MSFT is showing some weakness. The support is at 26.

MSFT is showing some weakness. The support is at 26.

Category Archives: Options

MSFT Straddle

Opened a straddle position on MSFT. Long MSFT Dec 30 @0.65 and MSFT Dec 30 Put @0.7 for a debt of 1.35.

MSFT Straddle

Opened a straddle position on MSFT. Long MSFT Dec 30 @0.65 and MSFT Dec 30 Put @0.7 for a debt of 1.35.

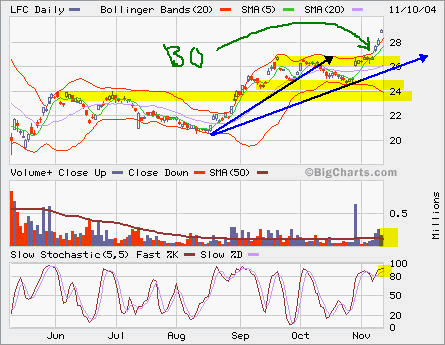

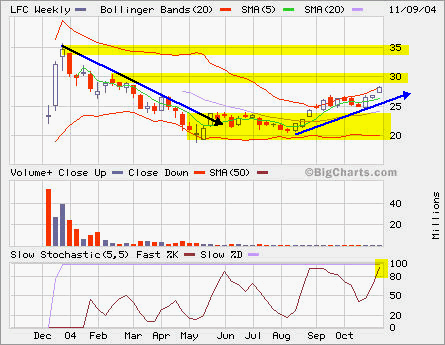

LFC and SUNW

LFC continues to move up since it broke out from base building between 24 and 27. The volume has picked up. It looks like we are heading towards 30 soon. I have sold Dec, Jan and Apr 30 Calls. They may get called away this time.

LFC continues to move up since it broke out from base building between 24 and 27. The volume has picked up. It looks like we are heading towards 30 soon. I have sold Dec, Jan and Apr 30 Calls. They may get called away this time.

SUNW experienced a sudden drop today. It may pull back to 4.5 after steady run-up. I would add some more in my long term account between 4.25 and 4.5.

SUNW experienced a sudden drop today. It may pull back to 4.5 after steady run-up. I would add some more in my long term account between 4.25 and 4.5.

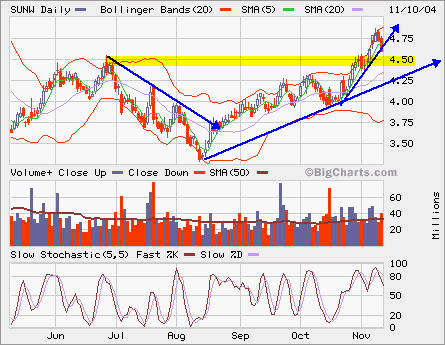

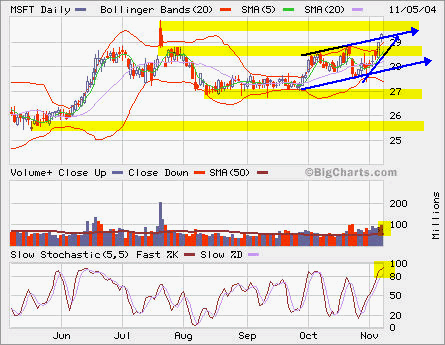

MSFT

MSFT is moving towards major resistence at 30 once again. The volume is picking up and it’s in overbought condition. Later this month, it will pay a special dividend of $3. The stock price, its SSF and options will be adjusted with the $3 change accordingly.

MSFT is moving towards major resistence at 30 once again. The volume is picking up and it’s in overbought condition. Later this month, it will pay a special dividend of $3. The stock price, its SSF and options will be adjusted with the $3 change accordingly.

If you like to play breakout, you may watch it closly if it breaks out from 30 with higher than average volume, which is about 50 million shares.

If you like to short, it’s pretty close to the top now. The next resistence above 30 is 32, but you may not want to have that big stop loss. So it’s somewhere between 30 and 32.

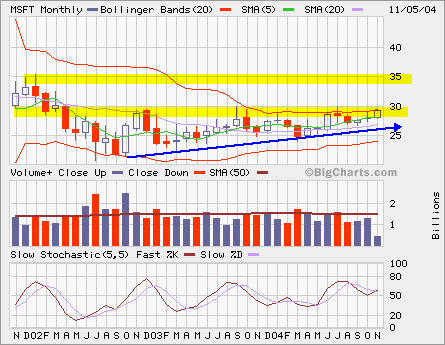

The monthly chart shows an ascending triangle indicating a possible breakout from 30. You may buy straddle (buy a call and a put at the same strike and expiration date) to capture this breakout, but with recent sharp move, you may have to pay more since its volativity is higher.

The monthly chart shows an ascending triangle indicating a possible breakout from 30. You may buy straddle (buy a call and a put at the same strike and expiration date) to capture this breakout, but with recent sharp move, you may have to pay more since its volativity is higher.