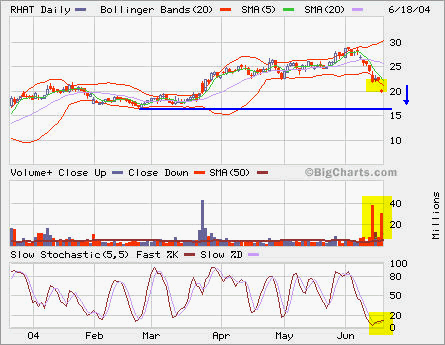

RHAT took a big hit of roughly 10% on Friday. Its CFO quiting caused concerns among investors despite it met its earning target. It will likely break 20 support level and move down further. I bought Jul 20 Puts at 1.25. The target is between 18 and 19. The stop will be 21.