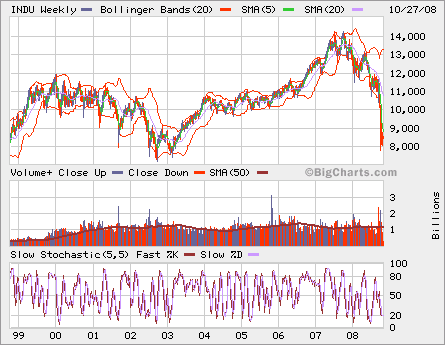

Dow Jones Industrial Average bounced back hugely with more than 11%. It reversed the dramatic slide in the past weeks, but the downtrend line is overhead right now. It would take some time to work it out the resistance or another drop is more likely after hitting the downtrend line.

Melting down …

The melt down continues. We have broken 9000 level. Looking back 10 years, the support level is around 7500.

Dow Jones Industrial Average is at oversold condition, but with current credit crisis still spreading and running its course, any technical bounce is possible but would not last long.

Unless you have significant cash positions, wait in sideline. Cash is king in this juncture.

Crash tomorrow???

US market was closed due to the MLK holiday but the other markets in the world had closed down a lot from 5 to 7%. Asia markets are down more than 5% the second day. How will the US market react? Unless it’s prolong decline, it might be a buying opportunity. But be carefuly the old saying “don’t catch the falling knife!”.

Dow Jones Industrial will break the 12,000 support for sure. Next support is 11,500.

Be careful tomorrow!

INDU reaching support area

Dow Jones Industriral is moving towards its support areas. The first one is around 12,700 and 2nd one is above 12,500.

It’s getting ugly now

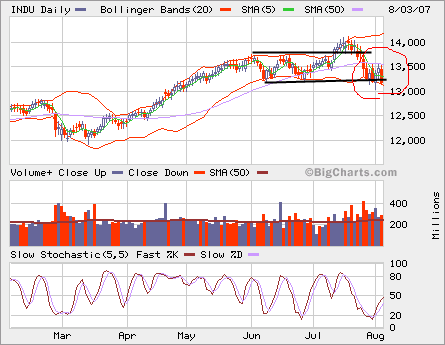

The reversal we were talking about came after all.

13,000, well a round number, is the major support. We will see if Dow Jones can hold itself, but the drop today is ugly.