow Jones US Energy) 19.5%, VDE 19.44% (Vanguard Energy VIPERS), IXC 16.73% (iShares S&P Global Energy Sector) and IGE 14.17% (iShares Goldman Sachs Natural Resource).

Since I consider energy sectior quite extended for now, I won’t buy them at this point. The top 5 ETFs excluding energy related issues are EWY 11.52% (iShares MSCI South Korea Index), EWA 7.54% (iShares MSCI Australia Index), EPP 4.91% (iShares MSCI Pacific ex-Japan), EWS 4.88%(iShares MSCI Singapore Index) and ADRE 4.2% (BLDRS Emerging Markets 50 ADR Index).

We can see the underlying story, that is, Asia and Pacific are where the growth will be!

We can see the underlying story, that is, Asia and Pacific are where the growth will be!