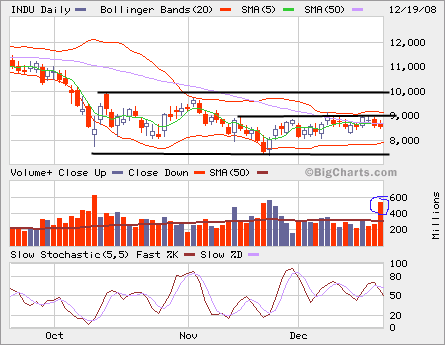

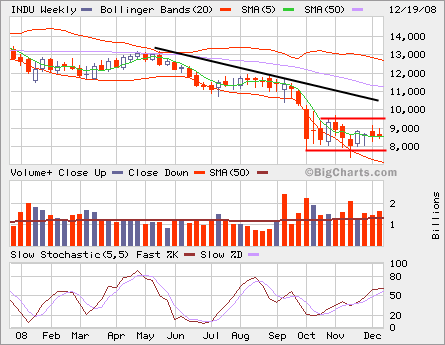

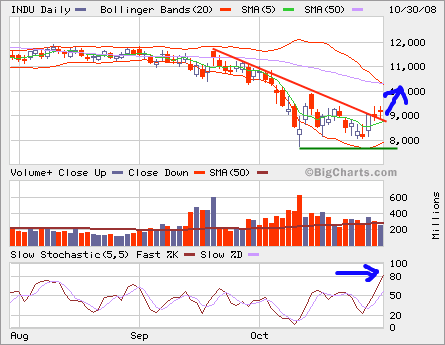

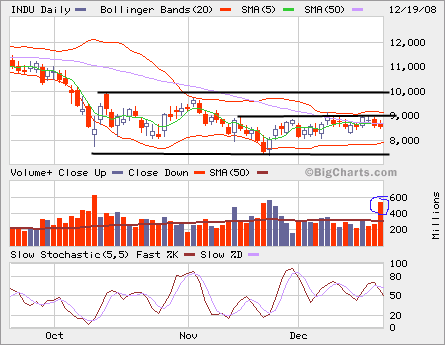

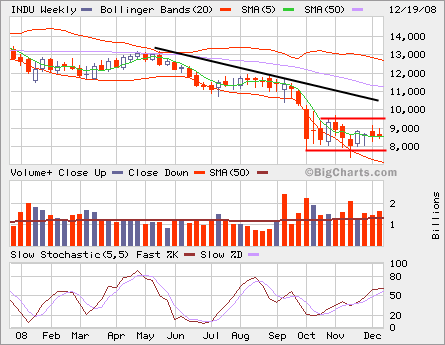

Dow Jones Industrial Average has been up and down for the past many weeks but it appears that it has moved towards sideways. As recession has been officially announced and confirmed, how much has the market priced in all the bad news?

Certainly investors are looking for values after significant drops, but it’s not clear that if it will range bound between somewhere below 8000 and somewhere above 9000.

If it builds a long base above 8000 and consolidates the base, we may see more upside but we need to see the confirmation.